9th

Annual

Bootstrapped

Survey: Part I

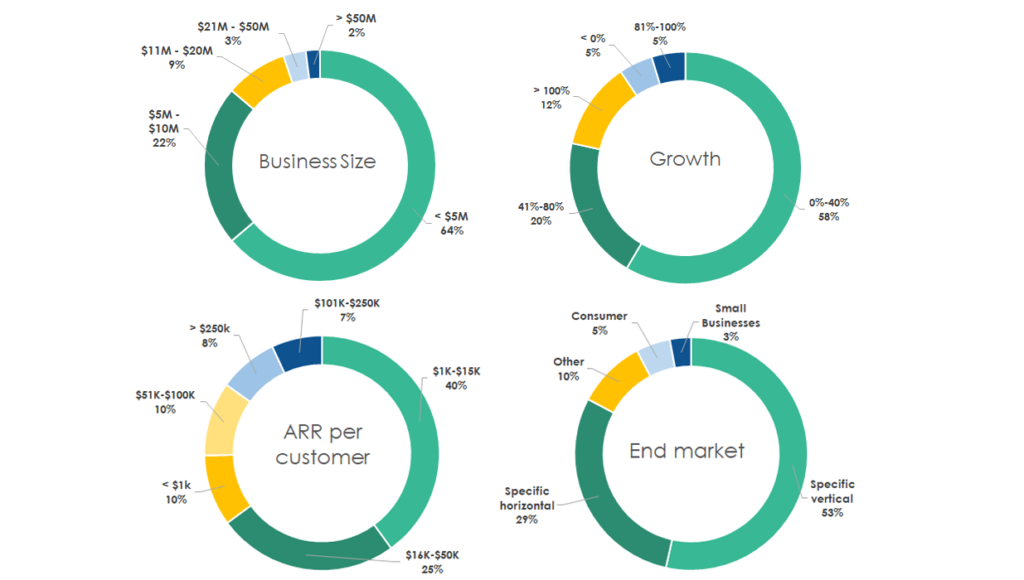

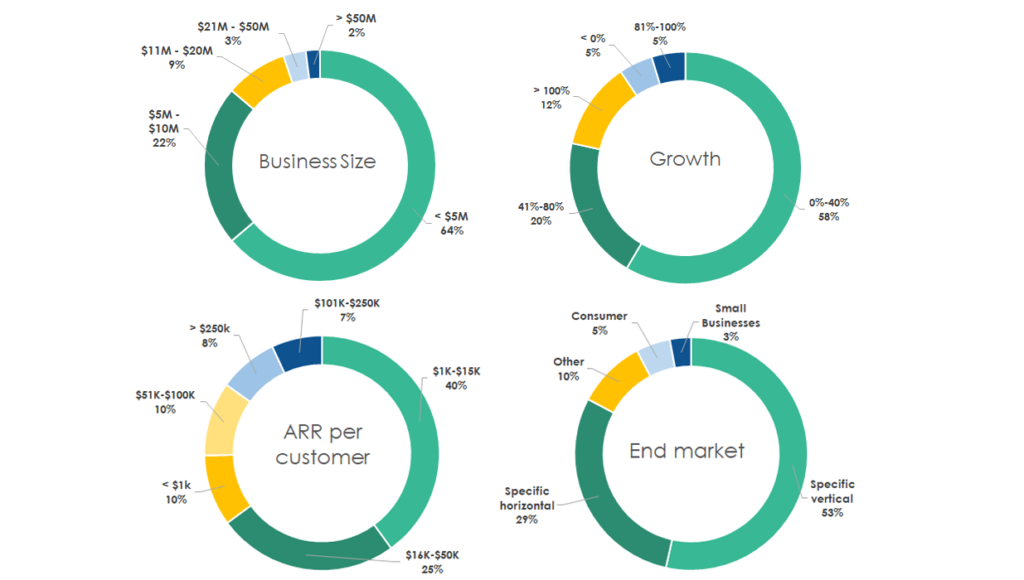

Mainsail conducted the Bootstrapped Sentiment Survey for the 9th consecutive year at the end of 2019. With answers crunched from hundreds of entrepreneurs located across the U.S., this survey provides a unique perspective into how entrepreneurs are feeling about the U.S. economy, their specific industries and the future growth potential of their businesses. Because this segment of business owners is uniquely focused on growth and profitability, their insight often serves as an early indicator of trends in the broader market.

In addition, this year’s findings take a deep dive into the strategies that these companies are using to drive growth to help uncover what the fastest growing companies are doing, compared to their peers.

PART II: BEST PLACES TO BOOTSTRAP – We also surveyed entrepreneurs on the role that geography plays in the success of their company. Based on the results, we have highlighted what we believe are the ten best metropolitan areas in the country to bootstrap a company. You can access those results here.

Table of Contents

Key Findings

Bootstrapped company growth strategies

What growth strategies are bootstrapped companies prioritizing in 2020?

