3 Strategies That Can Help Grow Recurring Revenue Through Pricing

Bootstrapped businesses are generally cash-hungry. It’s no surprise then, that we often see bootstrappers basing their prices on how much a service costs to provide or charging significant one-time fees in the first year. The problem with this type of cost-based pricing is that it can potentially leave recurring revenue on the table, diminishing the long-term value of the business.

The Operations Team at Mainsail often works with software companies in our portfolio to help restructure their pricing models. The goals of these projects are usually to facilitate strategic price increases, to shift new bookings mix toward more recurring revenue, or both. Based on our experience and understanding of the levers that drive recurring revenue, here are 3 principles to keep in mind when restructuring pricing.

1Bundle implementation costs to drive recurring revenue

In the world of on-premise software, it made sense to charge for implementation fees up front along with the license. As SaaS has matured, we believe that’s become less and less true. SaaS companies are generally valued based on their recurring revenue, and SaaS customers have come to pay for most (if not all) of their software costs on a recurring basis. If you have a low churn rate, you can offer your customers lower up-front fees in exchange for a slightly higher recurring fee and potentially come out ahead.

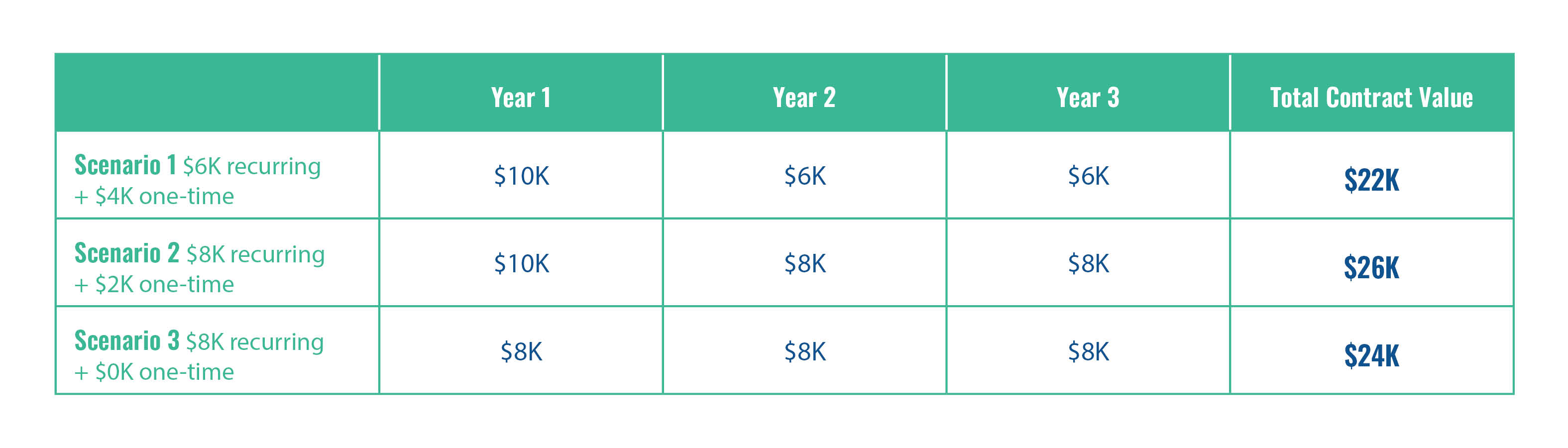

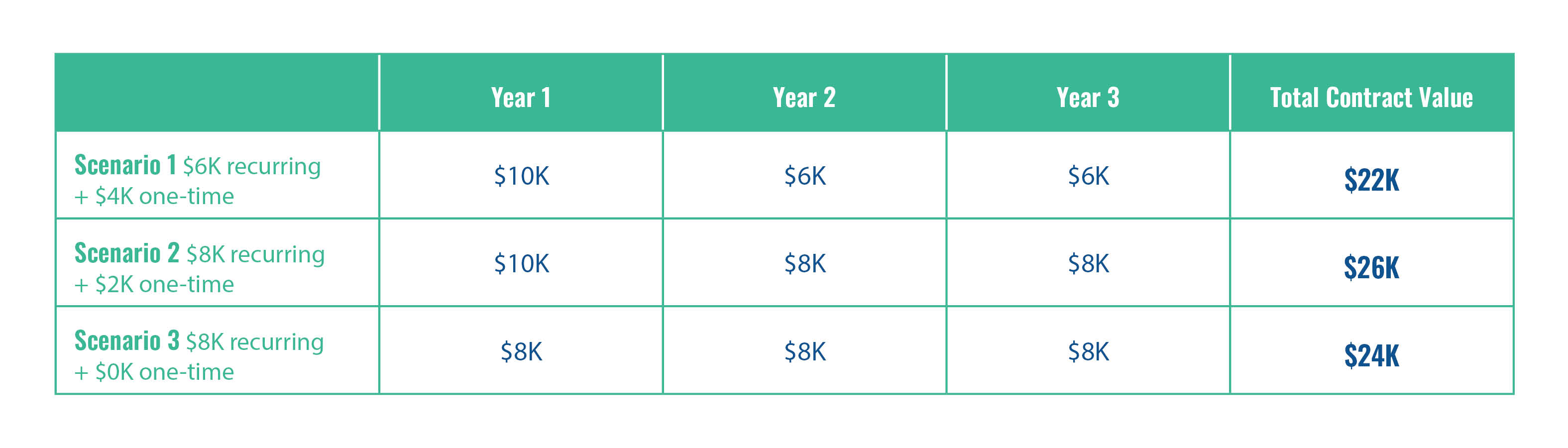

Consider the three scenarios above. Scenario 1 is common among companies that have significant implementation or professional services costs associated with onboarding a new customer; the company is charging $10K in year one, $6K of which is recurring. But as we can see in Scenario 2, if the company charged the same $10K but shifted the mix so that $8K was recurring, it’d make 18% more over 3 years. Even if the company didn’t charge a one-time implementation fee (as in Scenario 3), it’d still come out ahead. There is near term value to receiving a higher Year 1 fee, having cash today carries more value than having it later down the line. However, the more you are able to drive recurring revenue, the greater the potential for long-term value.

We have found that many customers are not resistant to trading lower first year fees for higher recurring prices. To see if this is true of your customers, flag deals that are one-time fee heavy to understand if the root cause is truly customer pushback, or just a function of your legacy pricing framework, sales incentive structure, or other internal factors.

2Price according to value gained by customers

It’s tempting to charge low prices for functionality that’s easy to build or set up. But that’s leaving money on the table. Don’t price based on how much the feature costs to develop, price based on the willingness of the customer who demands it to pay – a complex core feature might need to be in every package (including base) while a simple and cheap API used by enterprise customers might command a premium.

To price according to value, determine which customers need which features by analyzing usage data, interviewing sales and implementation teams, and speaking to customers. Try to quantify time and cost savings for customers, as well as incremental revenue generated by the additional functionalities in your system and use that to inform your pricing.

3Bundle for simplicity and incremental value

Many fast-growing companies try to be simple at the outset with one price but quickly end up with a laundry list of a la carte add-ons as they add new features and functionalities. This can lead to confusion on all fronts. The sales team is unsure of the product they’re really selling, the onboarding team needs to customize each implementation, and the support staff needs to balance a vast permutation of configurations.

