2018

Bootstrapped

Survey

Mainsail Partners conducted the 8th Annual Mainsail Bootstrapped Sentiment Survey in November and December of 2018. With answers crunched from hundreds of entrepreneurs located across the U.S., this survey provides a unique perspective into how entrepreneurs are feeling about the U.S. economy, their specific industries and the future growth potential of their businesses. Because this segment of business owners is uniquely focused on growth and profitability, their insight often serves as an early indicator of trends in the broader market.

In addition, this year’s findings take a deep dive into how these companies are tactically approaching a variety of functional areas, uncovering industry best practices.

Key Findings

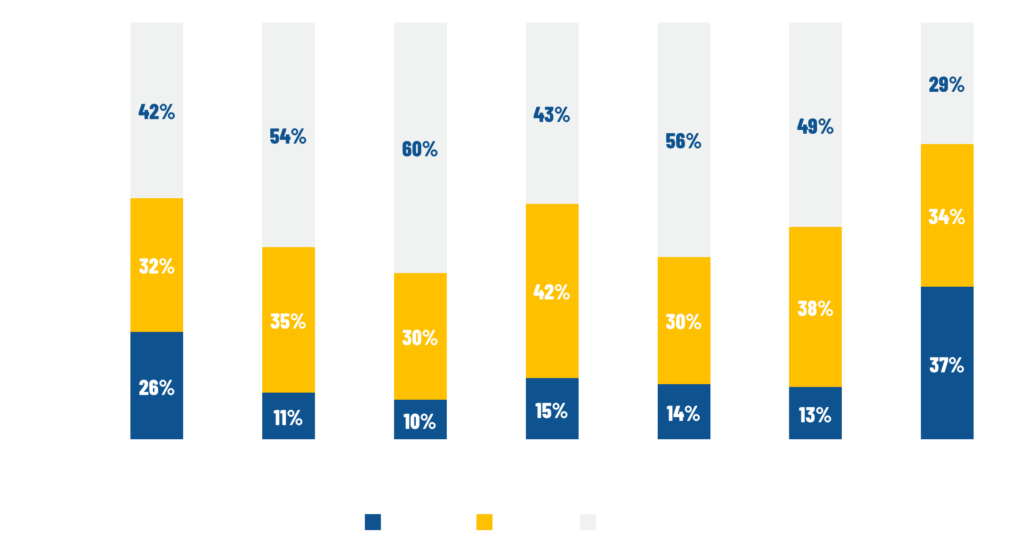

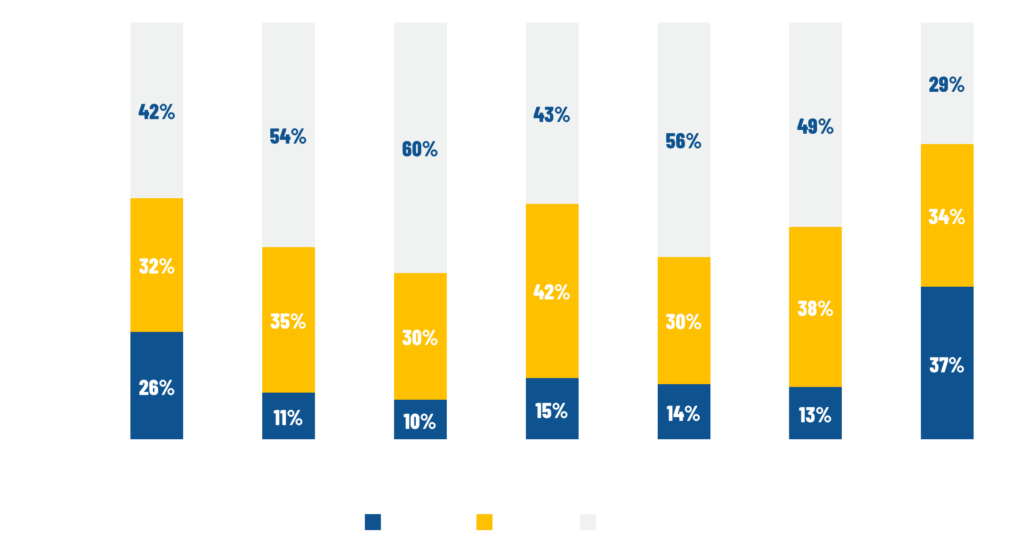

Confidence in the U.S. economy is at an all-time low.

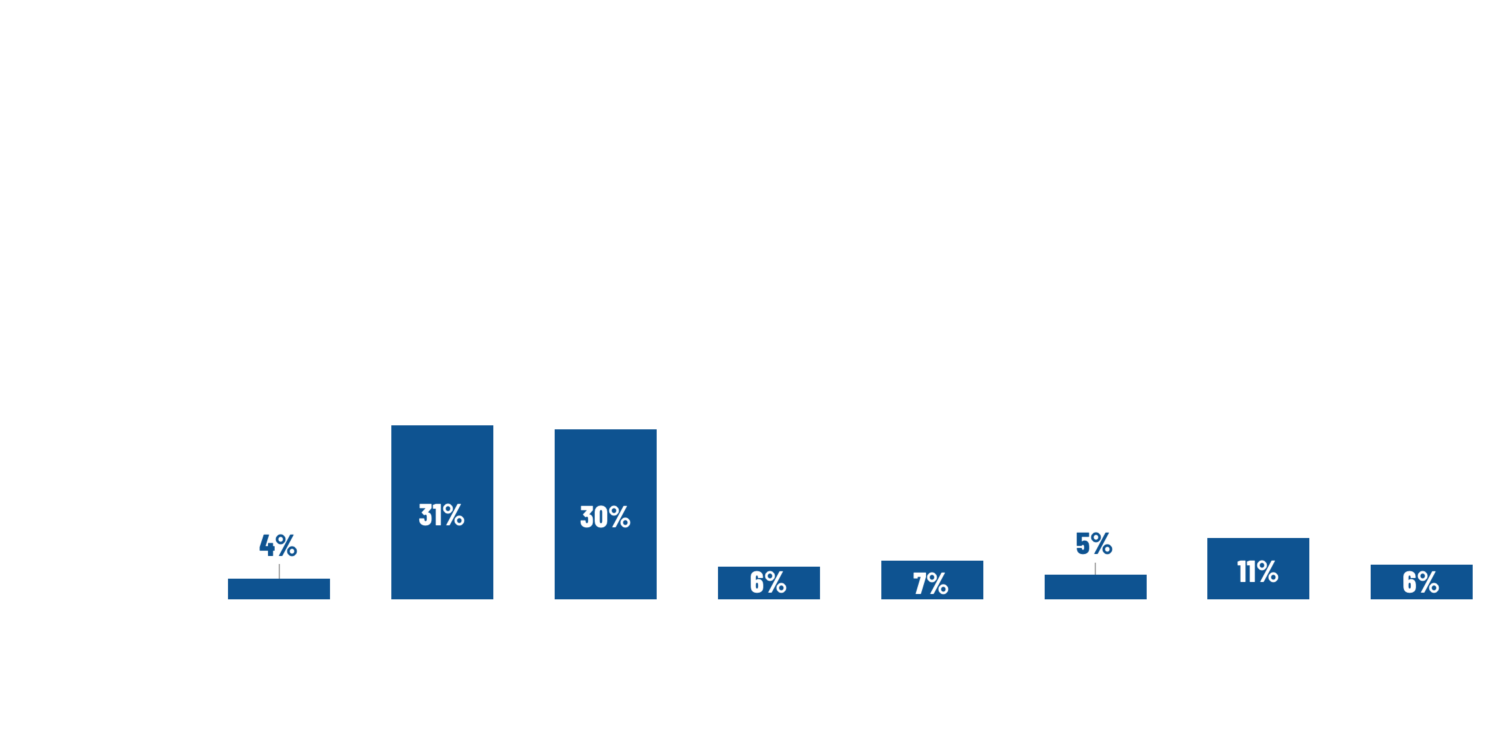

Of the 311 entrepreneurs surveyed, 37% believe the economy will get worse in 2019. This represents the lowest rate of confidence since 2012, when 26% believed the economy would decline.

