Evaluating Your Pricing Model

When navigating a software company’s growth journey, an important question founders will face is whether they have the “right” pricing model. In a 2022 Mainsail Partners Bootstrapped sentiment survey, more than half of bootstrapped founders said they planned to make changes to their pricing in 2023. The mistake that many companies make when evaluating their pricing is solely focusing on whether they should increase or decrease current prices.

A better approach is to evaluate whether you have the right product packaging and price metrics in your pricing model design.

Product Packages are the bundles of your product’s features, functionality and capacity that are available for customers to purchase. Example: Microsoft Office is a package, Microsoft PowerPoint is not.

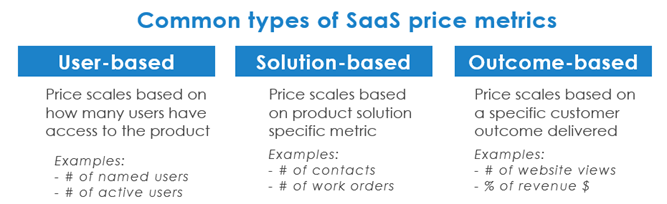

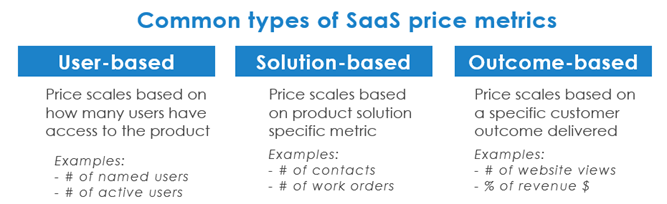

Price Metric is the unit of measure that will scale a customer’s price. Example: Zoom’s price metric is users and HubSpot CRM’s price metric is contacts. The price of both solutions is determined by the customer’s metric quantity.

Put another way, the product package is what a customer buys and the price metric is how the price is determined. Product packaging and price metrics are major components of your pricing model and play a significant role in determining a customer’s price.

Here are some suggestions on how to start evaluating your product packaging and price metric.

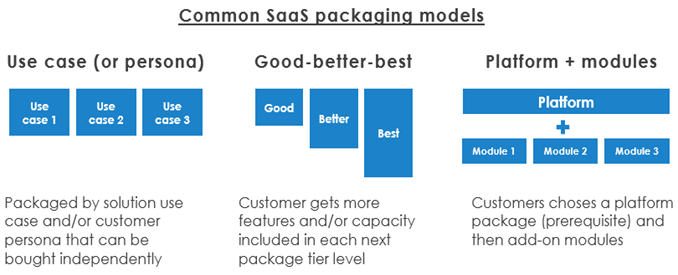

Evaluating your product packaging

Getting product packaging right is part art, part science. It requires a deep understanding of how your customers use and value your products and it constantly evolves as you release more products.

What does great product packaging look like?

- It is designed around your Ideal Customer Profiles (ICP). The packaging should be aligned to your ICP’s solution needs and use-cases.

- It has the right level of simplicity for your buyer, GTM and product solution. The more package options you create, the more choice-complexity is added to the buying process. There is no perfect number of package options, but a rule of thumb is:

-

- Companies with high sales velocity, low ACVs, short sales cycles, and basic software solutions should have fewer packaging options.

- Companies with low sales velocity, high ACVs, long sales cycles and more sophisticated software solutions should have more packaging options.

- Packages are designed to drive customer upgrades. Packages should be designed to encourage customers to upgrade to the next package tier or advanced module. Two common packaging approaches to drive upgrades are:

-

- Feature gating: Limiting the available features in each package. This encourages customers to upgrade packages to gain access to more advanced features. For example, you might restrict access to automated workflows, integrations or custom reporting to higher package levels.

- Usage gating: Limiting the amount of usage in each package. This encourages customers to upgrade packages to unlock more usage capacity. For example, you might limit the amount of storage capacity, message volume, or number of API calls between package levels.

Questions to evaluate the effectiveness of your product packaging

- How frequently are customers upgrading package levels? If a low percentage of customers are upgrading package levels, this is typically a signal to revisit how packages are bundled and identify opportunities to add more gating to drive upsell.

- Are there features with high usage that only serve a fraction of customers? This is typically a signal that more value could be extracted from packaging these features as add-ons outside of the core product.

- Are there packages with underperforming KPIs? Look for high logo churn, significant customer down-sell, below-average close rate and discounting price pressure.

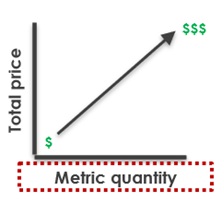

Evaluating your price metric

Getting your price metric right requires making two important design decisions:

- What metric should determine the price?

- How many price metrics will you add to the pricing model?

What makes a great price metric?

- It is aligned with customer value. As your customer consumes more price metric units, they should also perceive increased value from the product.

- Easy for customers to understand. Customers need to be able to estimate the metric quantity when making a purchase decision.

- Visibility into metric usage. Both the software vendor and the customer must have the ability to monitor metric usage.

- Tracks with marginal cost to serve. The price metric needs to align with the unit cost economics of your product.

- It drives the intended customer behavior. The price metric should not cause customers to be surprised or dispute their charges.

When does it make sense to have more than one price metric?

It is important to weigh the benefits of multiple price metrics against the complexity that it adds to the customer. Common scenarios that may justify the need for multiple price metrics are:

- There is more than one distinct usage value dimension of the solution

- Customers have unique workload requirements that are difficult to align to a single metric

- The additional price metrics are used only by customers with advanced requirements

Questions to evaluate the effectiveness of your price metric

- Are there metric quantities at which the pricing is not competitive? This might be an indication that you are using the wrong price metric or that you need to apply a metric volume curve to your prices.

- Do customers frequently dispute their charges when increasing their quantity? This could mean you either have the wrong metric or that the metric needs to be explained better to customers.

- Are there trends in negative business KPIs around certain metric types or quantities? This could signal that the price metric does not align to value for certain size customers.

The wrap up

Remember: Finding the right product packaging and price metric is a critical part of designing your pricing model. This should be viewed as an ongoing process and not a one-time exercise. To be most effective, you should constantly be re-evaluating as your product, customer, and competition dynamics evolve.

The information herein is based on the webinar speakers' opinions and views and there can be no assurance other third-party analyses would reach the same conclusions as those provided herein. The information herein is not and may not be relied on in any manner as, legal, tax, business or investment advice.

Certain information contained in this content piece has been obtained from published and non‐published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for the purposes of this content piece, neither Mainsail nor the author assume any responsibility for the accuracy or completeness of such information and such information has not been independently verified by either of them. The content piece will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof, or for any other reason.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of terms such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “projects,” “future,” “targets,” “intends,” “plans,” “believes,” “estimates” (or the negatives thereof) or other variations thereon or comparable terminology. Forward looking statements are subject to a number of risks and uncertainties, which are beyond the control of Mainsail. Actual results, performance, prospects or opportunities could differ materially from those expressed in or implied by the forward-looking statements. Additional risks of which Mainsail is not currently aware also could cause actual results to differ. In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. The forward-looking events discussed in this content piece may not occur. Mainsail undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in the enclosed materials by Mainsail and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. For additional important disclosures, please click here.