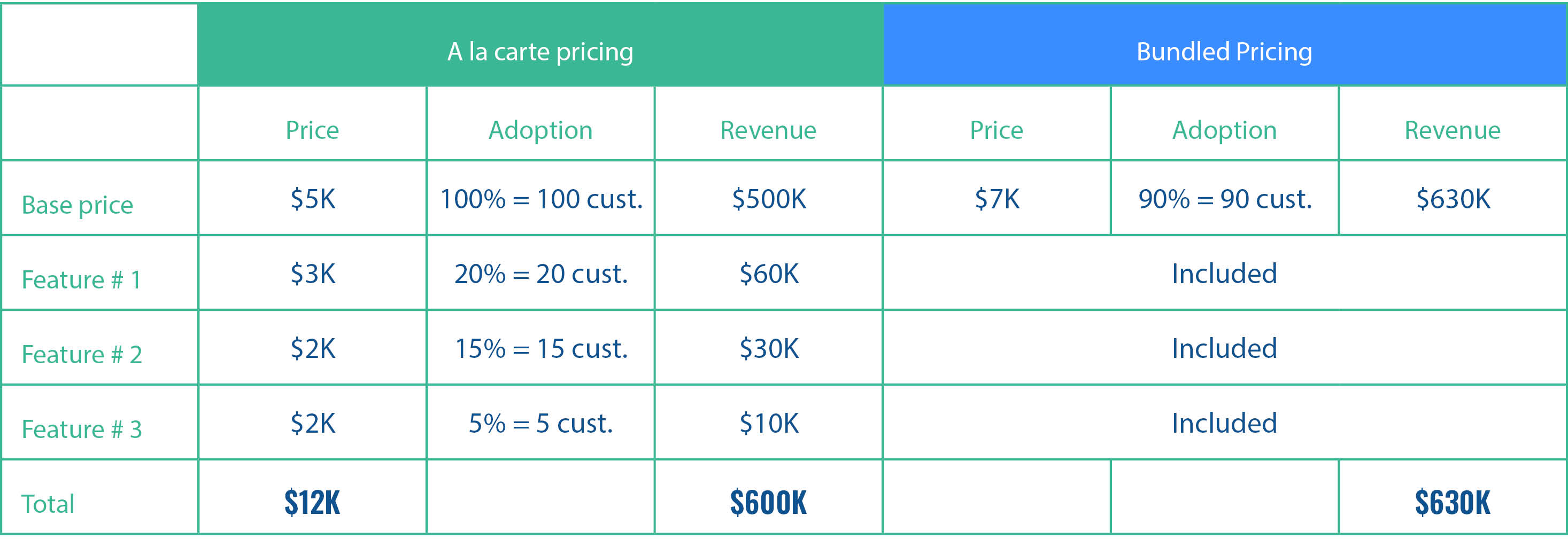

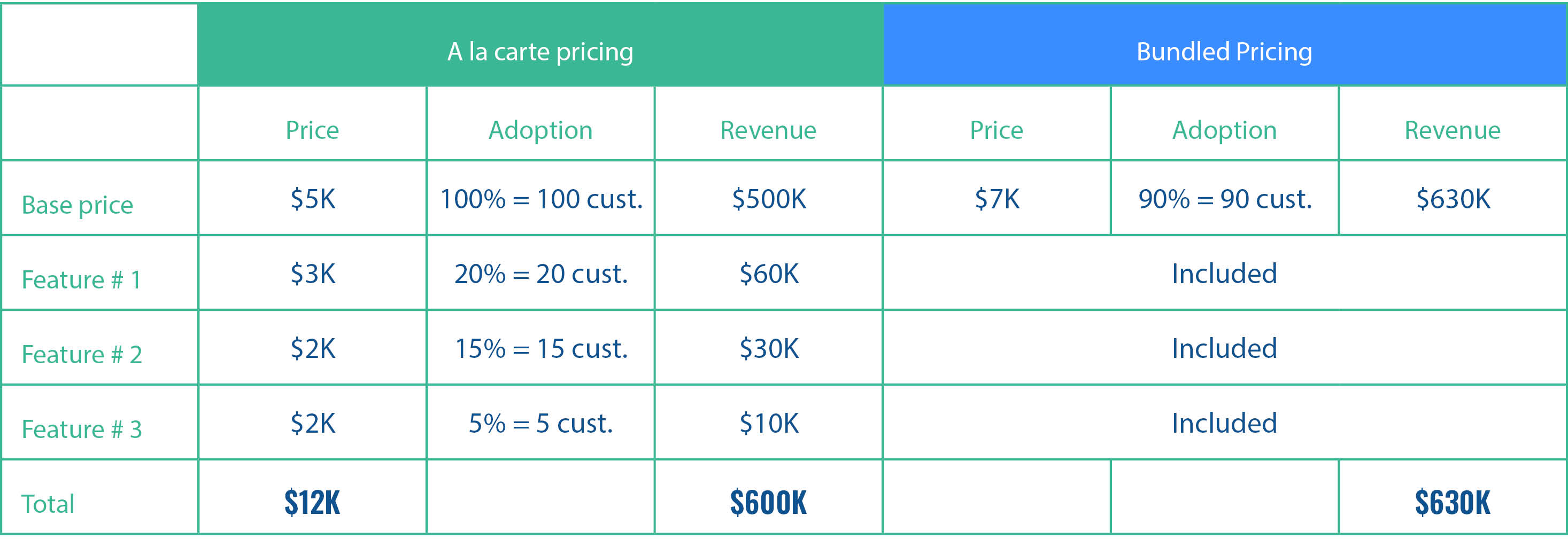

Consider the example above for a company that books 100 new customers per year. With a la carte pricing, the company could theoretically charge up to $12K per customer, but due to the sporadic adoption of additional features, the average contract value drops to $6K per customer. With bundled pricing, including a la carte features at a lower $7k base price point to 90% of the new customers drives more revenue. Bundling is not necessarily the right solution in every scenario. Leverage your product team to understand how users are interacting with your platform to evaluate if bundling is right for your business.

Should you focus on pricing? Signals to evaluate

Internal complexity – Gather feedback from your sales and onboarding staff. How hard is it to give a customer a quote? Why is it difficult to onboard customers? If answers from your team stem from the complex pricing structure or high levels of customization, it can be a signal to re-evaluate pricing.

External confusion – Do prospects understand your pricing structure? Can current customers articulate what’s included in their contract? Surveying current and former customers can provide valuable insight on whether customers are clear on the price-to-value that your software provides.

Customer segmentation and prioritization – Are there features that are constantly used or prioritized by certain customers? Are your most valuable customers leaning on certain features or elements of your platform? Analyzing potential discrepancies with your platform’s pricing structure and how your core customers are using your product can unearth additional revenue for your business.

Increasing the recurring revenue mix of contracts through SaaS pricing can enhance organizational transparency, create a more marketable platform, and increase topline revenue. As you think about how to shift the revenue mix of contracts or whether it’s the right decision to bundle elements of your platform, take the time to evaluate your current customer base and team to decide if restructuring your pricing framework is right for you.

The information herein is based on the author’s opinions and beliefs on pricing frameworks. There can be no assurance other third-party analyses would reach the same conclusions as those provided herein. The information herein is not and may not be relied on in any manner as, legal, tax, business or investment advice.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of terms such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “projects,” “future,” “targets,” “intends,” “plans,” “believes,” “estimates” (or the negatives thereof) or other variations thereon or comparable terminology. Forward looking statements are subject to a number of risks and uncertainties, which are beyond the control of Mainsail. Actual results, performance, prospects or opportunities could differ materially from those expressed in or implied by the forward-looking statements. Additional risks of which Mainsail is not currently aware also could cause actual results to differ. In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. The forward-looking events discussed in this content piece may not occur. Mainsail undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in the enclosed materials by Mainsail and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The content piece will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof, or for any other reason.

For additional important disclosures, please click here.