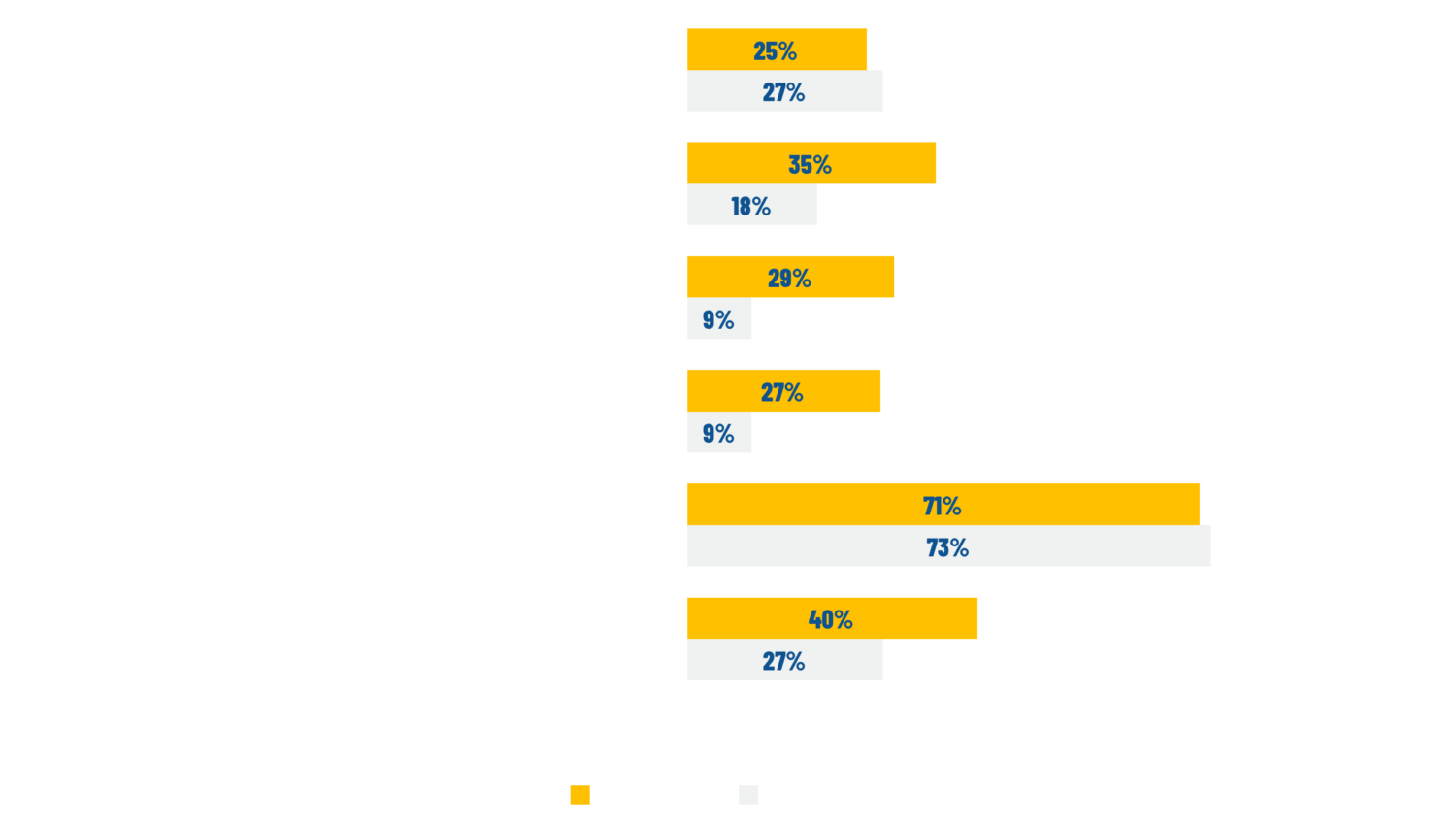

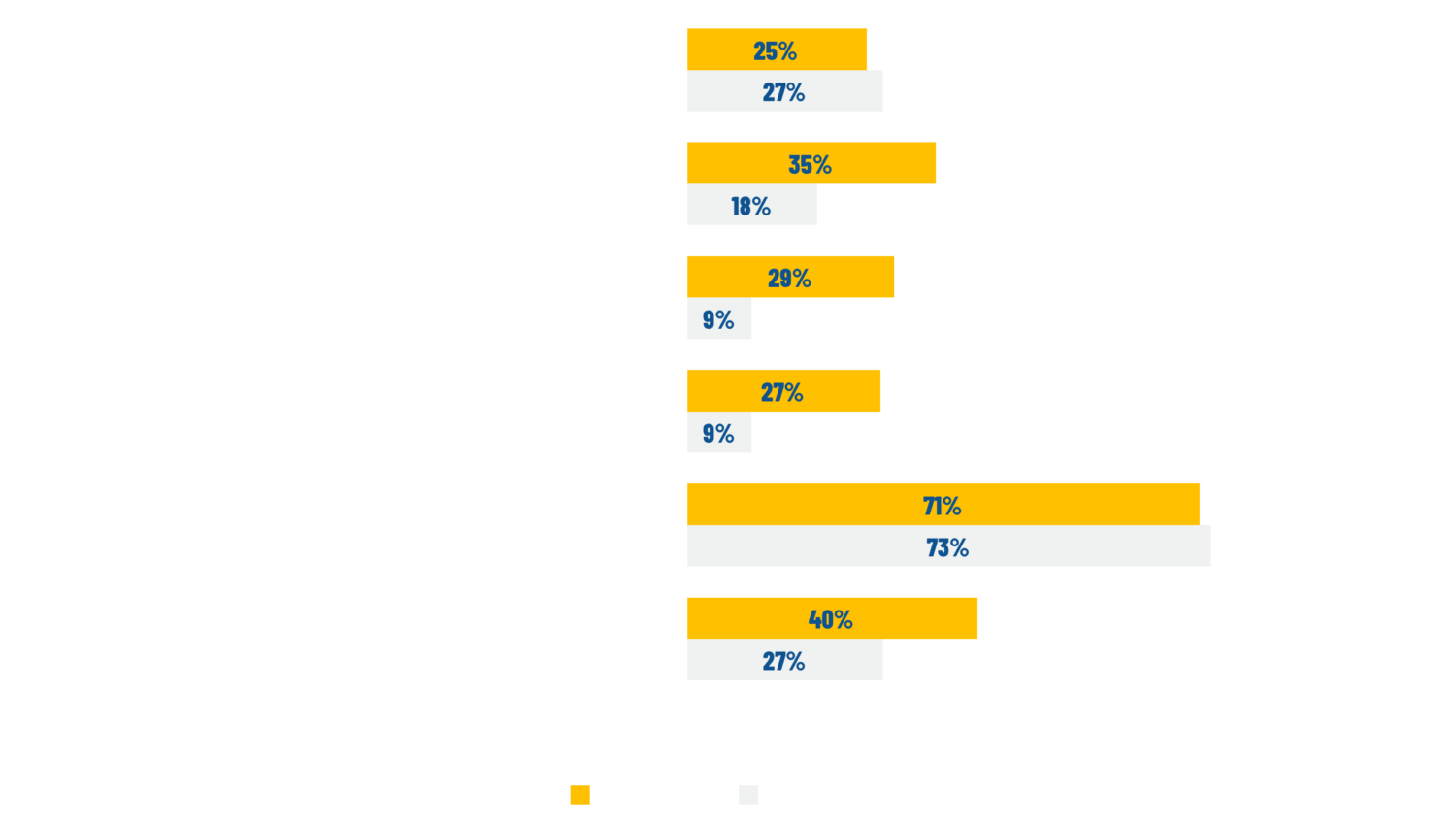

WE ASKED: Do you expect the U.S. economy to be better or worse next year?

A lack of confidence in the U.S. economy is shaping the way entrepreneurs feel about their businesses’ ability to perform.

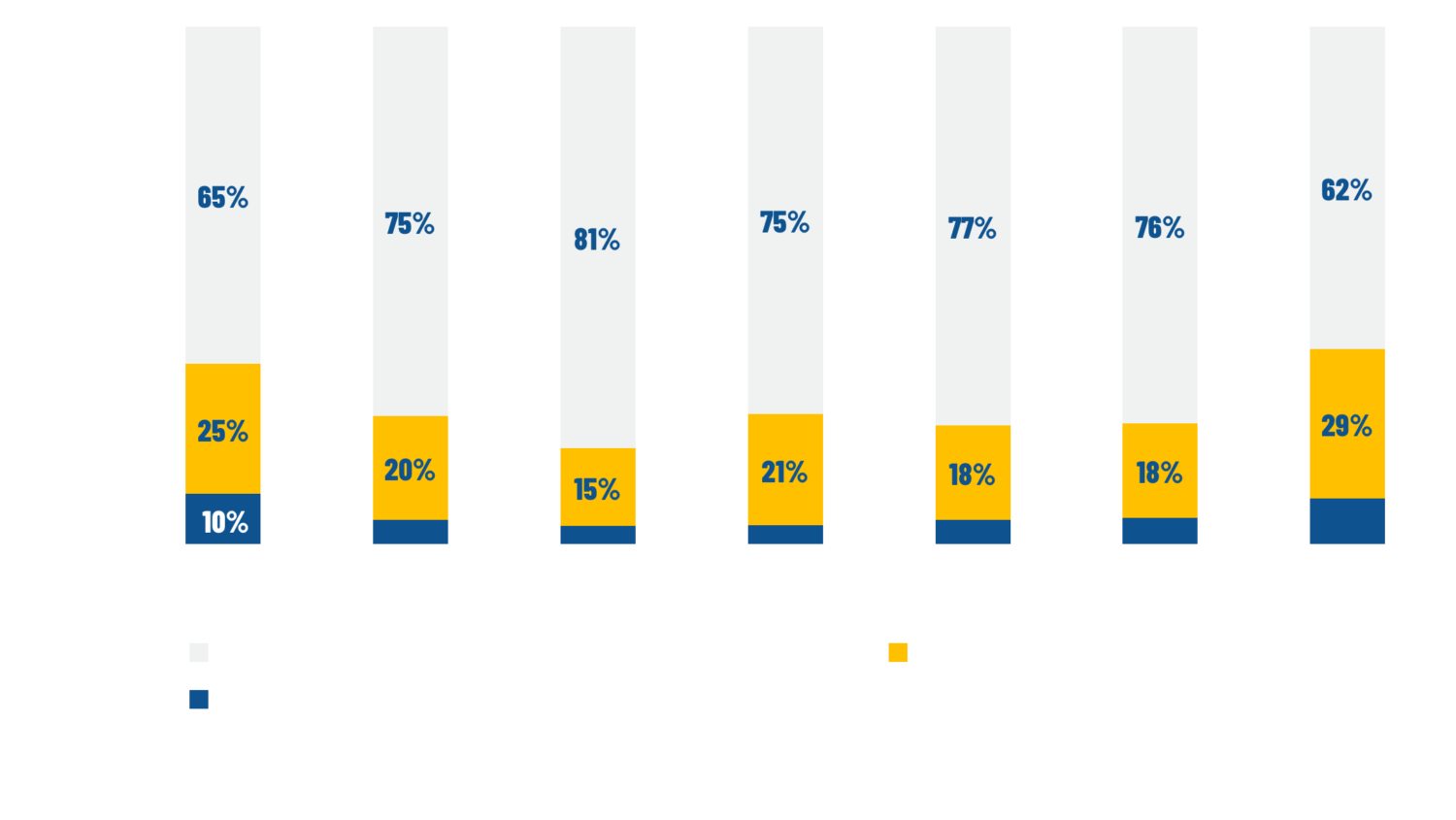

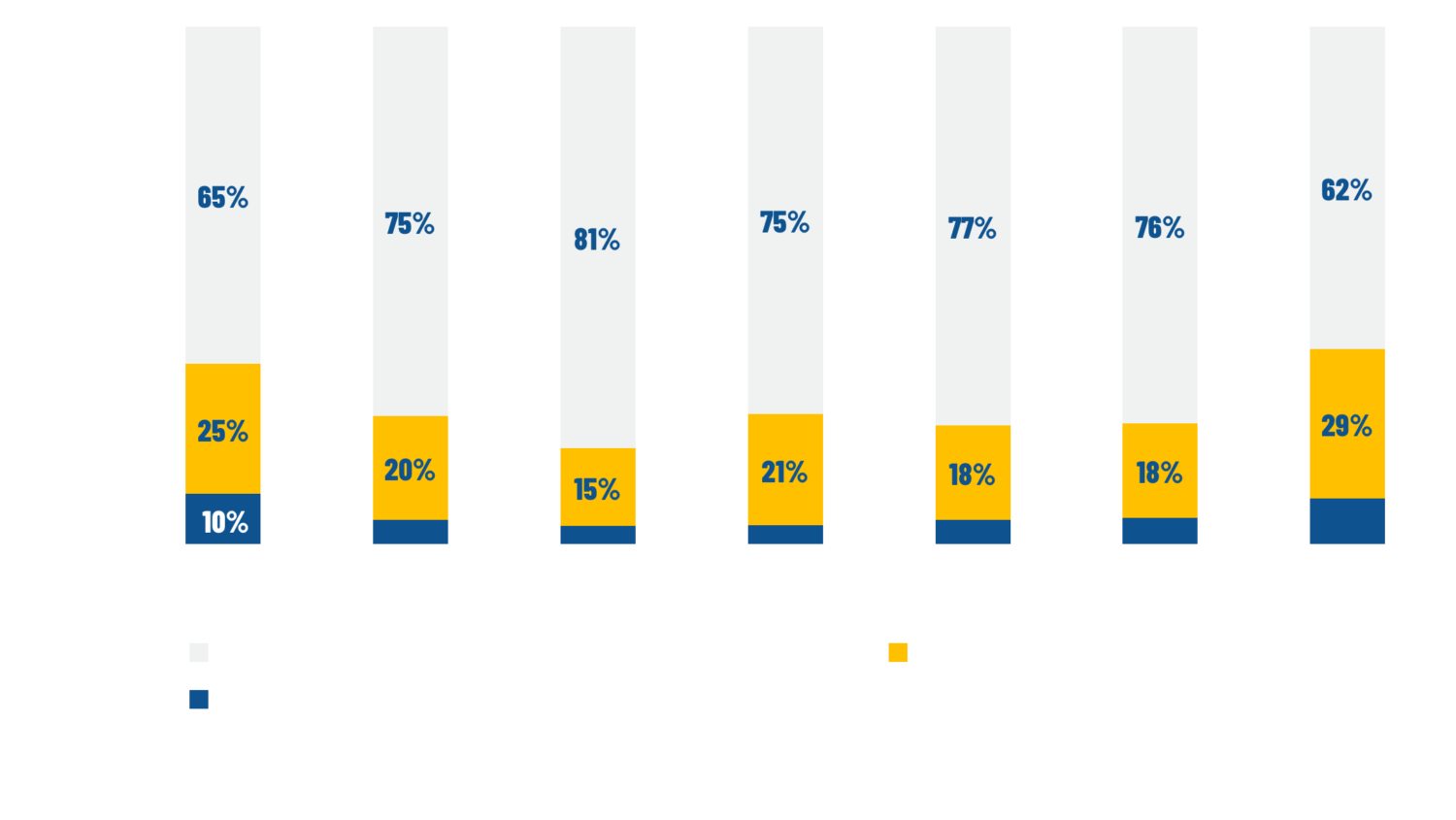

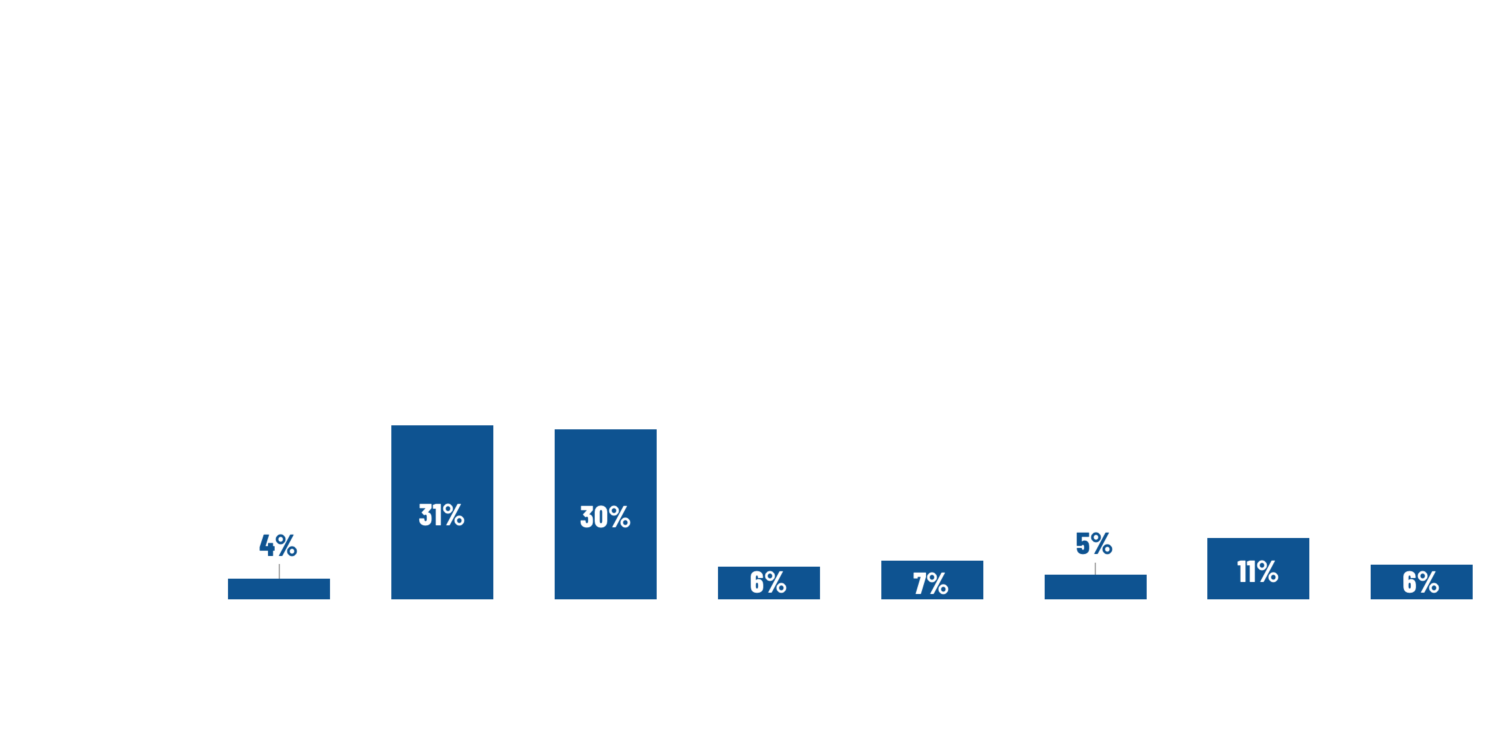

A record-low 62% of entrepreneurs believe their businesses will grow faster this year as compared to last. Despite this decrease, less than 10% of entrepreneurs predict the growth of their business to slow.

