How to Think About Pricing Your Product

From Eddie Hartman’s presentation at the 2018 Mainsail Executive Summit

In today’s complex, customer-driven economy, it’s no longer enough to be innovative with your product. You also need to be innovative with your pricing strategy. According to the pricing firm Simon-Kucher & Partners, 72% of all innovations fail, and much of that failure stems from poor product-market-pricing fit.

“The rate of failure does not have to be this high,” Eddie Hartman told attendees at the 2018 Mainsail Partners Executive Summit. Now a Senior Manager at Simon-Kucher & Partners, Eddie formerly co-founded LegalZoom. “Pricing is such a simple way to make products succeed.”

In his presentation, Eddie provided an actionable model for shifting pricing to reflect the real value a product delivers to each customer.

Ask What People Are Willing to Pay

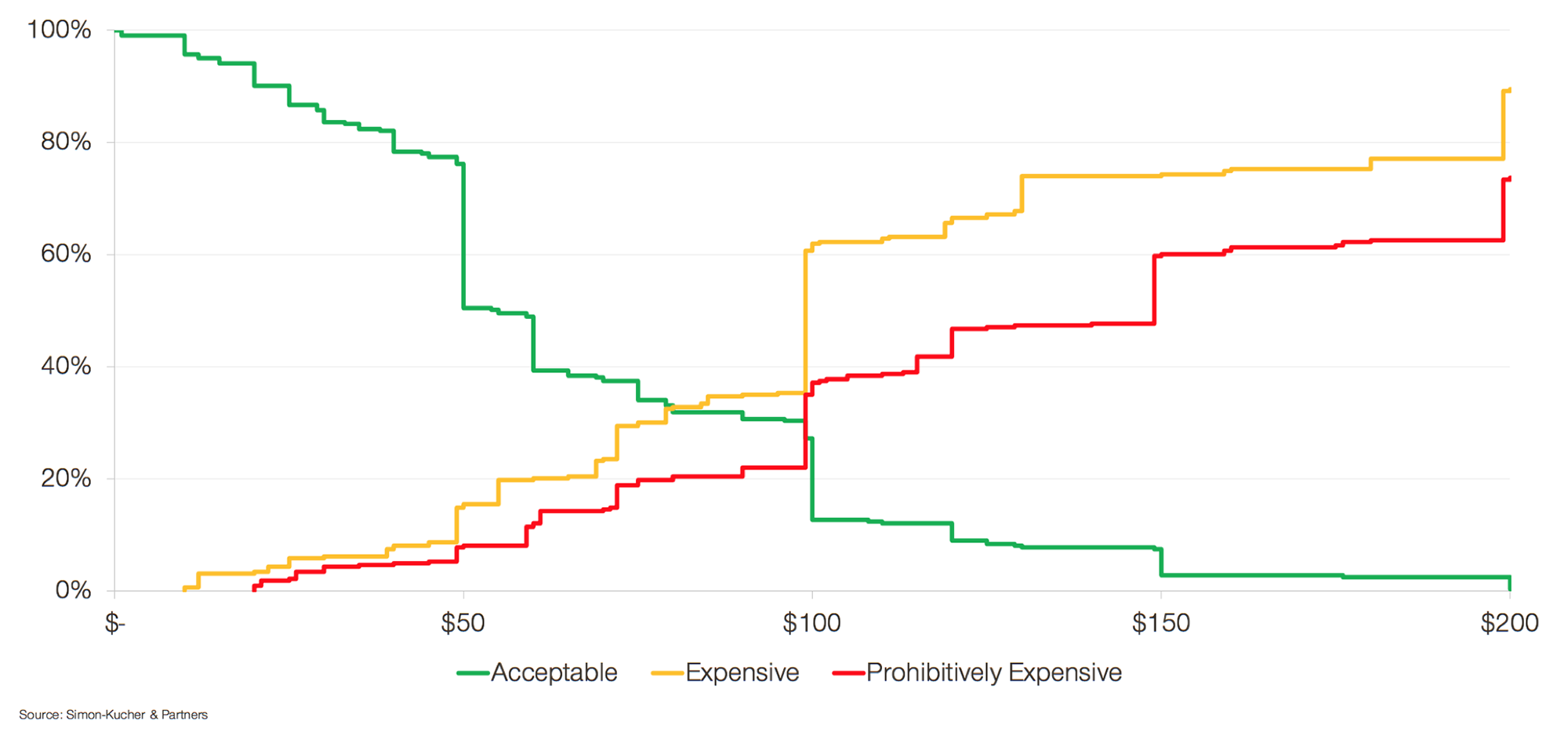

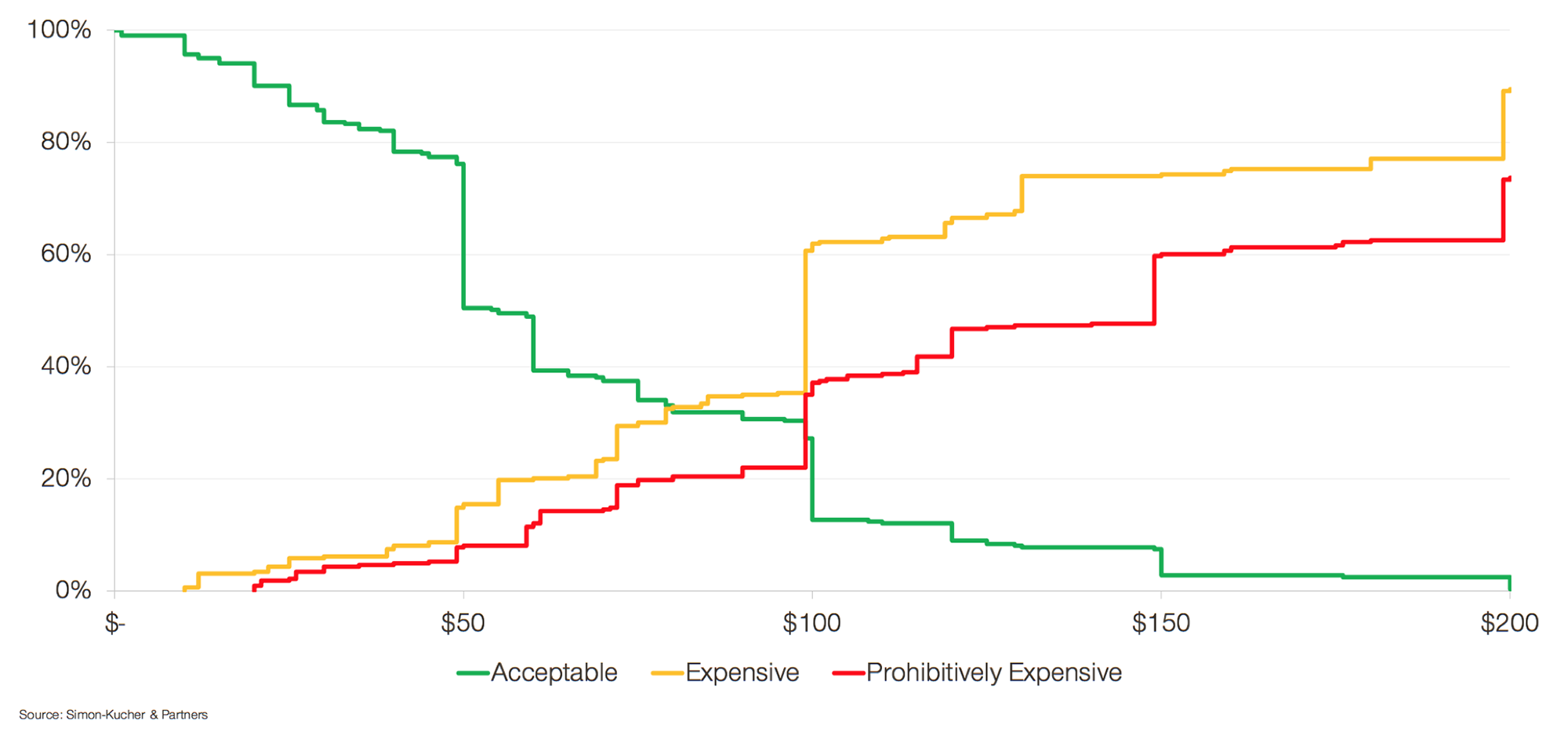

Innovators are constantly selling themselves, and their products, short. Driven by fear of rejection, they bring a product to market and then nearly give it away. One of the easiest ways to validate pricing before going to market is, simply, to ask. Eddie suggested the Van Westendorp Price Sensitivity Meter, which asks a test group three questions: What is an acceptable price? An expensive price? A prohibitively expensive price?

SETTING THE PRICE USING THE VAN WESTENDORP PRICE SENSITIVITY METER

By gathering and charting that data, companies can visually discover “psychological cliffs”, or price points at which the consumer’s willingness to pay drastically changes. Somewhere in the middle of those answers lies your pricing sweet spot.

It’s Not Just What They Pay—It’s How They Pay

One of the most significant shifts in today’s economy is the diversity of price metrics and price structures. Flat license or per-seat pricing structures are becoming outdated.

Companies need to be in tune with their buyer and present a price metric and price structure that align with the value they hope to deliver.