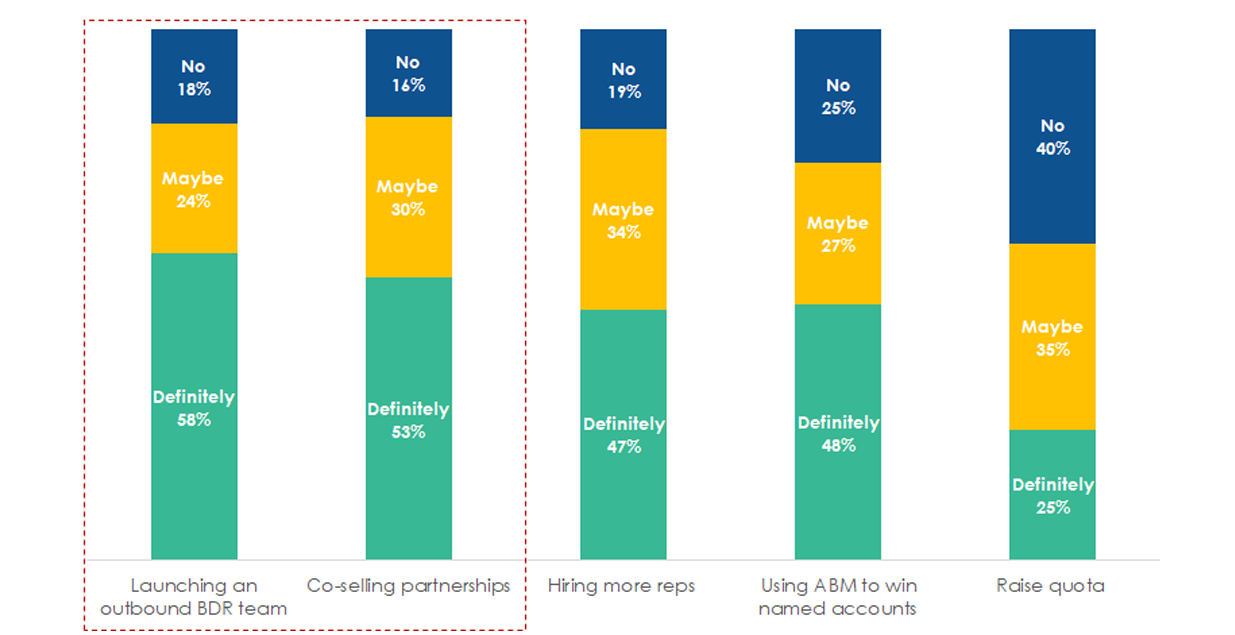

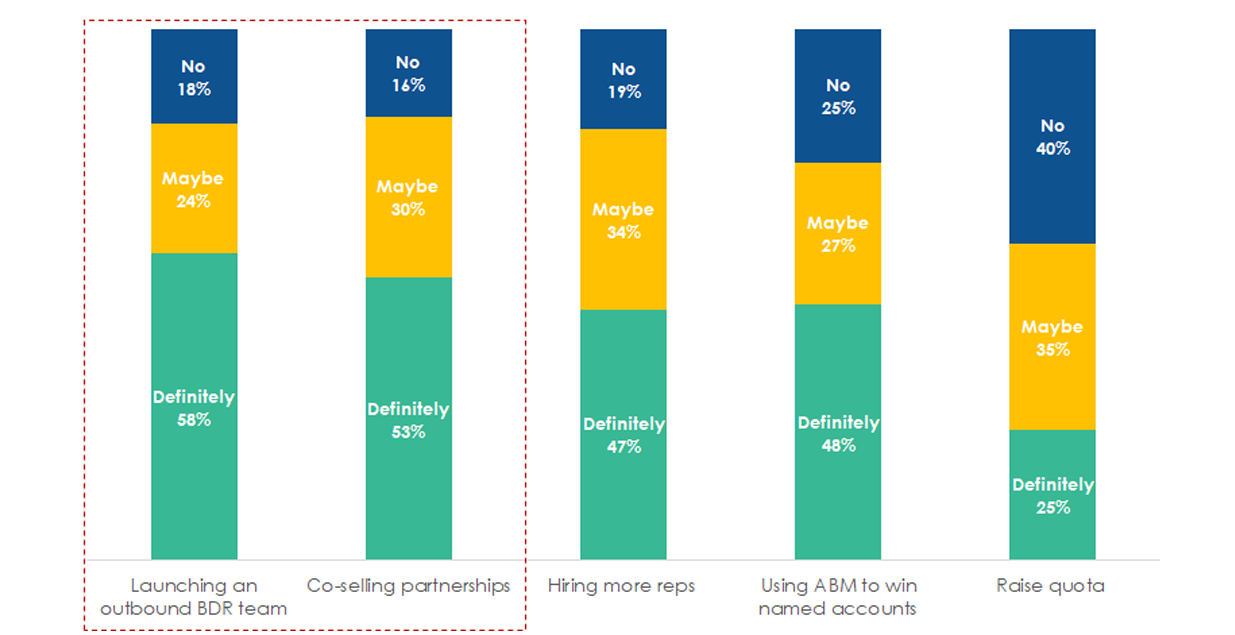

SALES & MARKETING: Over 50% of bootstrapped companies are prioritizing co-selling partnerships and launching outbound BDR teams.

Are you planning on implementing the following sales & marketing strategies to your business in 2020?

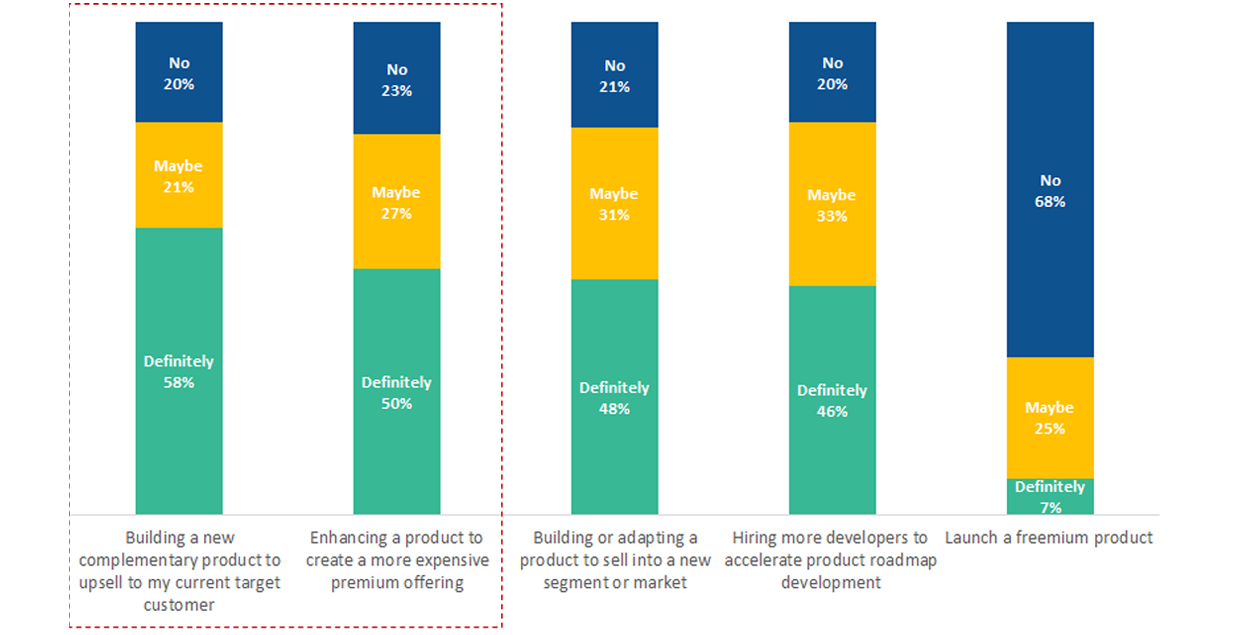

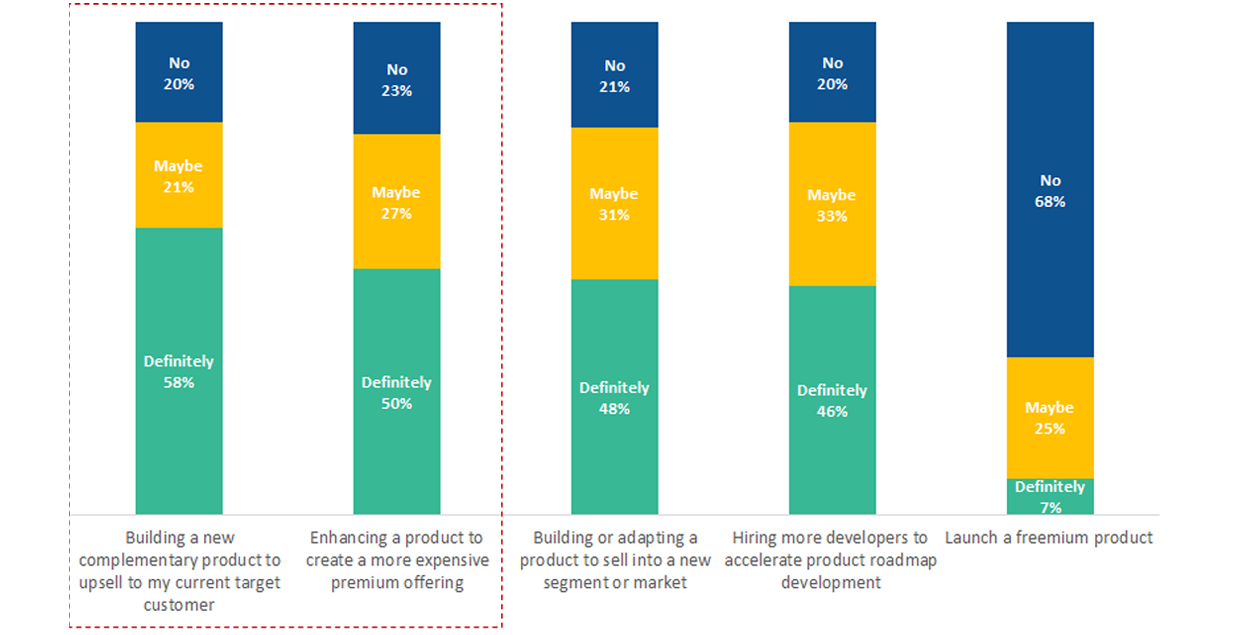

PRODUCT: Bootstrapped companies are focusing on building new complementary products and enhancing existing products in 2020.

Are you planning on implementing the following product strategies to your business in 2020?

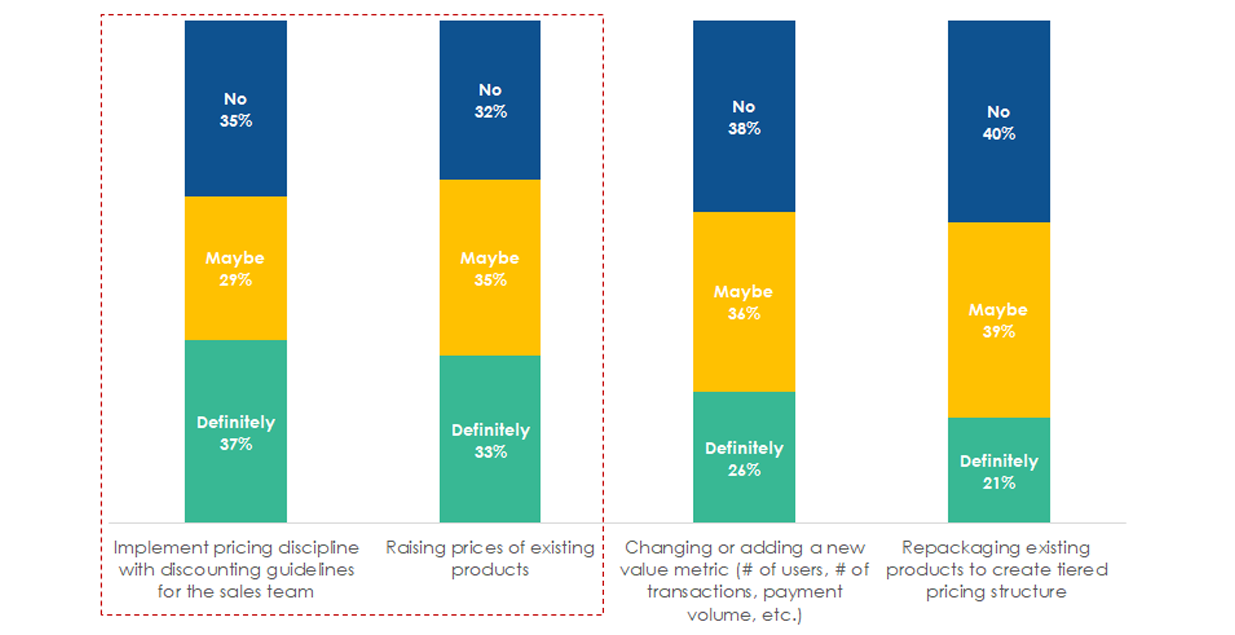

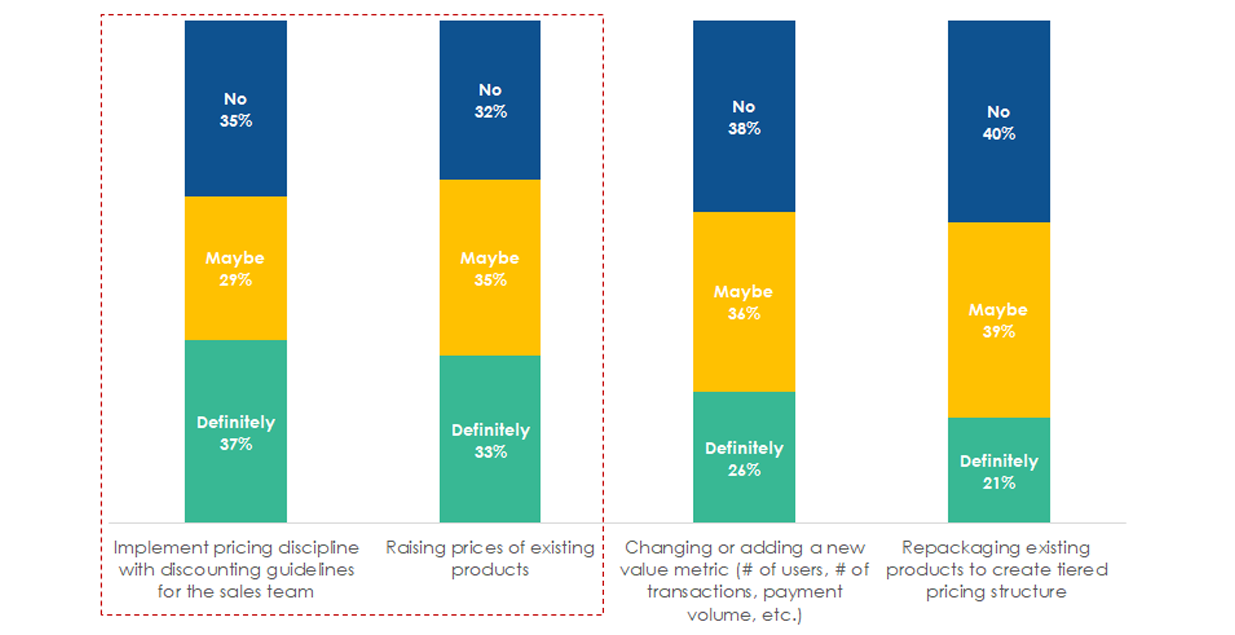

PRICING: The biggest pricing focus for bootstrapped companies in 2020 is implementing pricing discipline and raising pricing.

Are you planning on implementing the following pricing strategies to your business in 2020?

High Growth vs. Low Growth Company Strategies

What are high growth (>40% growth) bootstrapped companies doing differently?

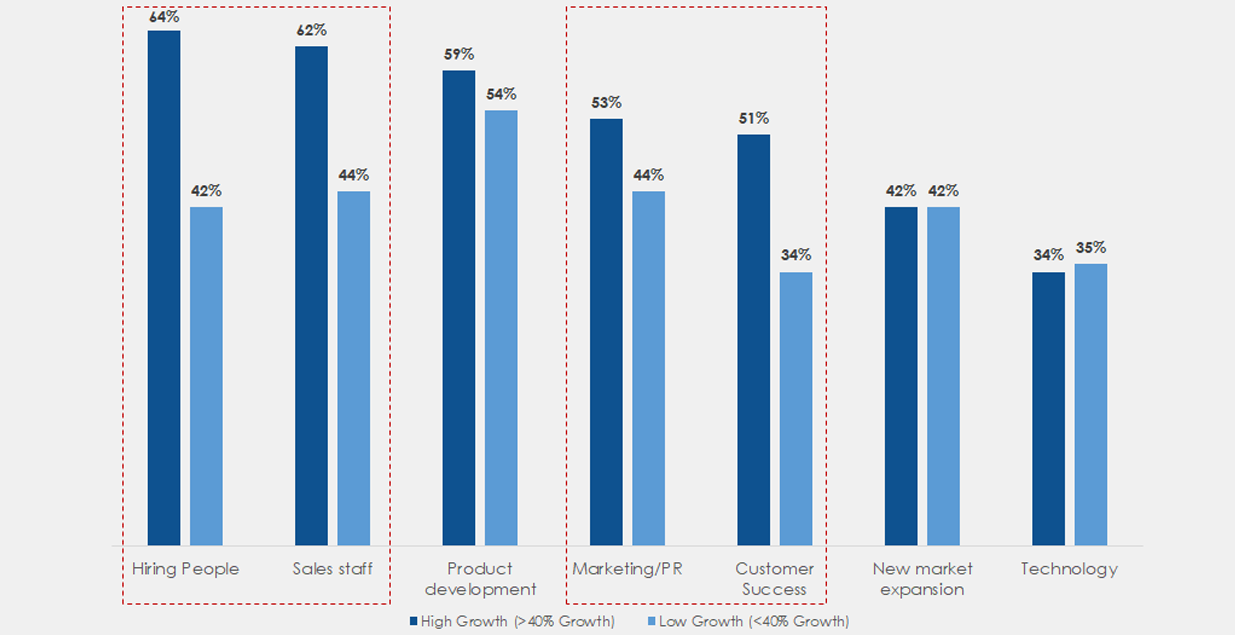

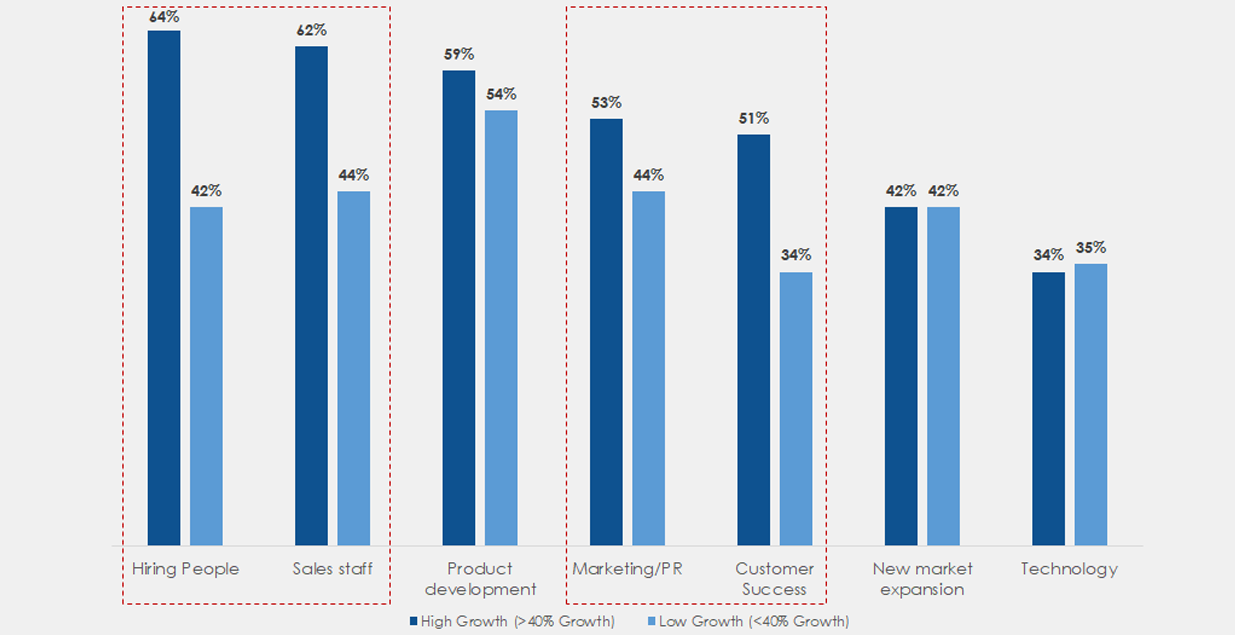

HIGH GROWTH COMPANIES ARE MORE DECISIVE AND EXPANSIVE IN THEIR GROWTH STRATEGIES: High growth companies are particularly focused more on sales, marketing, and customer success compared to low growth companies.

What are your most important areas of investment in 2020?

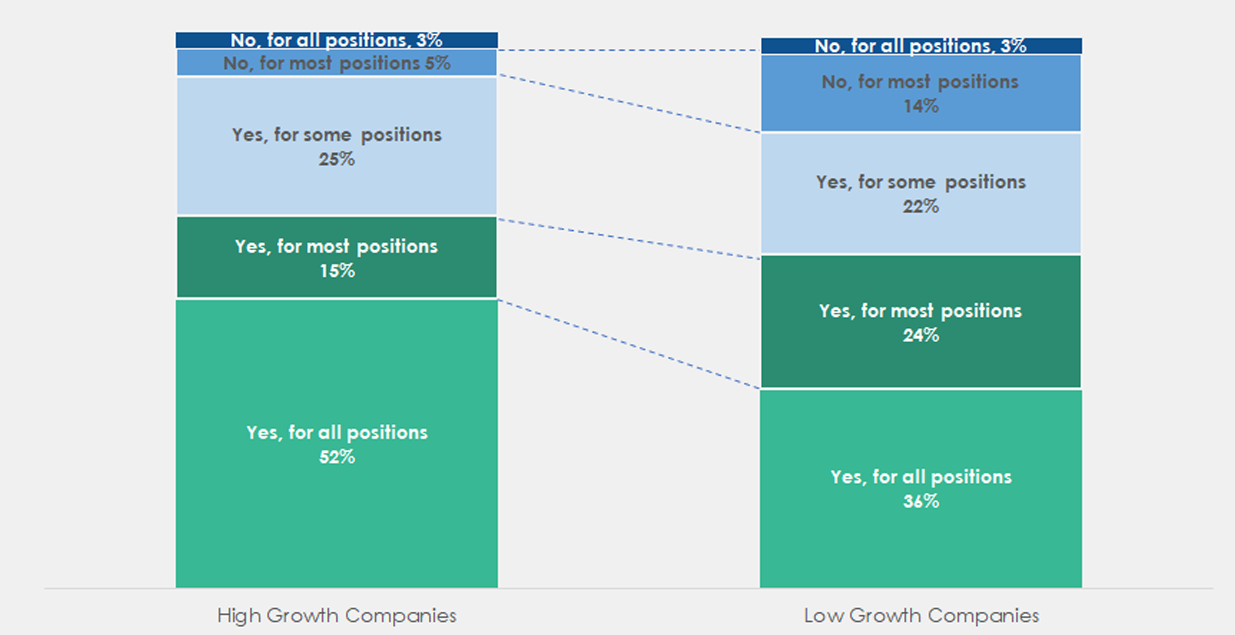

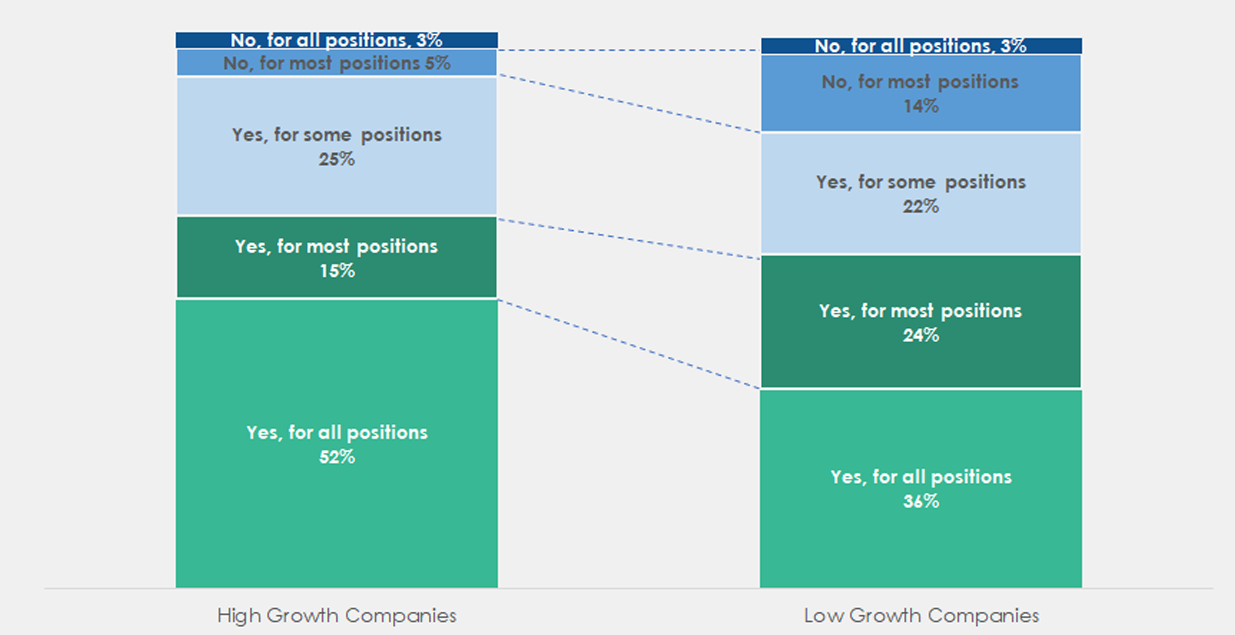

HIGH GROWTH COMPANIES HAVE MORE ACCESS TO TALENT: 52% of high growth companies have access to talent compared to 36% of low growth companies.

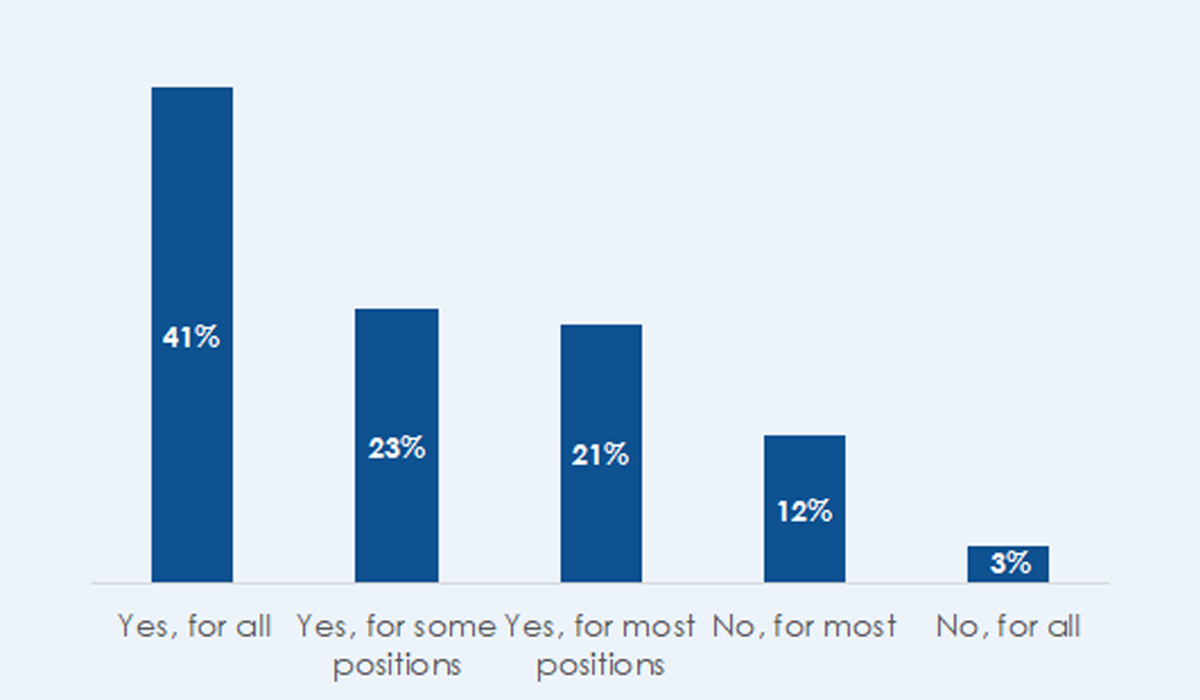

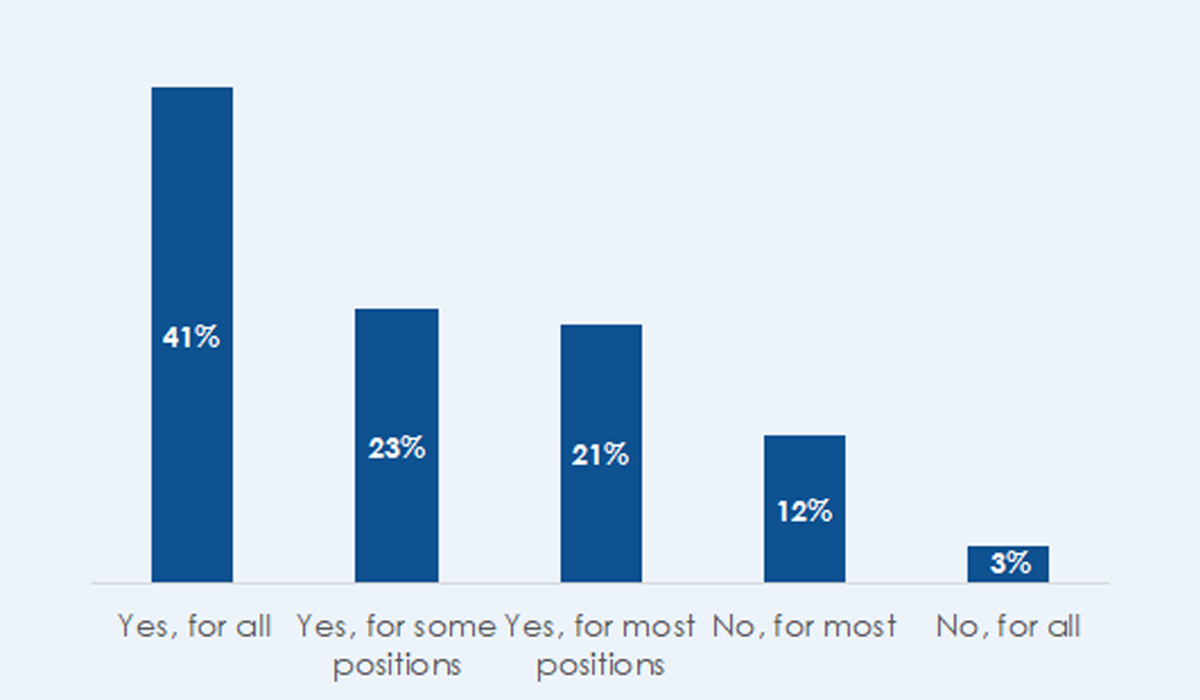

Do you have access to hire top talent locally?

Underutilized Growth Strategies

What growth strategies are not prioritized by entrepreneurs?

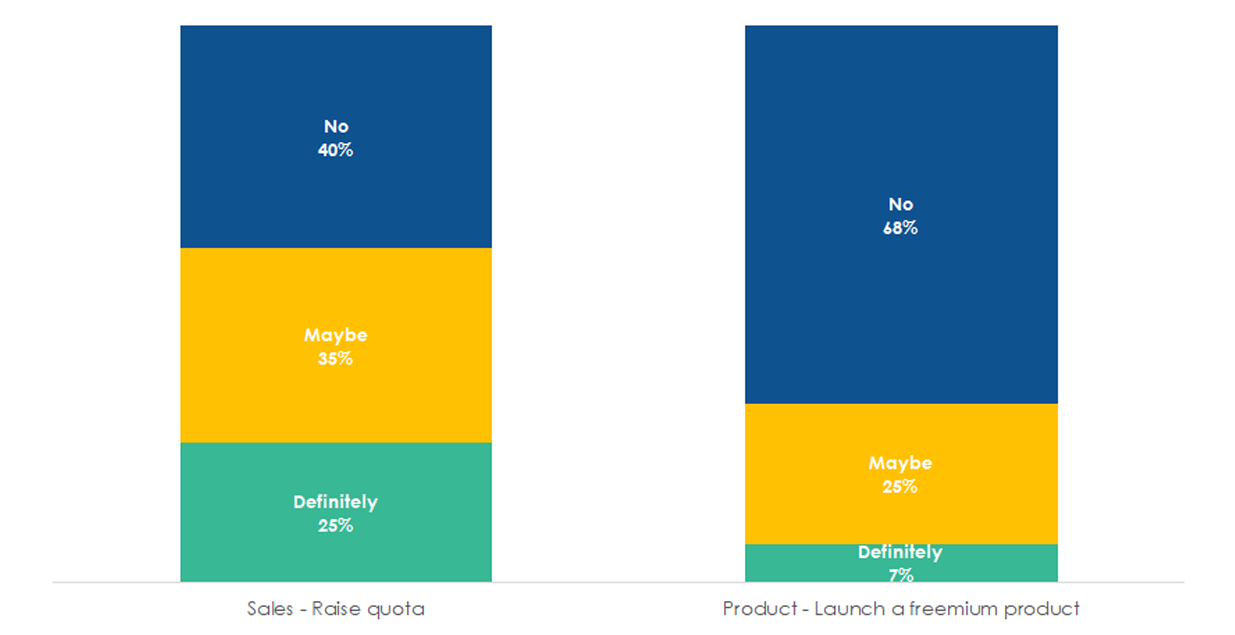

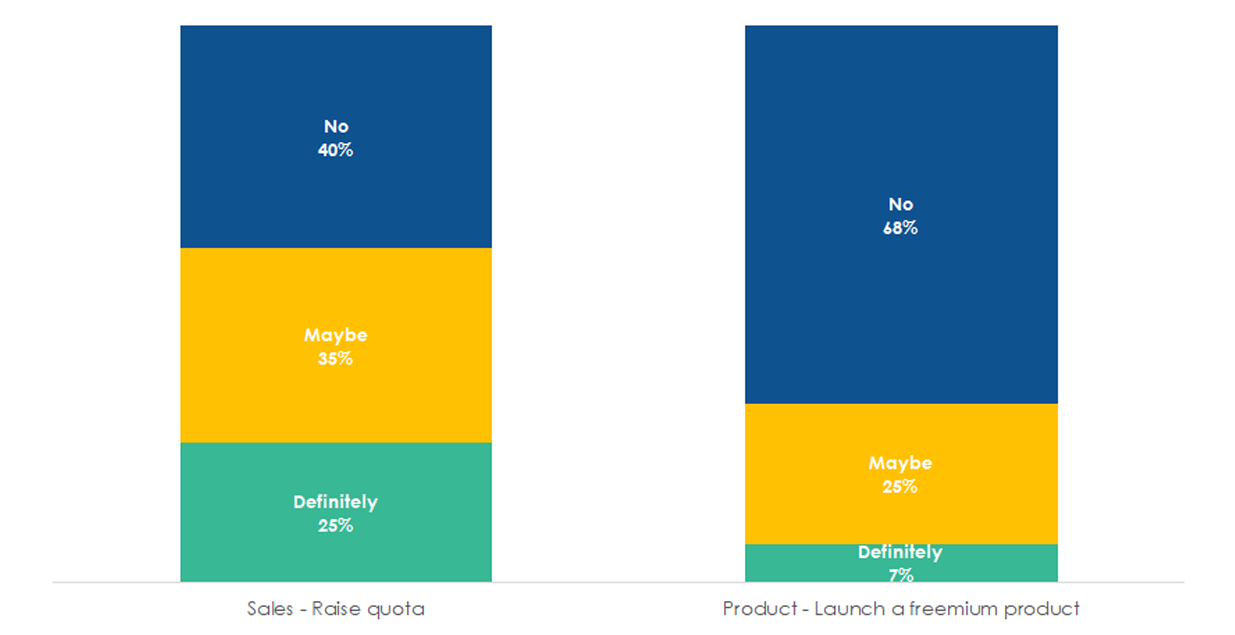

SALES & PRODUCT: Raising quotas and launching freemium products are not highly considered by bootstrapped entrepreneurs in 2020.

Are you planning on implementing the following sales & product strategies to your business in 2020?

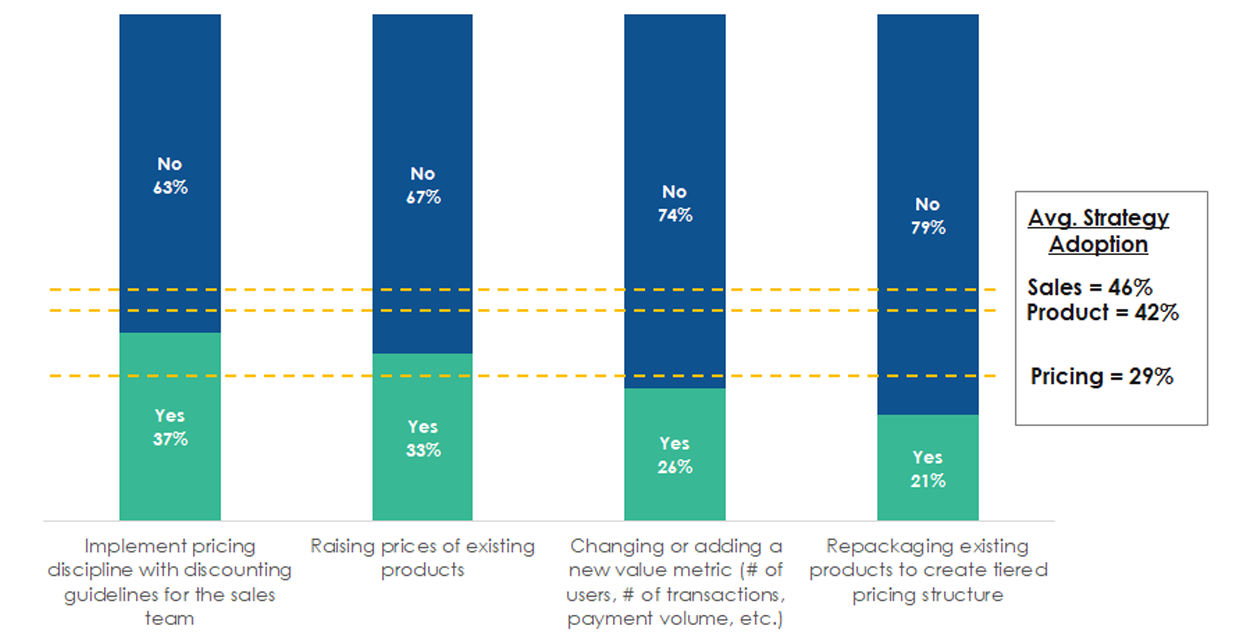

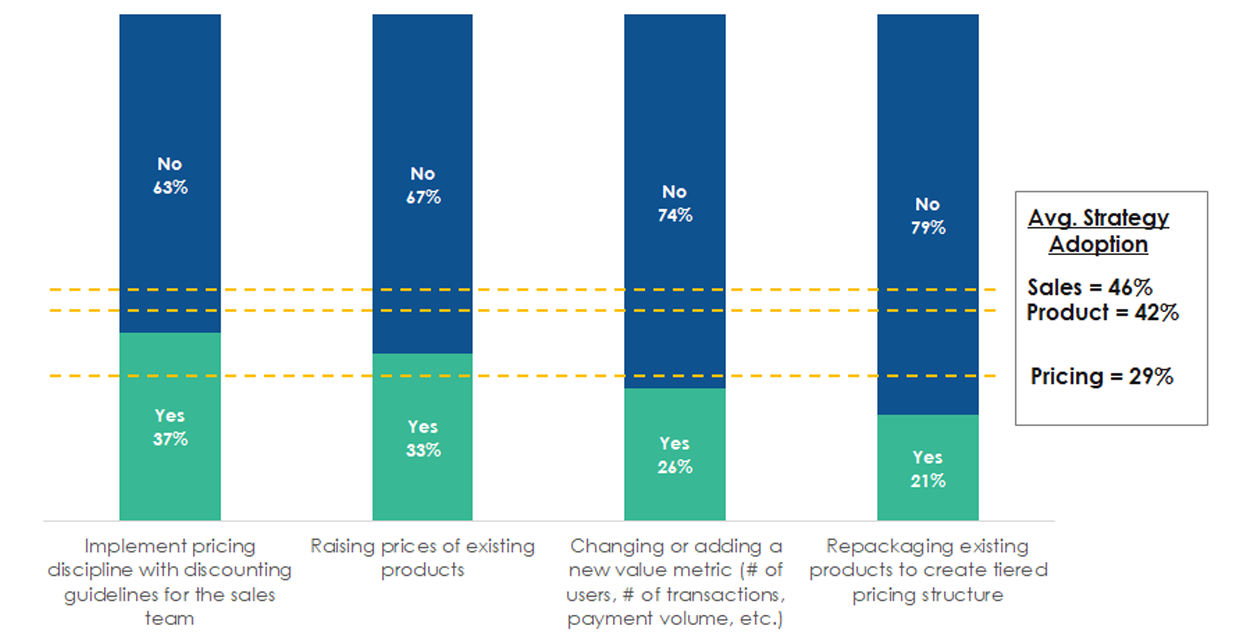

PRICING: Bootstrapped entrepreneurs are very sensitive to changing pricing strategy; >40% of entrepreneurs are considering various sales and product strategies in 2020 compared to only 29% considering pricing strategies.