WE ASKED: What best describes your expectations for your business in 2019?

Regardless of where the economy is headed, bootstrapped companies are still hiring.

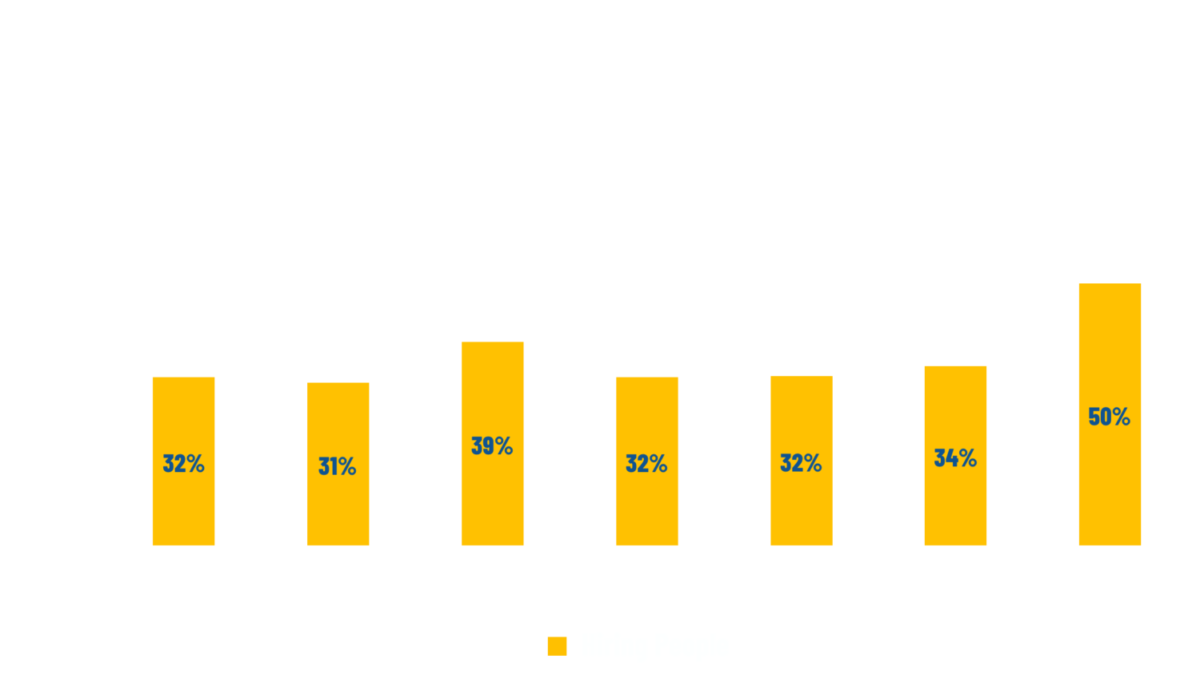

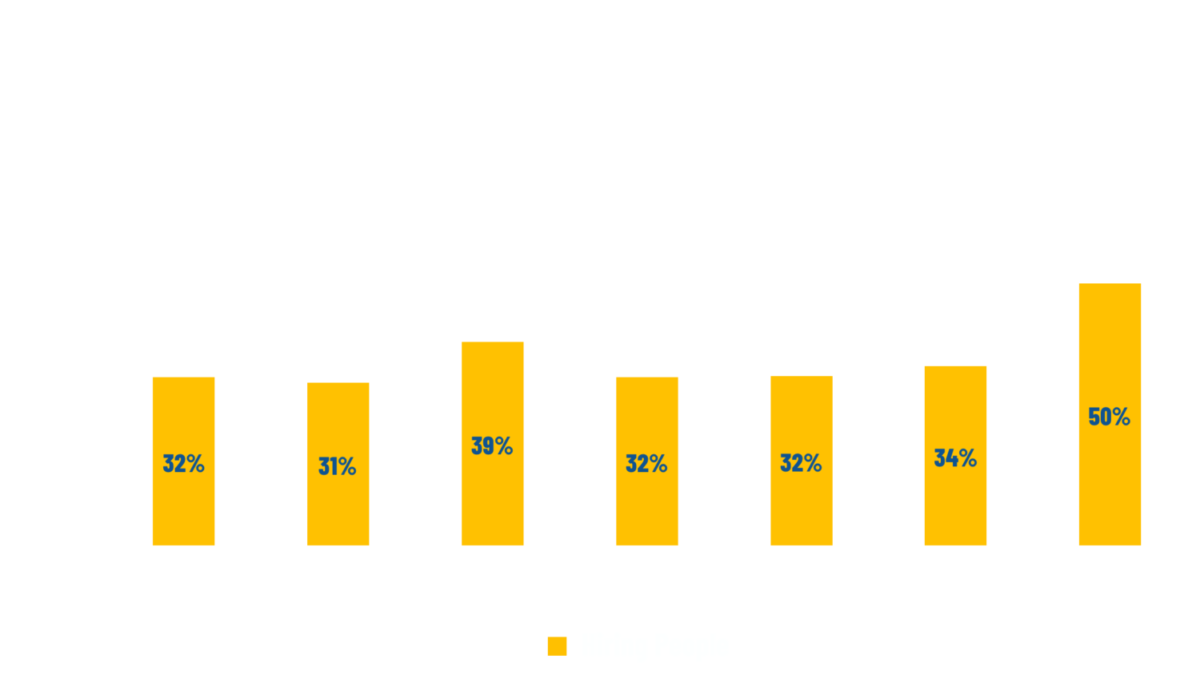

Half of all entrepreneurs surveyed say that “hiring people” is one of their most important areas of investment in the coming year, up 47% from 2017 and at an all-time high since 2012.

WE ASKED: What are your most important areas of investment?

Bootstrapped companies tend to have incomplete management teams.

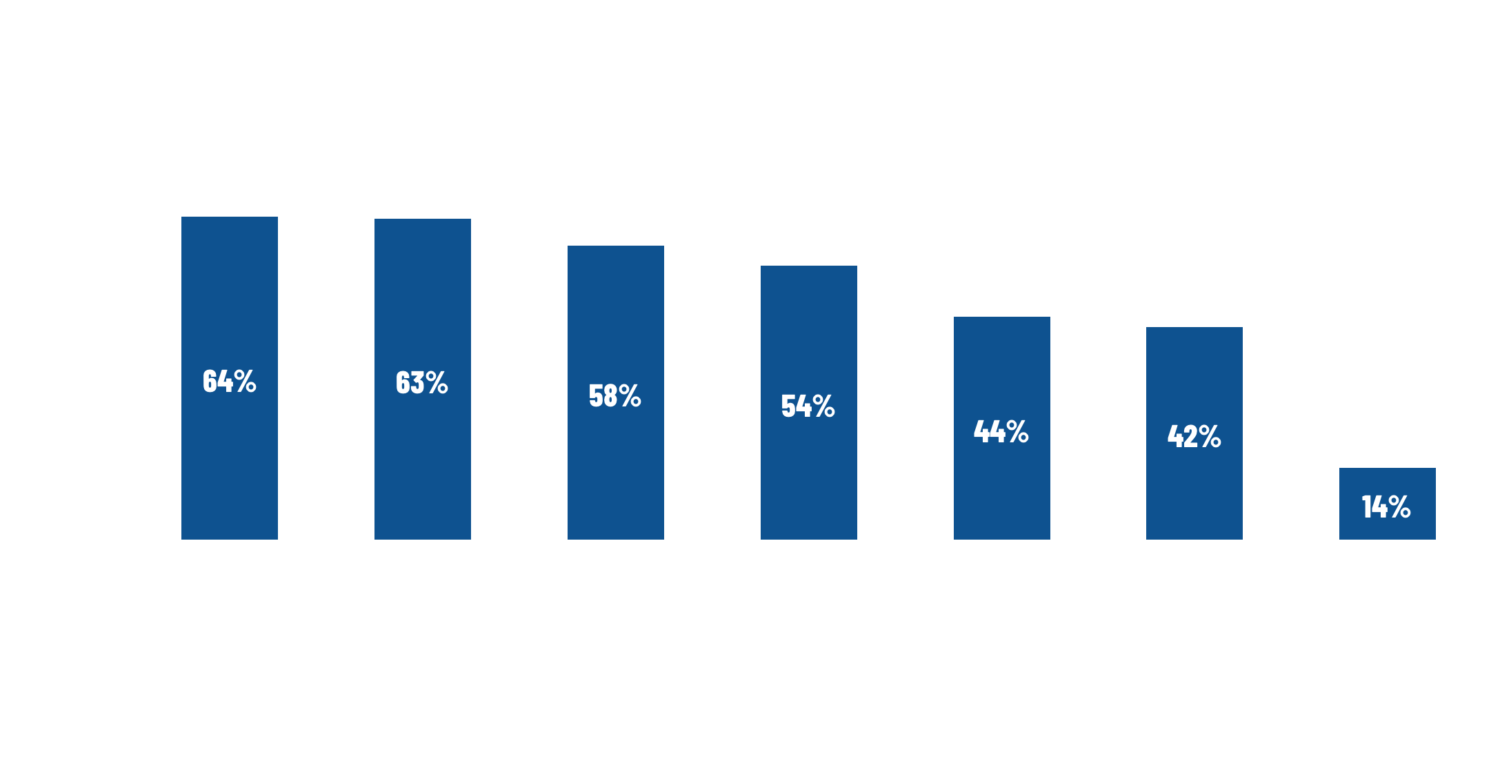

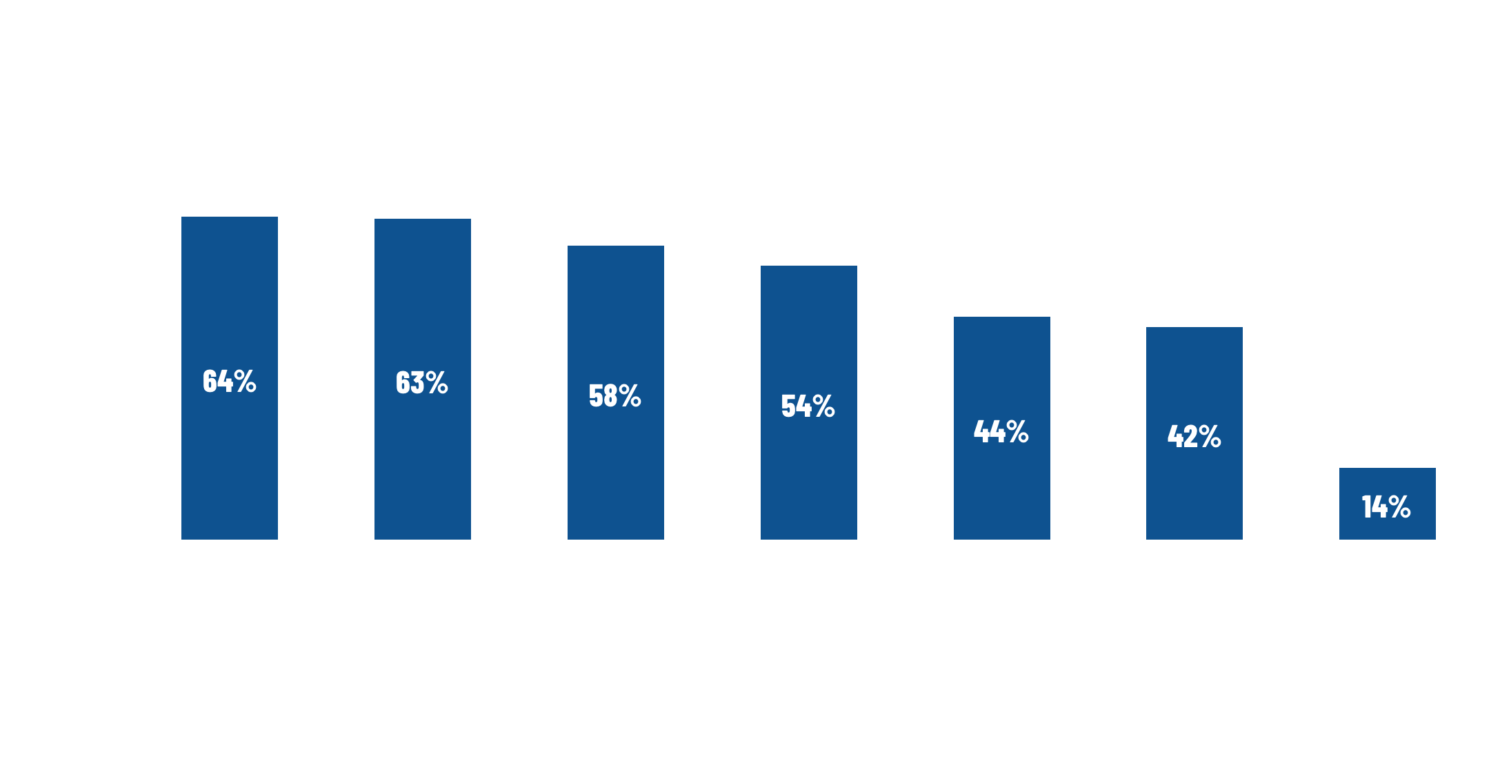

At this point in their growth journey, the majority have a functional leader (Director-level or above) for Sales and Engineering. By contrast, only 14% have a leader in Talent/HR and less than 45% have a leader in Marketing or Finance.