Eddie provided the example of Evernote, a popular organizational app that recently reached a growth plateau. Its user base was loyal and fairly satisfied with the features the app provided. Evernote needed to move more users to the next tier but knew that charging per feature would lead to a revolt. Instead, they used “number of devices” as a price metric, and upgraded users to the next tier when they were syncing Evernote on multiple devices. Almost immediately, they found that users with multiple devices were comfortable shifting to the next tier.

If you are not finding the market traction you want at your current price point, consider implementing a different metric or a different structure. You just may find yourself capturing even more value.

One Size Does Not Fit All

You’ve set your price and you’ve innovated your price structure. Now, it’s time to create packages and pricing tiers. Realize that different groups of people are willing to pay different amounts for exactly the same thing, based on the value they derive from your product. Eddie refers to these groups as “action segments”, and encourages companies to think about how they can craft product tiers and pricing accordingly.

A classic example is Microsoft, which offers slightly different versions of its product to students, businesses and individuals, priced and packaged very differently. “Action segments provide brilliant insight because they let you create different packages,” explains Eddie. “One size almost never fits all.”

The Buyer is Never 100% Rational

Finally, remember that pricing is part art and part science. It’s as much psychology as it is economics, and it’s up to you to control the customer’s perception of your value.

The Economist, for example, used to offer two subscription tiers: Online-only for $59 a year, or Print/Web for $125 a year. The company preferred to sell the more expensive print and web subscription, but only 32% of customers chose it. Then, the Economist added a decoy option and displayed in on-screen between the existing two: Print-only, for $125 (the same price as Print/Web). Within a year, the Print/Web subscription rate grew from 32% to 84%. Exactly zero people selected the Print-only option, but that decoy offering made Print/Web look like a deal in comparison.

“Price is so much more than a number that ends in 99 cents. Pricing should tell a story,” summed up Eddie. Eddie’s presentation served as a reminder to think beyond product-market fit and to consider product-market-pricing fit.

Watch the full presentation from the Executive Summit here: