Getting Started with RevOps Part 4: Understanding Revenue

Analyzing top-line revenue and clueing in on its customer origins can be vital to both retention and growth.

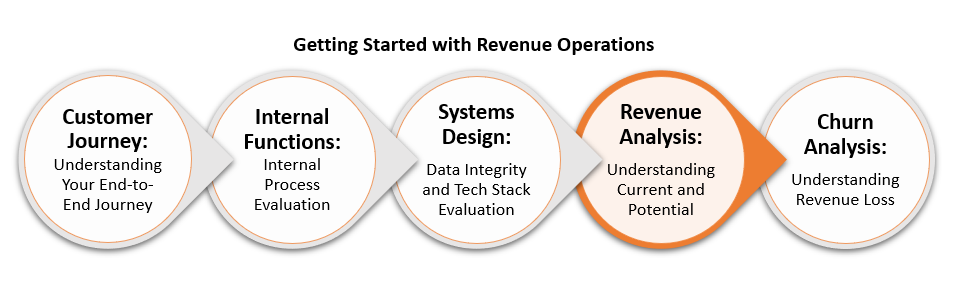

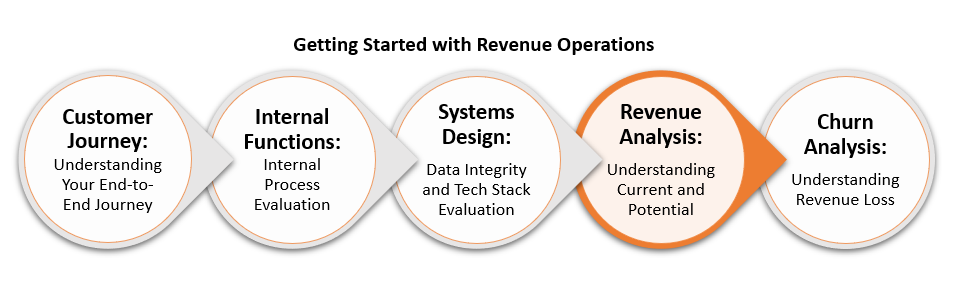

Revenue Analysis, the fourth in our series highlighting how to get started with Revenue Operations.

Understanding Revenue, Both Current and Potential

Revenue growth is the uniting force in many company initiatives and the very thing for which the RevOps function was named.

We started this series with a focus on your customer journey, underscoring the fact that customers are the most important part of your business. Why? Because without customers, you don’t have a business. Understanding from whom and how your revenue is derived allows for an effective use of company resources.

We then shared a post on how a unified technology stack helps align Go-To-Market functions with consistent, up-front data, illuminating key customer information. Leveraging this information to produce revenue analyses provides a picture of recurring and unrealized value, highlighting trends to drive strategic decisions.

With this post, we will take the next step in the RevOps journey and show how to generate and examine these revenue analyses.

Tracking Data to Garner Revenue Analyses and Insights

To garner insights from a detailed exploration of revenue, data tracking for each unique customer is essential and should be done within the system(s) that house your operational information, ideally your CRM.

Simplified, reportable fields maintained within the primary customer object and accessible to those responsible for customer marketing, sales, retention, growth and reporting is necessary to obtain strategic success.

It’s not enough to excel at either having great data for your front-line teams or generating strong trending analysis. Instead, the direct line from input to analysis and back to action is what sets apart the strongest companies.

For example, a report highlighting the opportunity for 30% growth within the base is worthless unless those specific customers can be identified and presented to marketing and upsell teams within their system of record. Conversely, without understanding how the performance of specific customers compares to your remaining customer base, offering discounts to win a handful of sales is a disservice to the company.

Not all analysis needs to be done within the CRM, however. In fact, most systems lack the capability to manipulate data in a way that makes sense for your business. But if all the data can be tied back to each customer with a unique customer identifier, then information can easily be exported, analyzed and re-imported with additional insights.

Once you have the data, it’s time to put it to use.

Determining your Source of Revenue

A dollar is a dollar, right? Not exactly. All revenue is not created equal in the world of SaaS, even when it is coming from the same customer.

According to the most recent Pacific Crest Survey, “Almost across the board, the fastest [growing companies] tended to have noticeably more reliance on upsells.” This is not to say that a company should stop the pipeline of new bookings and solely focus on sales back into their base. After all, you cannot have an upsell without the first initial sale. The point is that you need to focus on and have a plan to grow both.

Consider bucketing your income into various sources to understand, among other things, the percentage of your current revenue coming from each source, the opportunity for additional sales into that source, and the profitability of each source when you factor in total investing and operating costs. Those buckets should include, but not be limited to, the following list for each unique customer record:

- New vs. Existing Customer Revenue – This analysis will show how much revenue obtained from each customer was generated upon initial sale vs. an upsell, cross-sell, or renewal. The cost of sales into the existing base is typically less expensive – the same Pacific Crest Survey denotes that the average sale to an existing customer costs 5x less than a sale to a new customer. Additionally, understanding the split between new and expansion bookings should help you understand the need for internal resources, such as sales teams or account managers.

- Processed vs. Possible Revenue – Arguably one of the most important metrics to capture upon initial sale (other than the sale itself) is the potential revenue that you didn’t earn (i.e., the white space within each new account). This analysis ensures that you not only understand the product penetration of your existing customers , but it also establishes an immediate pipeline for upsell, cross-sell and renewal motions once the customer realizes the full value of your software. Again, selling to existing customers comes with less associated cost than pitching the value of your services to new prospects.

- Product vs. Segment-Specific Revenue – Along the same lines as processed vs. potential revenue, this analysis aims to directly correlate the total value to each unique product or feature. You can identify ideal customer profiles by analyzing this data and comparing it to similar company traits across similar product purchases, allowing for visibility into pricing or product bundles when products are consistently purchased together.

While it’s important to know which customer brought in the revenue for your business, you will also benefit from knowing the status and reason for that dollar spent.

Understanding actual revenue vs. potential revenue

In this instance, actual revenue is the actual money paid to the company from an individual customer. Potential revenue is the market value for which services are sold. In the world of SaaS, these values do not always match as discounts, and offering promotions is a common tactic used to attract new business. This analysis is crucial in ensuring there are no false perceptions of the true value of a customer. Take a simplified example of a software price at $100 per month.

$100 x 12 months = $1200 ACV

Now, let’s take that same customer and factor in a promotional 25% discount.

$100 x (1-.25) x 12 months = $800 ACV

$400 of revenue per year less than expected. While this may not appear like much, when extrapolated across an entire customer base, this variance of potential ($1200) vs. actual revenue ($800) can cause significant financial distress on the business.

Discounts, free months, and promotions need to be monitored and managed to not only maintain overall finances, but also to provide insights into customer behavior. Are these tactics drawing in lower-value customers with a higher probability to churn? Are you unintentionally training your prospects how to buy? To understand this, you’ll have to draw on cohort analysis to start seeing trends.

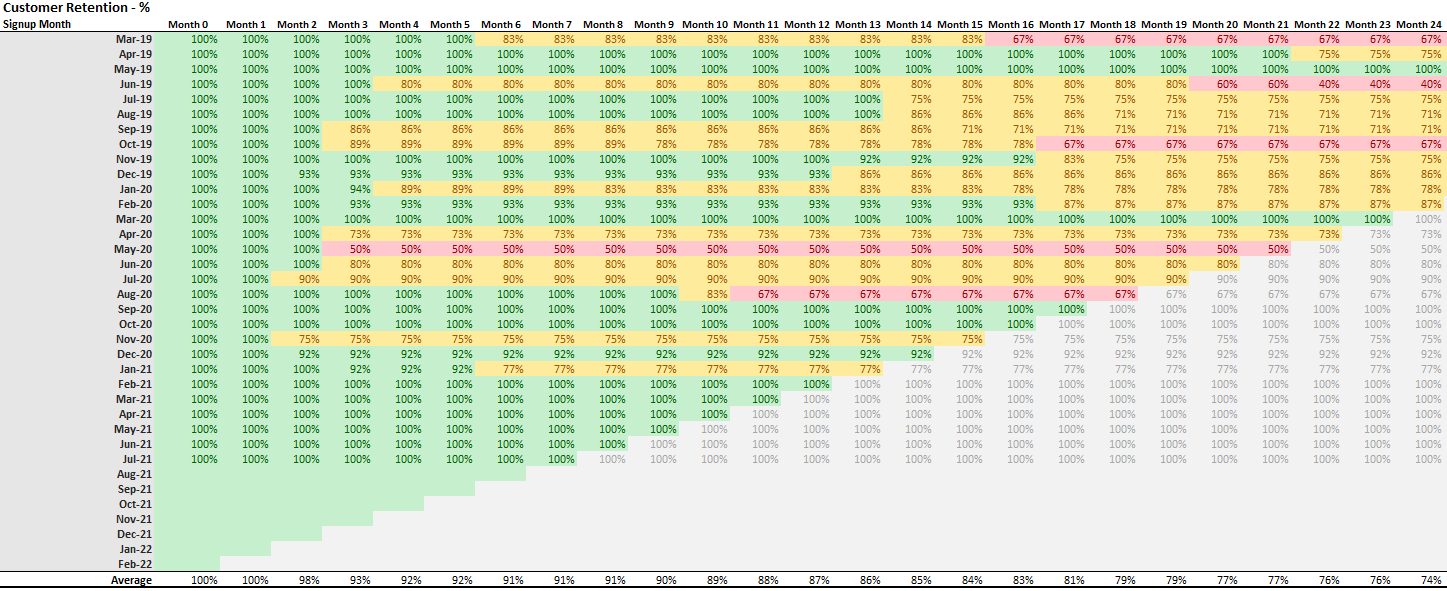

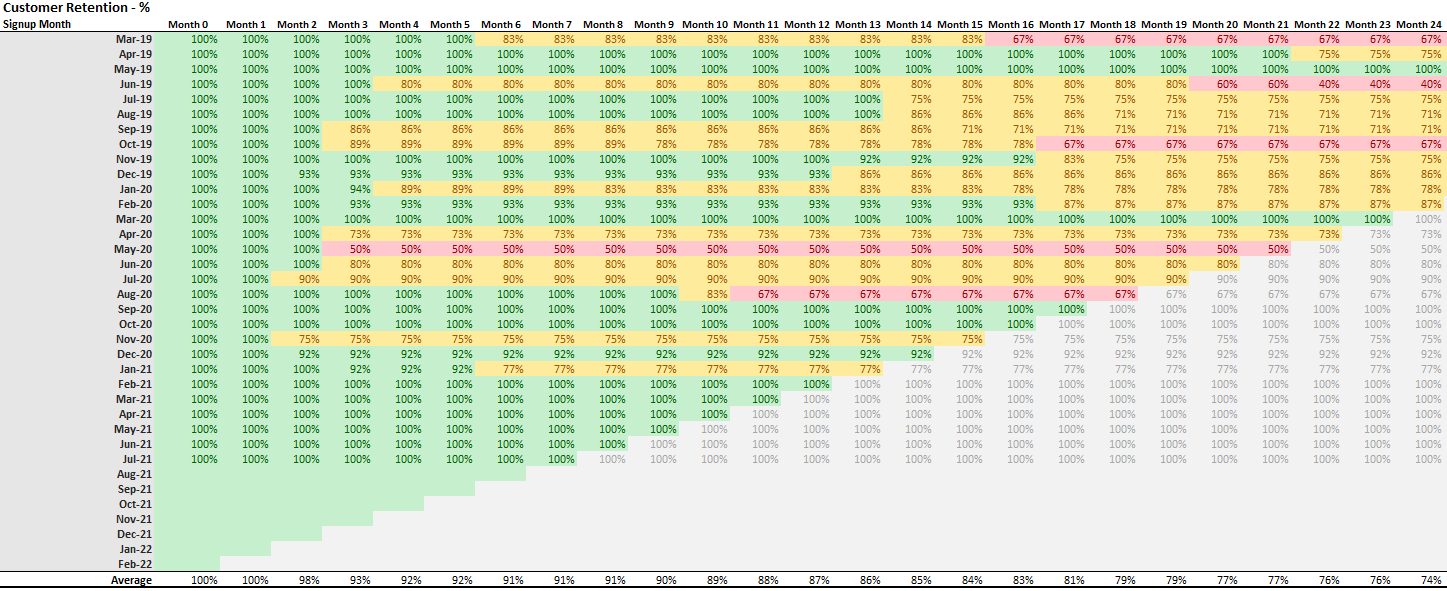

Performing Cohort Analysis

Cohort analysis – essentially grouping users based on shared traits – is an effective way to analyze a large set of customer data to visualize trends. In the example above, if the 25% promotion was given to customers signing up in a specific month, cohort analysis by signup month will help illuminate the behaviors of this specific subset of customers as compared to other months.

Beyond examining discount impacts, cohorts are essential to measuring retention or growth of a specific grouping over time, often on a monthly or quarterly basis. Common and helpful cohort groupings include lead source, signup month, date of purchase, product or segment.

Cohort analysis example

Customer retention cohort analysis based on signup month

Finding sustainable growth for your business includes retaining your customers for as long as possible and capitalizing on upside sales. If you cannot definitively say where you are earning your money from, you are bound to miss out on additional opportunities, or worse, lose what you already have.

In the final installment of this Getting Started with RevOps series, we’ll discuss the importance of tracking, understanding and ultimately mitigating churn.

The information herein is based on the author’s opinions and views and there can be no assurance other third-party analyses would reach the same conclusions as those provided herein. The information herein is not and may not be relied on in any manner as, legal, tax, business or investment advice.

Third-party images, logos, and references included herein are provided for illustrative purposes only. Inclusion of such images, logos, and references does not imply affiliation with or endorsement by such firms or businesses.

Certain information contained in this content piece has been obtained from published and non‐published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for the purposes of this content piece, neither Mainsail nor the author assume any responsibility for the accuracy or completeness of such information and such information has not been independently verified by either of them. The content piece will not be updated or otherwise revised to reflect information that subsequently becomes available, or circumstances existing or changes occurring after the date hereof, or for any other reason.

Certain information contained herein constitutes “forward-looking statements,” which can be identified by the use of terms such as “may,” “will,” “should,” “could,” “would,” “predicts,” “potential,” “continue,” “expects,” “anticipates,” “projects,” “future,” “targets,” “intends,” “plans,” “believes,” “estimates” (or the negatives thereof) or other variations thereon or comparable terminology. Forward looking statements are subject to a number of risks and uncertainties, which are beyond the control of Mainsail. Actual results, performance, prospects or opportunities could differ materially from those expressed in or implied by the forward-looking statements. Additional risks of which Mainsail is not currently aware also could cause actual results to differ. In light of these risks, uncertainties and assumptions, you should not place undue reliance on any forward-looking statements. The forward-looking events discussed in this content piece may not occur. Mainsail undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in the enclosed materials by Mainsail and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions. For additional important disclosures, please click here.