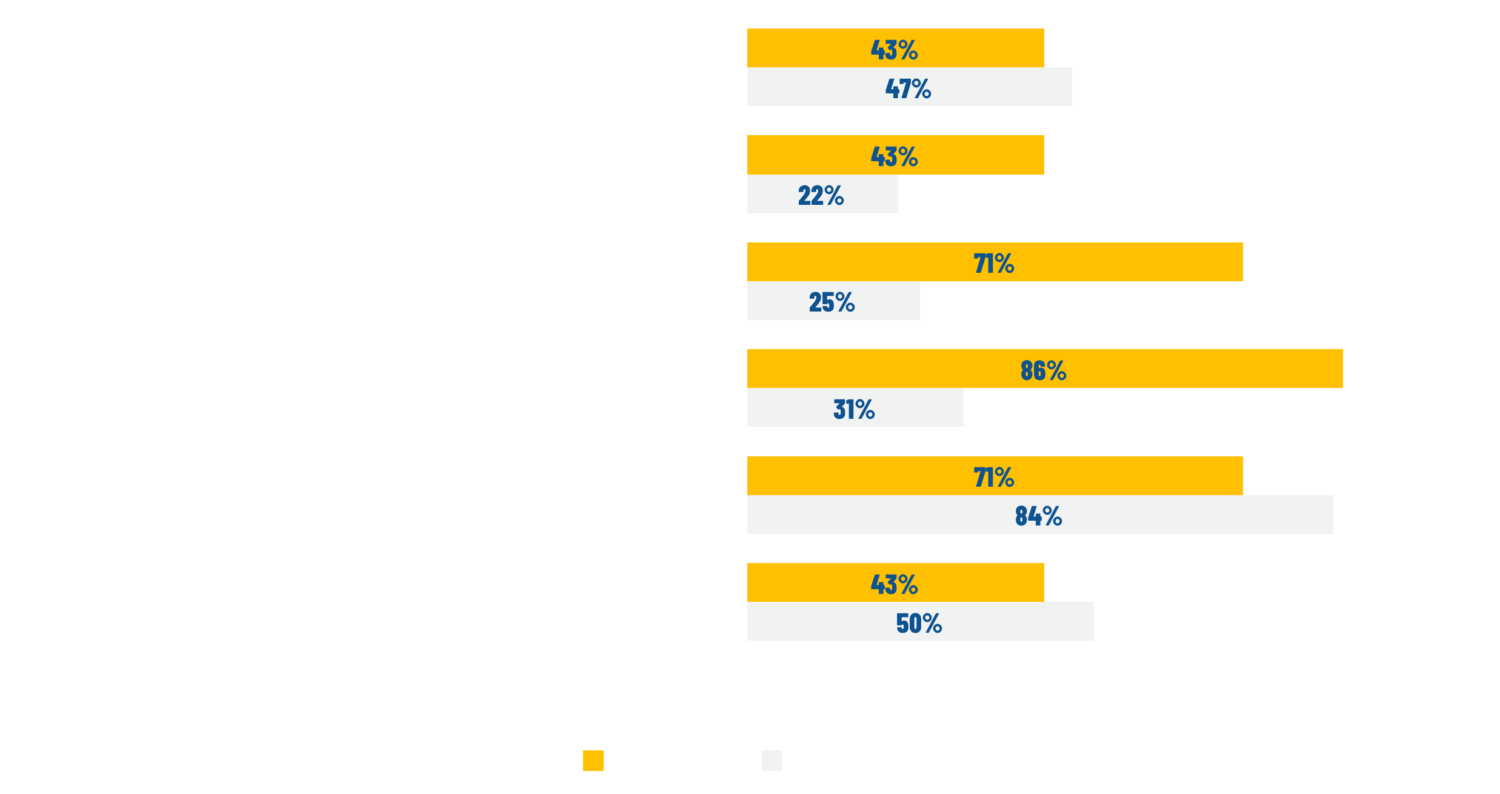

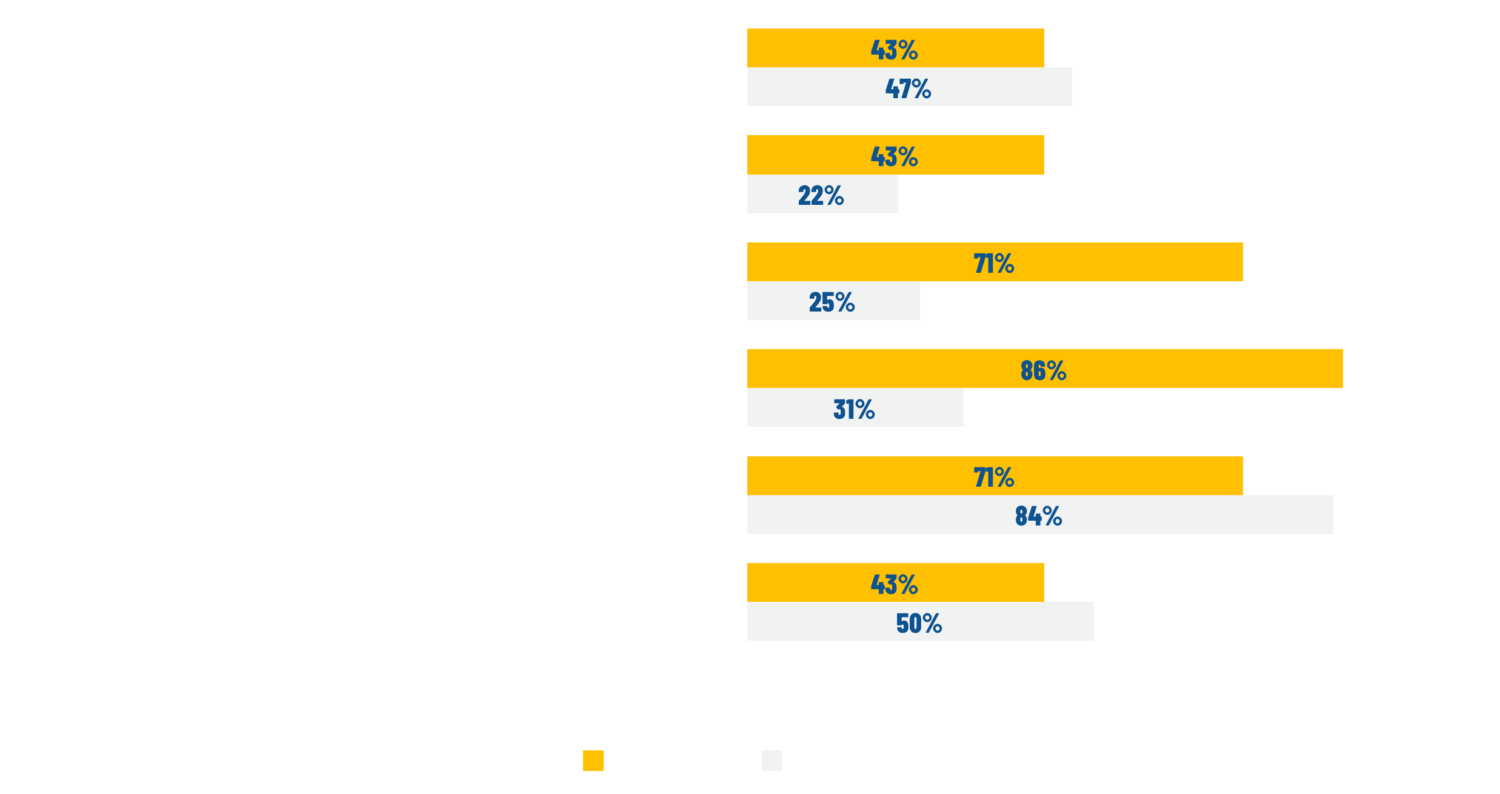

WE ASKED: In which functional areas do you have a leader in place (Director level or above)?

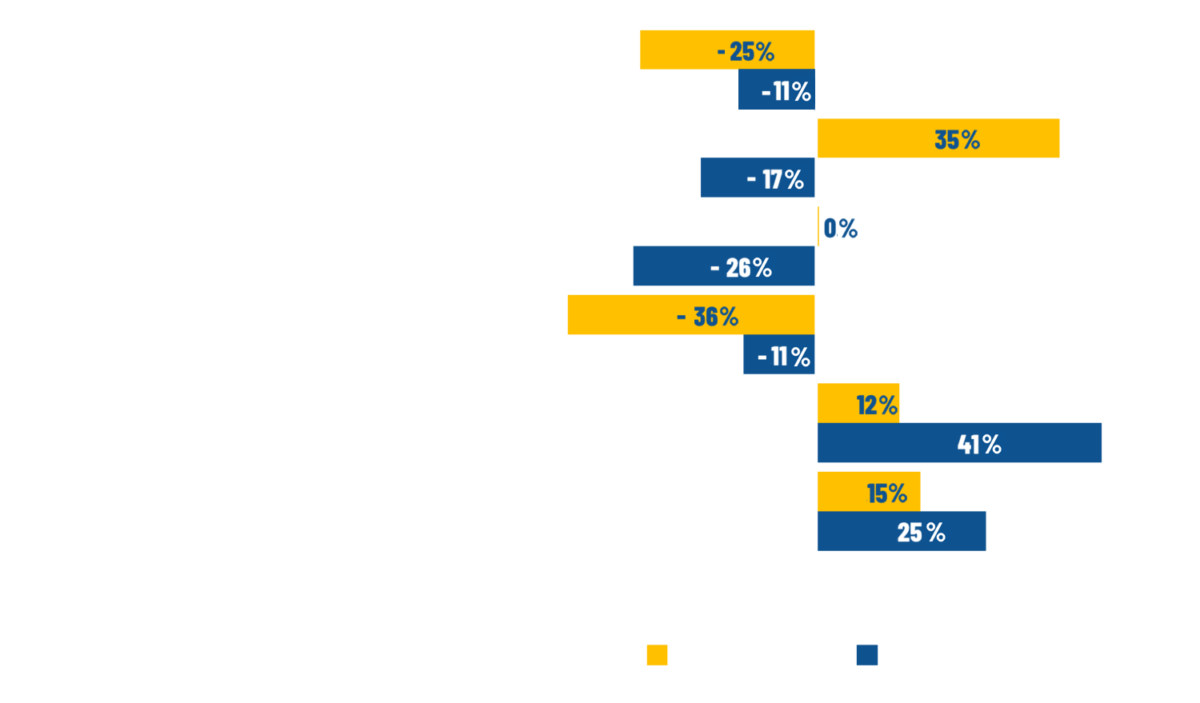

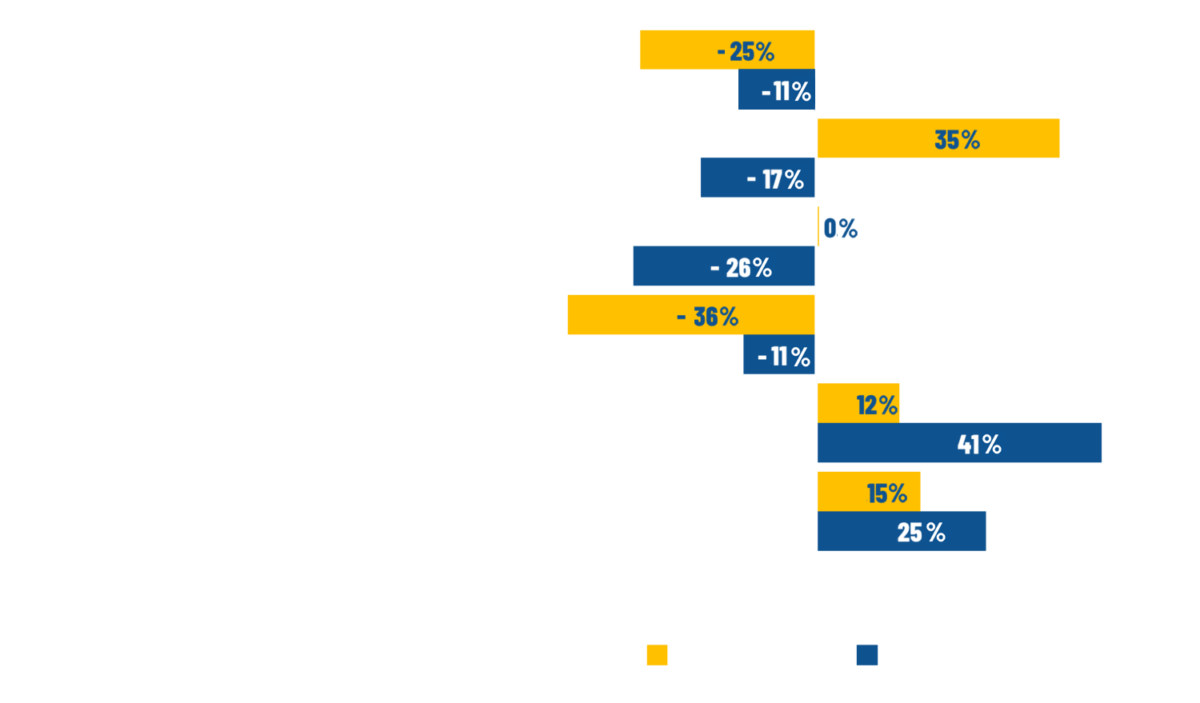

Among all functional areas, bootstrapped entrepreneurs are most likely to view Product & Engineering and Customer Success as strengths, and Sales and Marketing as weaknesses.

In all cases, this sentiment is juxtaposed with the perceived importance of these functions to the business, with Sales experiencing the biggest disconnect.

WE ASKED: How important do you perceive the following function to be, and do you view this function as a strength or weakness of your business?

Spotlight on Bootstrapped

Best Practices

The ability of a company to scale past initial product/market fit is predicated on its leadership, market dynamics and functional execution. To better delineate this growth journey, Mainsail has developed nearly 100 best practices that we believe create the most leverage when scaling a software company from $10M to $50M+ in revenue.

HOW TO READ THESE RESULTS

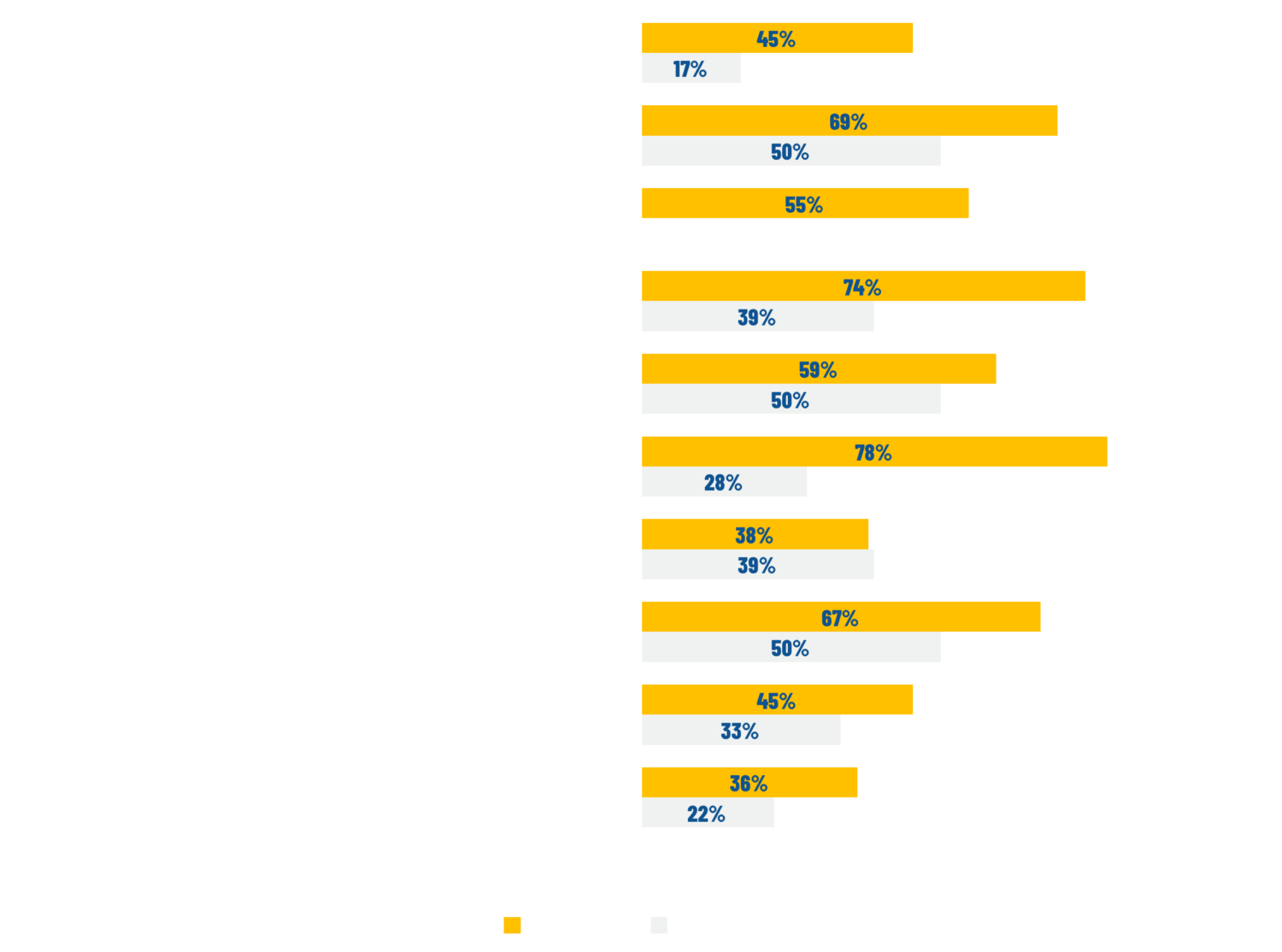

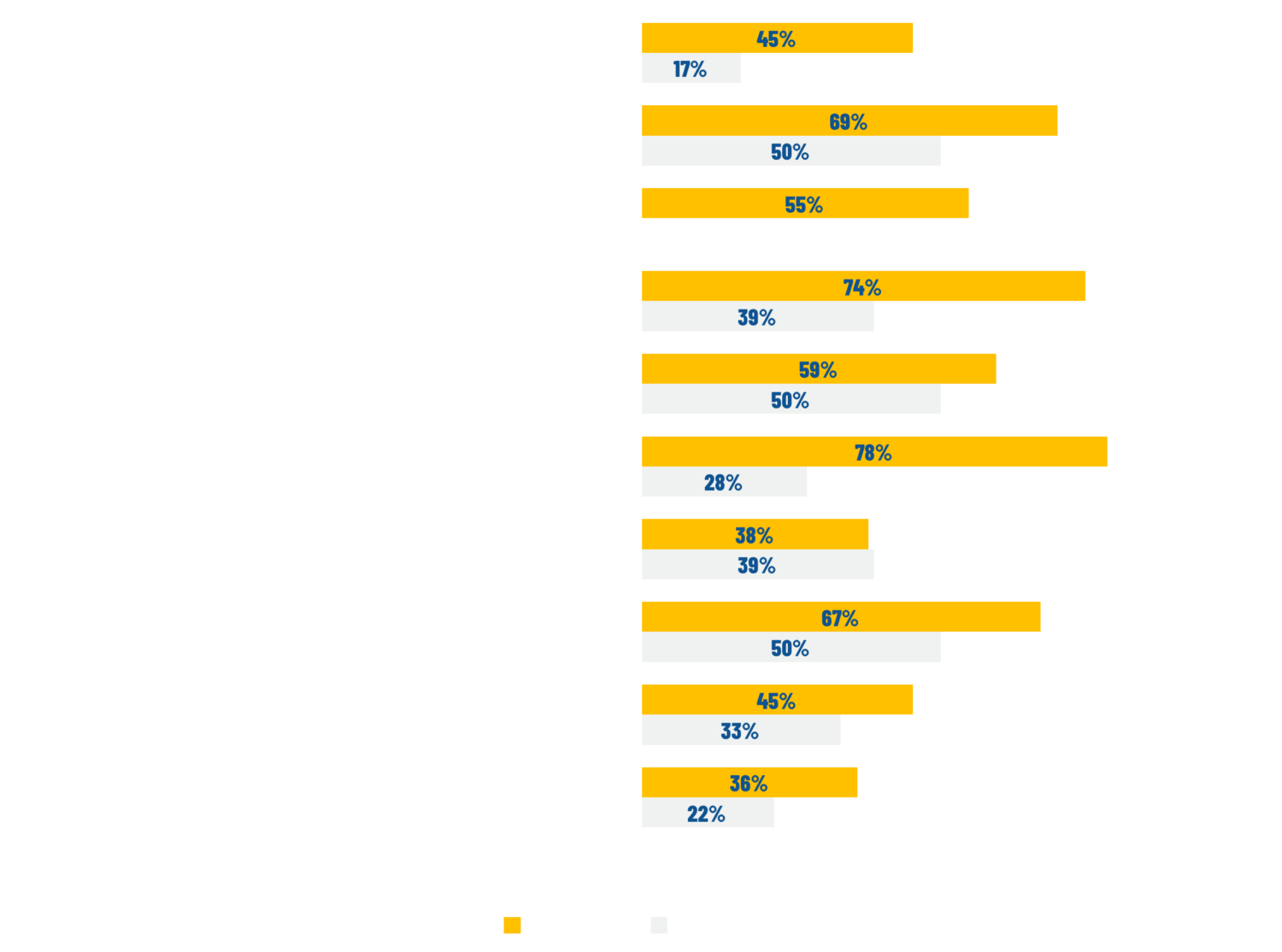

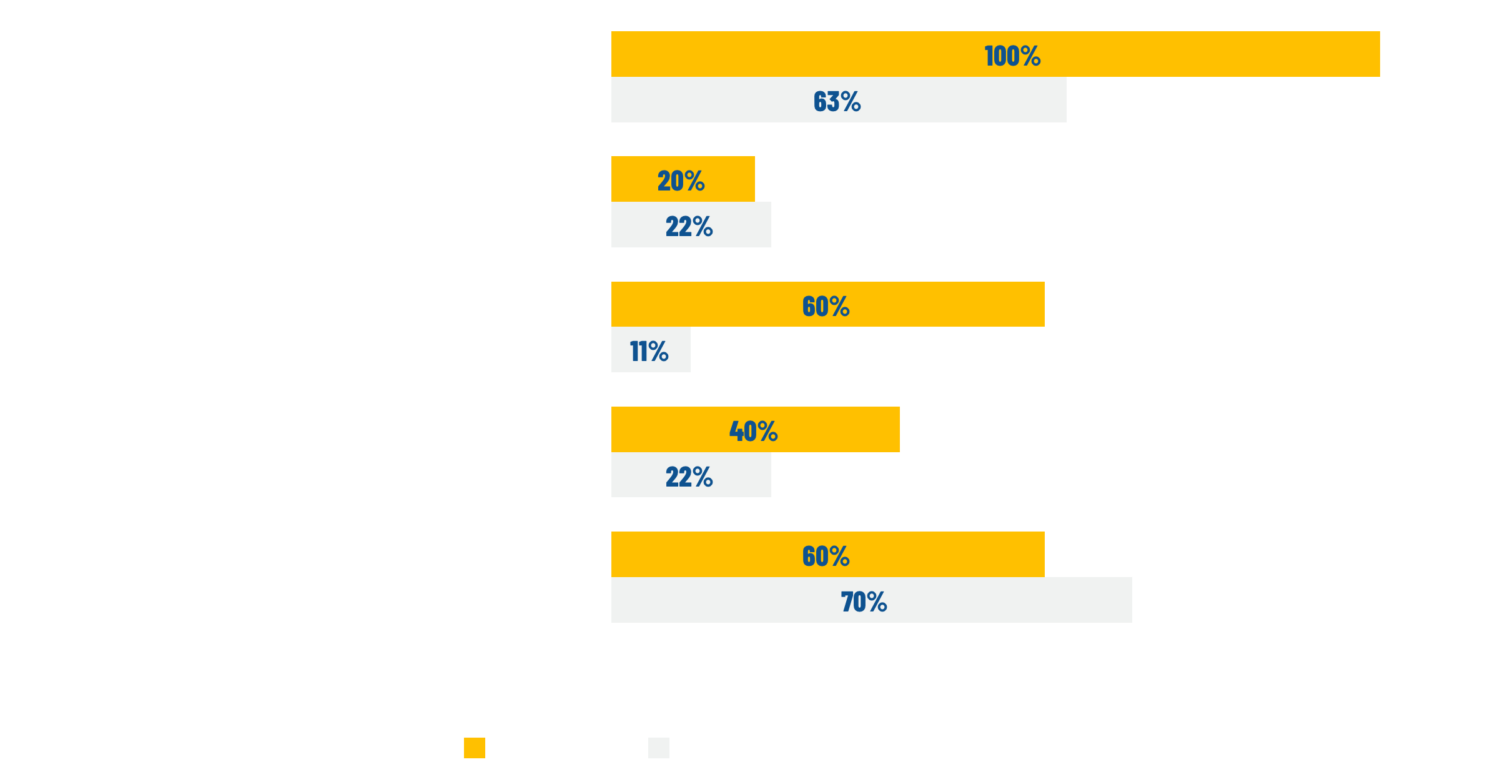

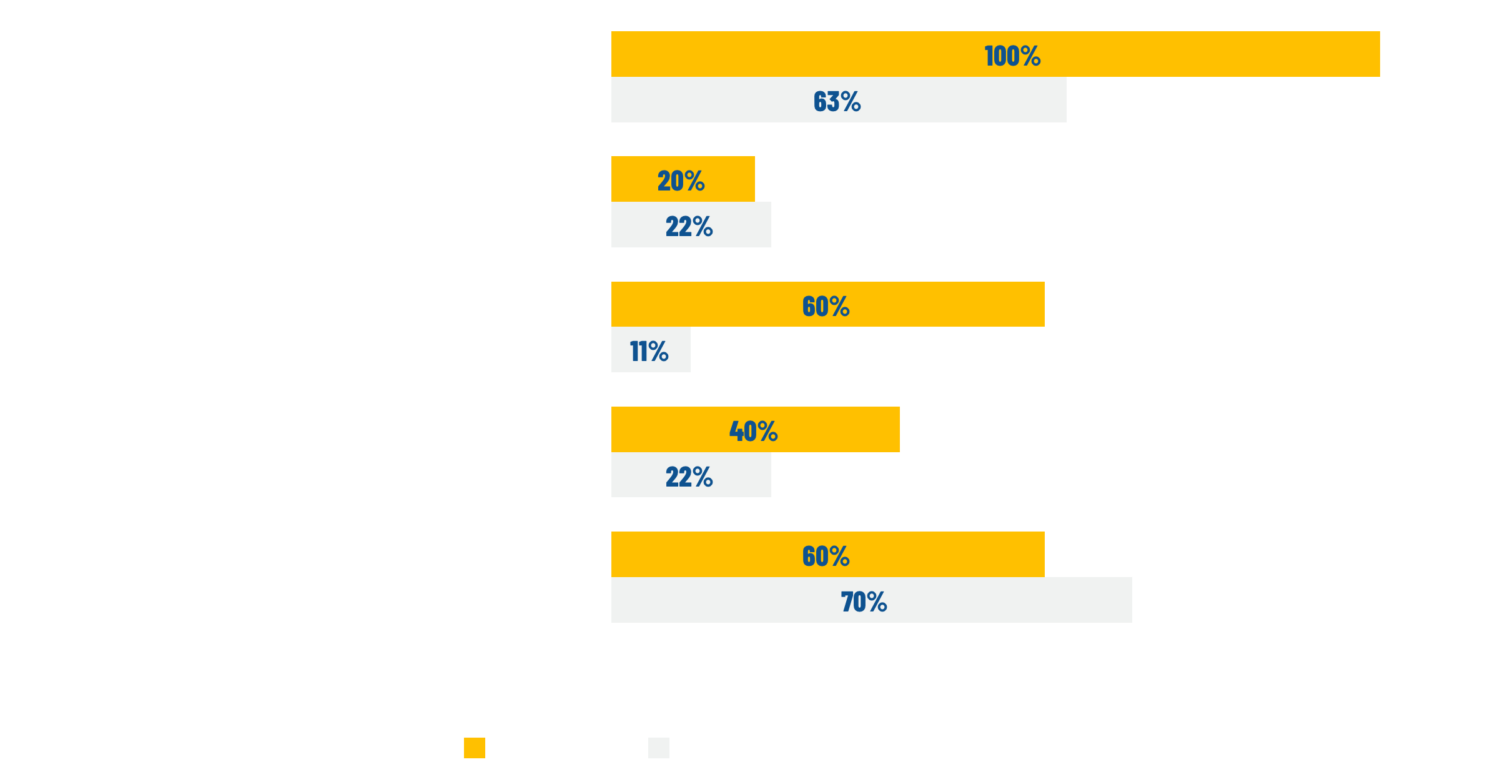

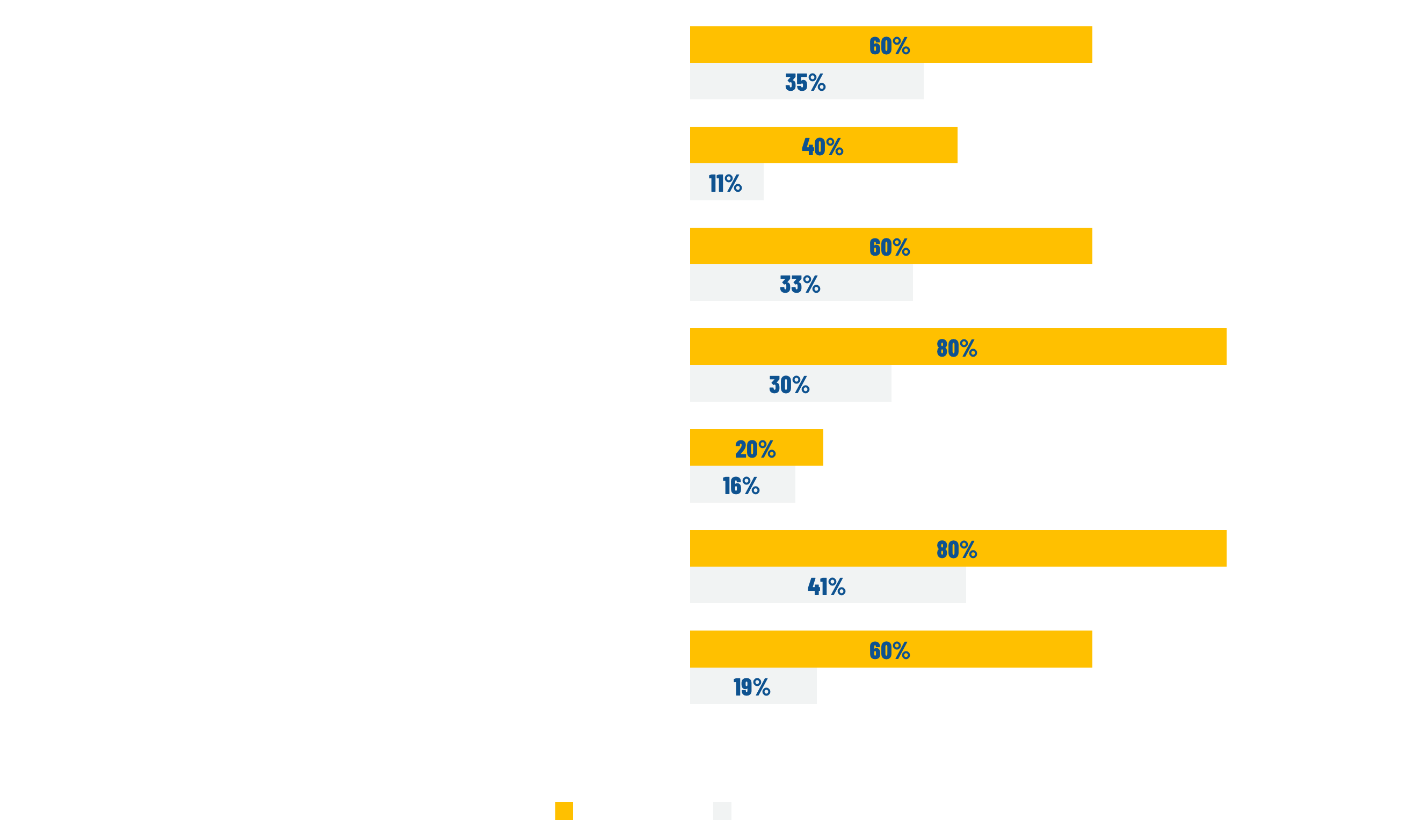

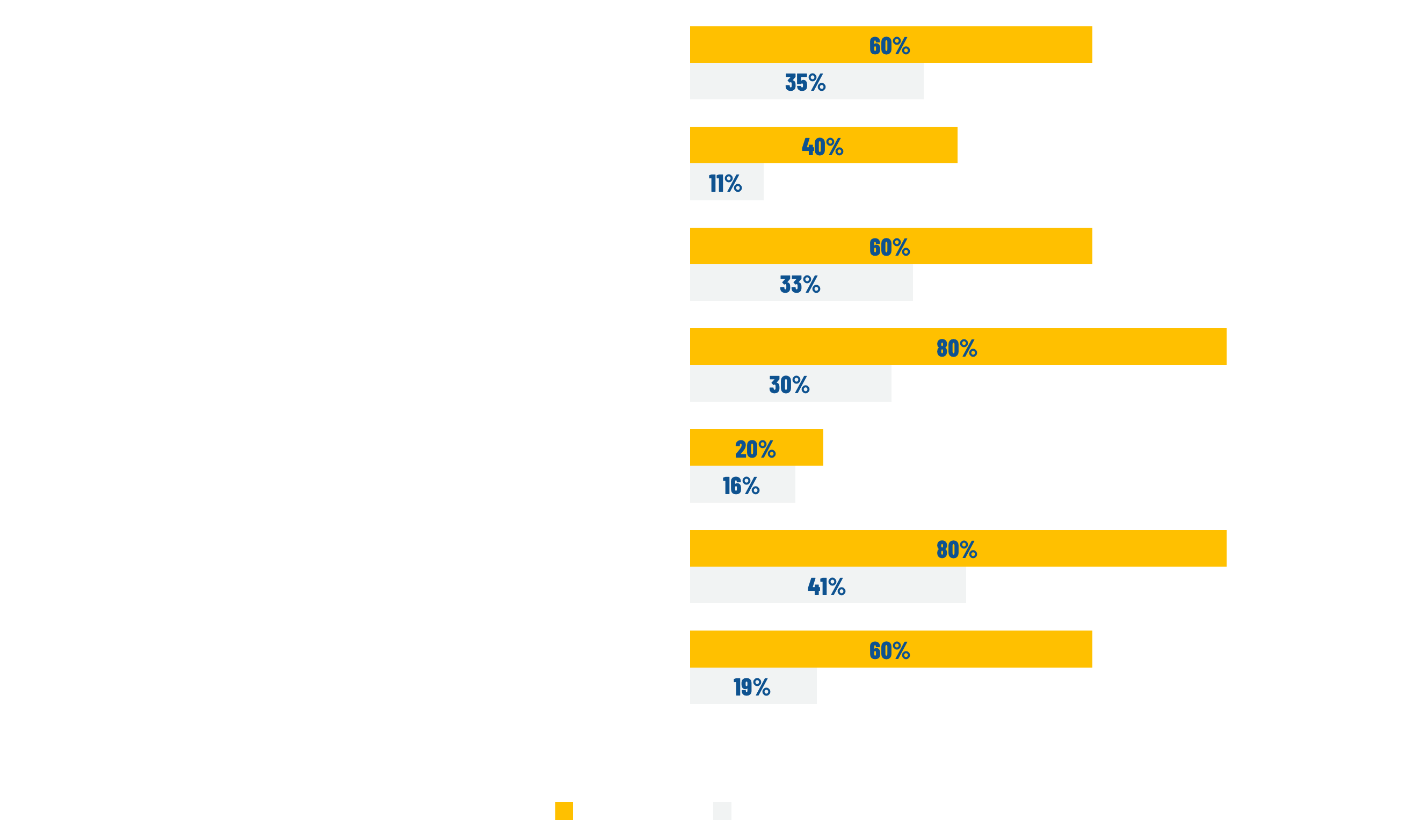

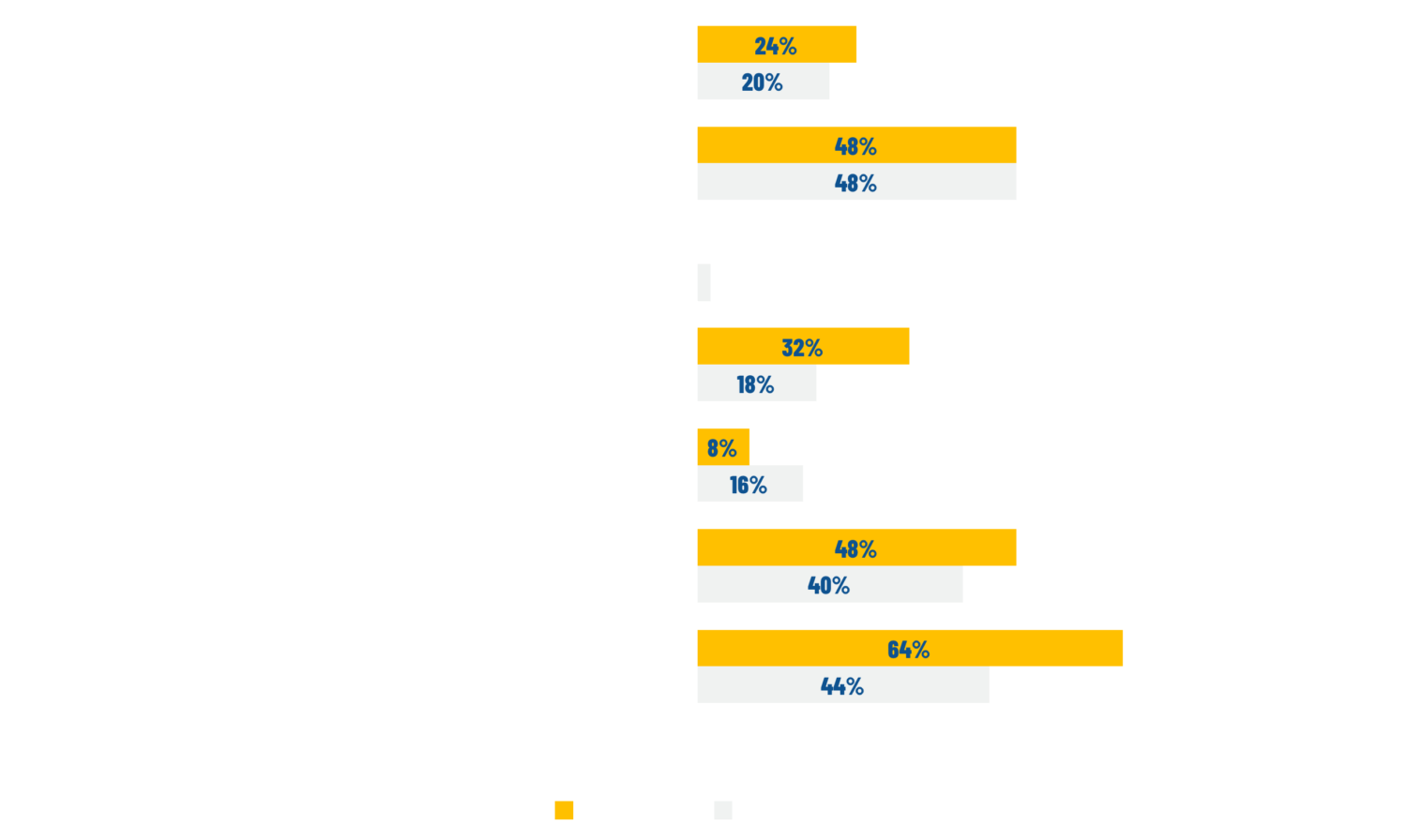

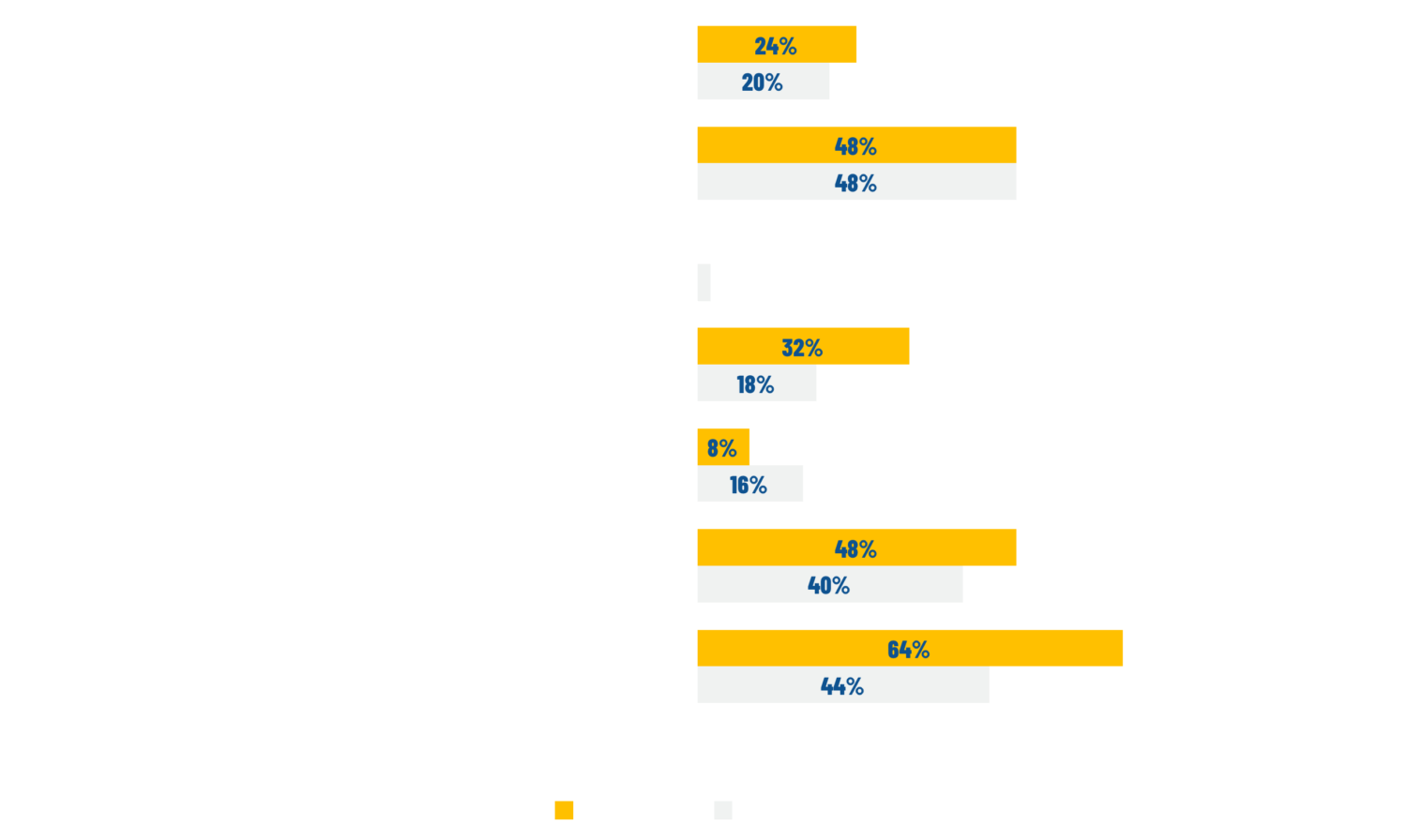

Entrepreneurs were asked to identify which functions of their businesses were their STRENGTHS and WEAKNESSES. The following charts compare best practices adoption between these two groups. The yellow bars show adoption by entrepreneurs that view the function as a strength. The white bar shows adoption by entrepreneurs that view the function as a weakness.

Customer Success / Support / Onboarding

Since 2015, our Bootstrapped Surveys have consistently revealed an increase in the importance of Customer Success. Today, many entrepreneurs view this functional area as a strength and 58% have an executive overseeing it. Companies that frequently conduct NPS surveys, align compensation plans with churn and revenue retention, and segment customers into tiers are most likely to view Customer Success as a strength.

WE ASKED: Which CUSTOMER SUCCESS Best Practices have you implemented?

Product & Engineering

Given that many entrepreneurs view Product & Engineering as a strength, it’s not surprising that best practice adoption is relatively high. The three best practices that tend to align with companies believing they are strong in this functional area are: develop an automated release process, communicate with customers and test new features with prototypes and utilize a Jira-type system to track bugs and new features.

WE ASKED: Which PRODUCT & ENGINEERING Best Practices have you implemented?

Finance

While the majority of entrepreneurs viewed Finance as the least important functional area, those that view their financial departments as a core strength are more likely to implement an equity incentive program, complete annual audits and perform a sales tax nexus, as compared to companies that view Finance as a weakness.

WE ASKED: Which FINANCE Best Practices have you implemented?

Talent

Companies intend to increase hiring in 2019, but also lack confidence in their ability to do so. 55% of entrepreneurs have indicated that they see “finding good people to hire” as a challenge and only 14% have a Talent/HR leader in place to support this initiative. Companies that implement company-wide OKRs and develop core company values are more likely to view Talent as a strength.

WE ASKED: Which TALENT Best Practices have you implemented?

Marketing

Second only to Finance, Marketing is the function that entrepreneurs are least likely to view as a strength. Second only to Talent/HR, it’s the functional area for which they are least likely to have a leader. Those that do view Marketing as a strength are most likely to use a marketing automation program, have clearly defined buyer personas and value proposition, and specialize the roles within the Marketing team.

WE ASKED: Which MARKETING Best Practices have you implemented?

Sales

There is a strong disconnect between the perceived importance of Sales and the strength of execution, despite this being one of the roles for which entrepreneurs are most likely to have hired a functional leader. Companies that view Sales as a strength are most likely to utilize on-demand dashboards, have optimized commission plans and have developed a clear map of the buyer journey and aligned that to their sales process.

WE ASKED: Which SALES Best Practices have you implemented?

Growth Outlook for 2019

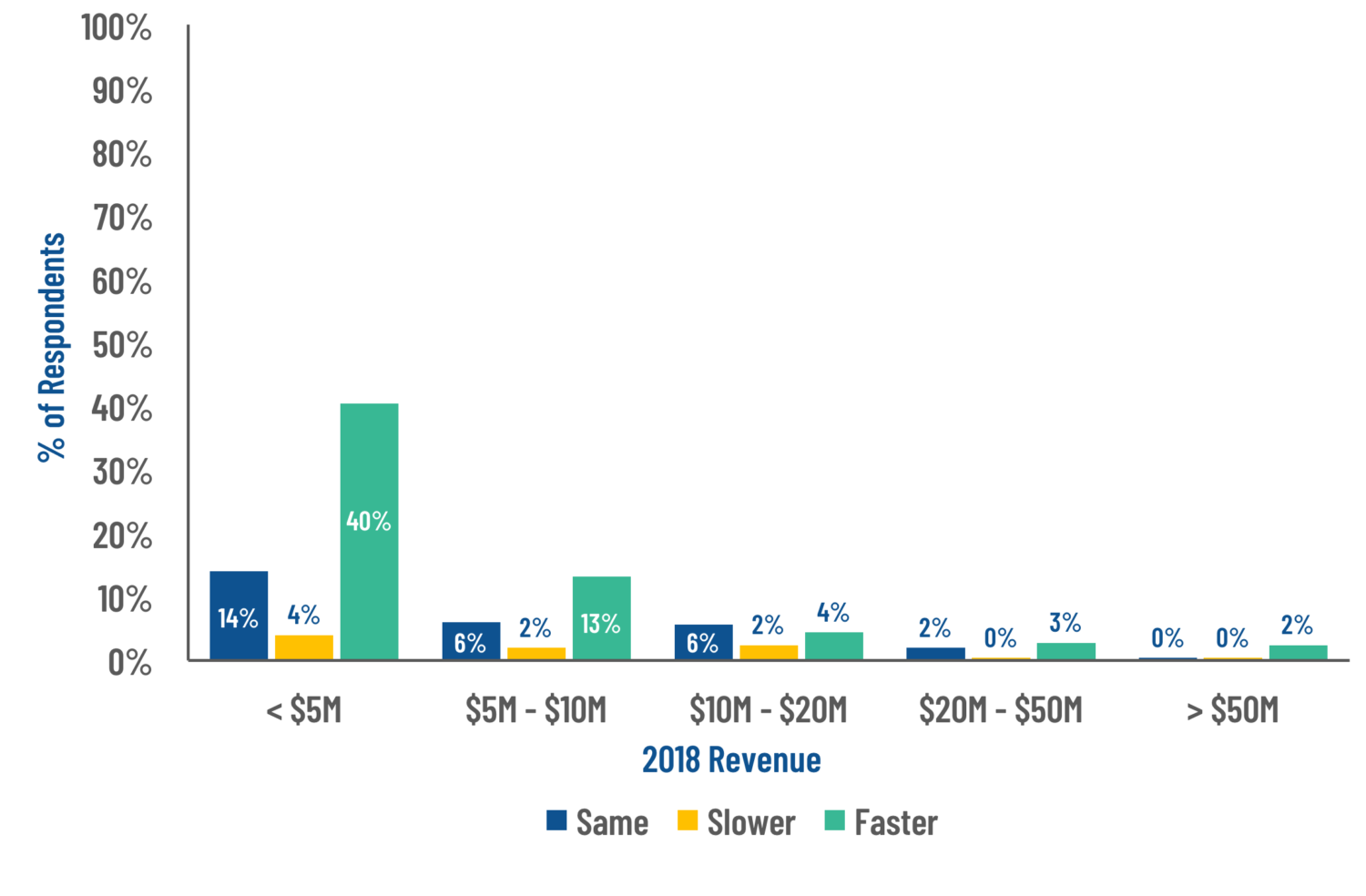

Despite a weakening economic outlook, 62% of bootstrapped entrepreneurs still believe their businesses will grow at a faster rate in 2019.

This optimistic sentiment is particularly prominent among companies that exited 2018 with under $10M in revenue.

WE ASKED: What best describes your growth rate expectations for your business in 2019?

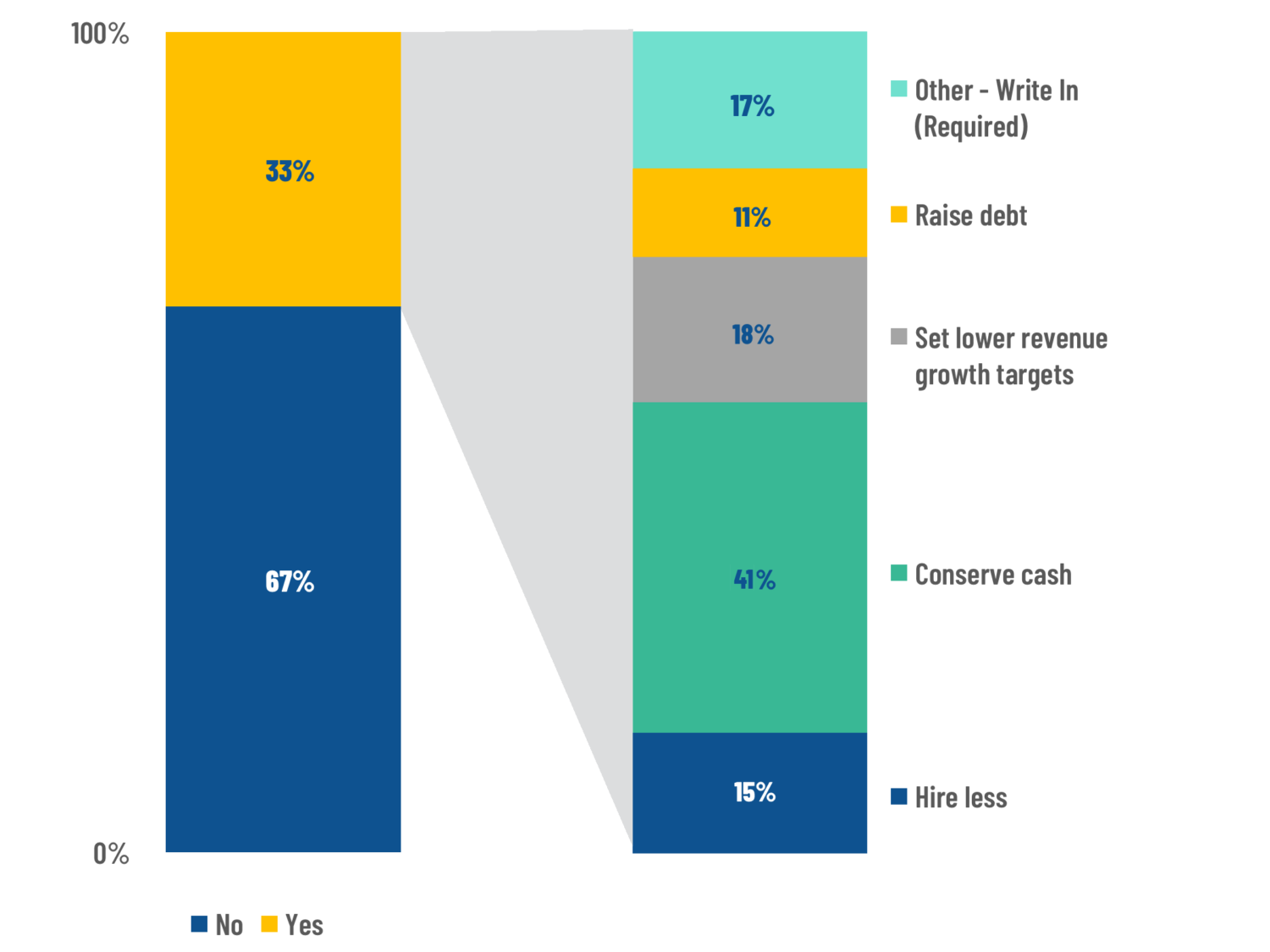

Despite the prolonged bull market cycle we’re currently experiencing, only 33% of entrepreneurs plan to manage their businesses differently in 2019.

WE ASKED: Will you manage your business differently in 2019 than you would otherwise because of where we are in the bull market cycle AND what will you do differently?

Survey

Demographics

The survey included 311 entrepreneurs across The US and Canada

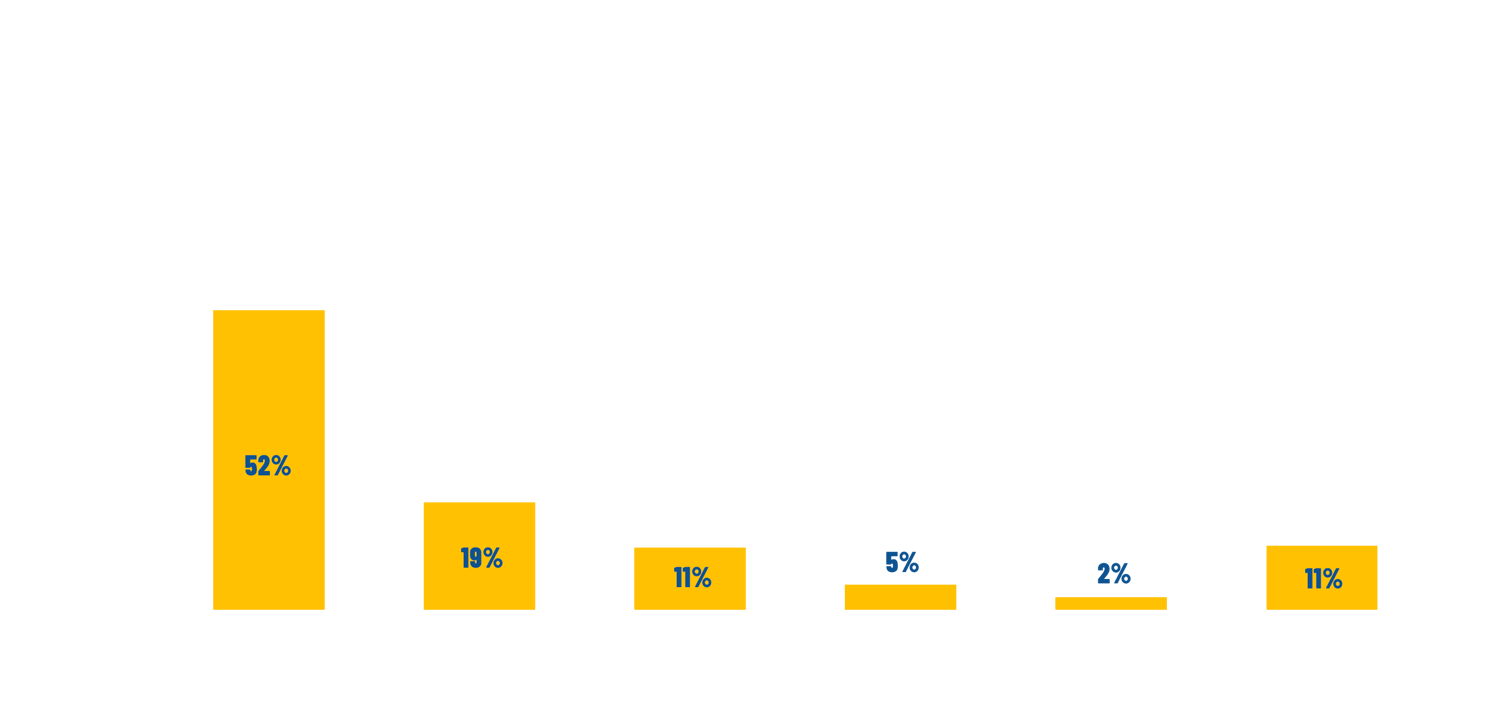

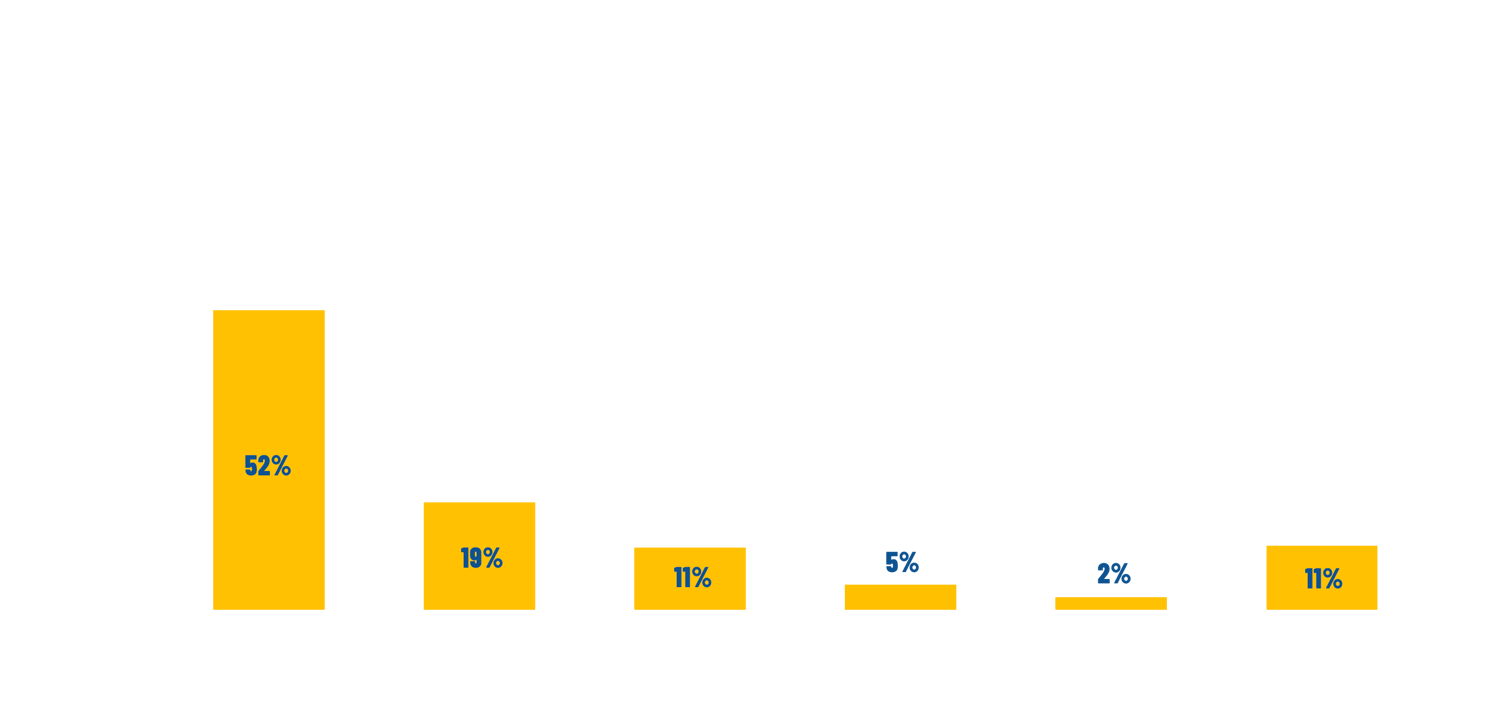

By 2018 Revenue

By

growth

rate

2017 to 2018

About Mainsail Partners

Mainsail Partners is a San Francisco-based growth equity firm that invests in fast-growing bootstrapped software companies. For 15 years, the firm has partnered with exceptional founders and entrepreneurs across numerous end-markets. Mainsail has a team of experienced operating professionals to help entrepreneurs scale their businesses and accelerate growth.

This content piece has been prepared solely for informational purposes. The content piece does not constitute an offer to sell or the solicitation of an offer to purchase any security. The information in this content piece is not presented with a view to providing investment advice with respect to any security, or making any claim as to the past, current or future performance thereof, and Mainsail Management Company, LLC (“Mainsail” or “Mainsail Partners”) expressly disclaims the use of this content piece for such purposes.

The information herein is based on Mainsail’s analysis of survey results and related topics. Totals may not sum due to rounding. There can be no assurance other third-party analyses would reach the same conclusions as those provided herein. The information herein is not and may not be relied on in any manner as, legal, tax, business or investment advice.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of terms such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “projects,” “future,” “targets,” “intends,” “plans,” “believes,” “estimates” (or the negatives thereof) or other variations thereon or comparable terminology. Forward looking statements are subject to a number of risks and uncertainties, which are beyond the control of Mainsail. Actual results, performance, prospects or opportunities could differ materially from those expressed in or implied by the forward-looking statements. Additional risks of which Mainsail is not currently aware also could cause actual results to differ. In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. The forward-looking events discussed in this content piece may not occur. Mainsail undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in the enclosed materials by Mainsail and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. The content piece will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof, or for any other reason.

For additional important disclosures, please click here.