Are you planning on implementing the following pricing strategies to your business in 2020?

ENTREPRENEUR ECONOMIC OUTLOOK

How has entrepreneur sentiment about the economy and their businesses changed over time?

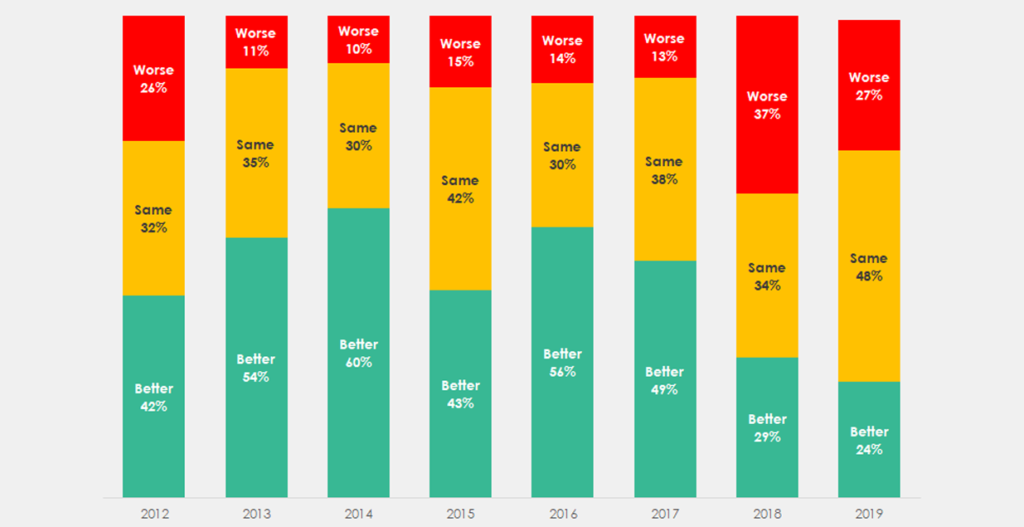

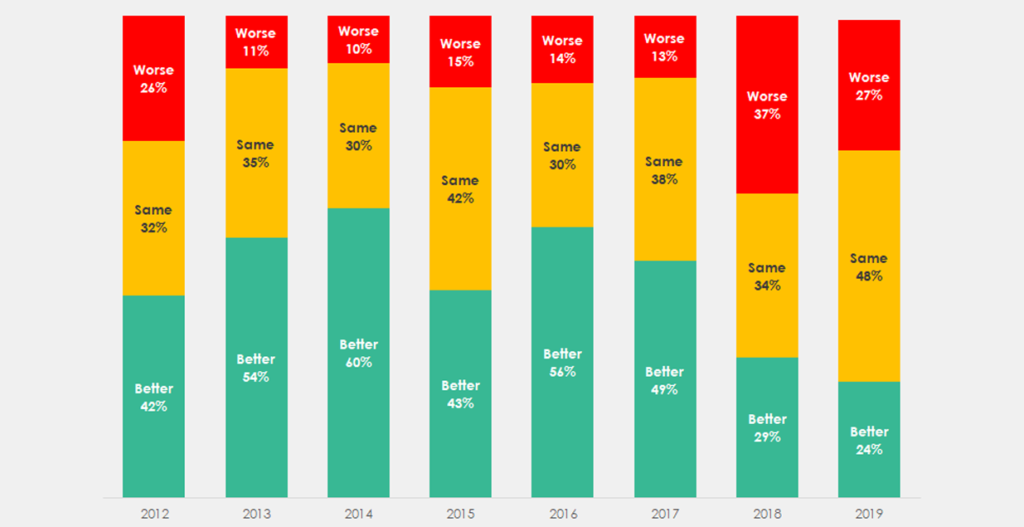

ENTREPRENEURS HAVE A WEAK OUTLOOK FOR THE ECONOMY: For the second year in a row the outlook for entrepreneurs on the economy is down dramatically from previous years.

Do you expect the US economy to be better or worse in 2020?

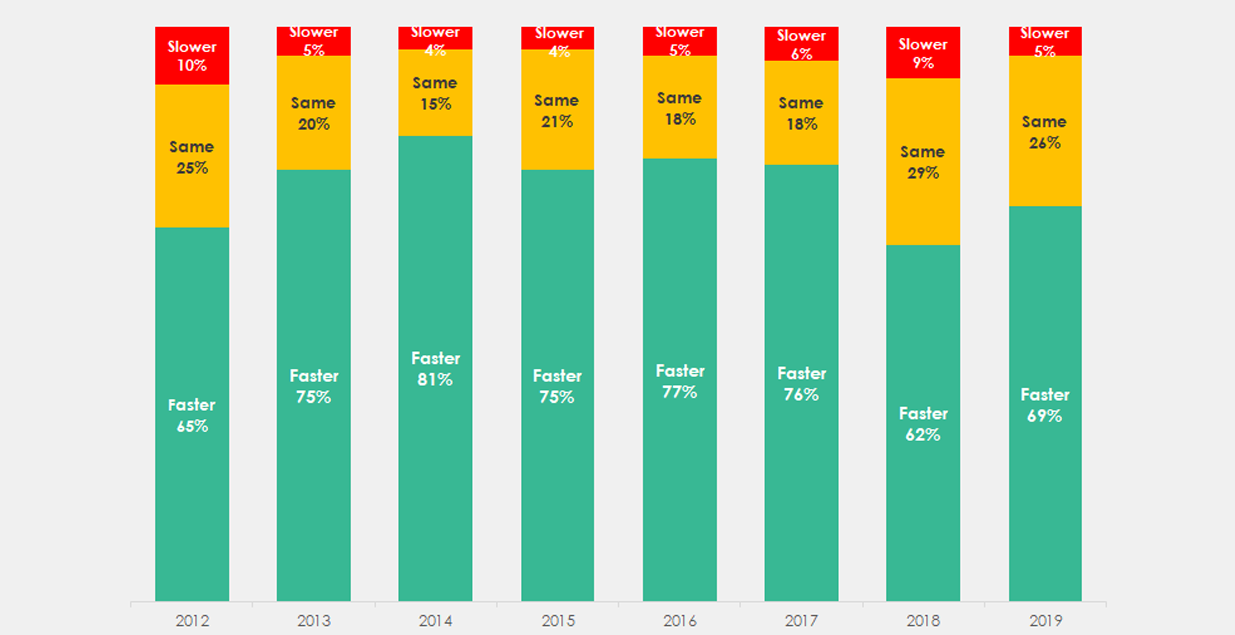

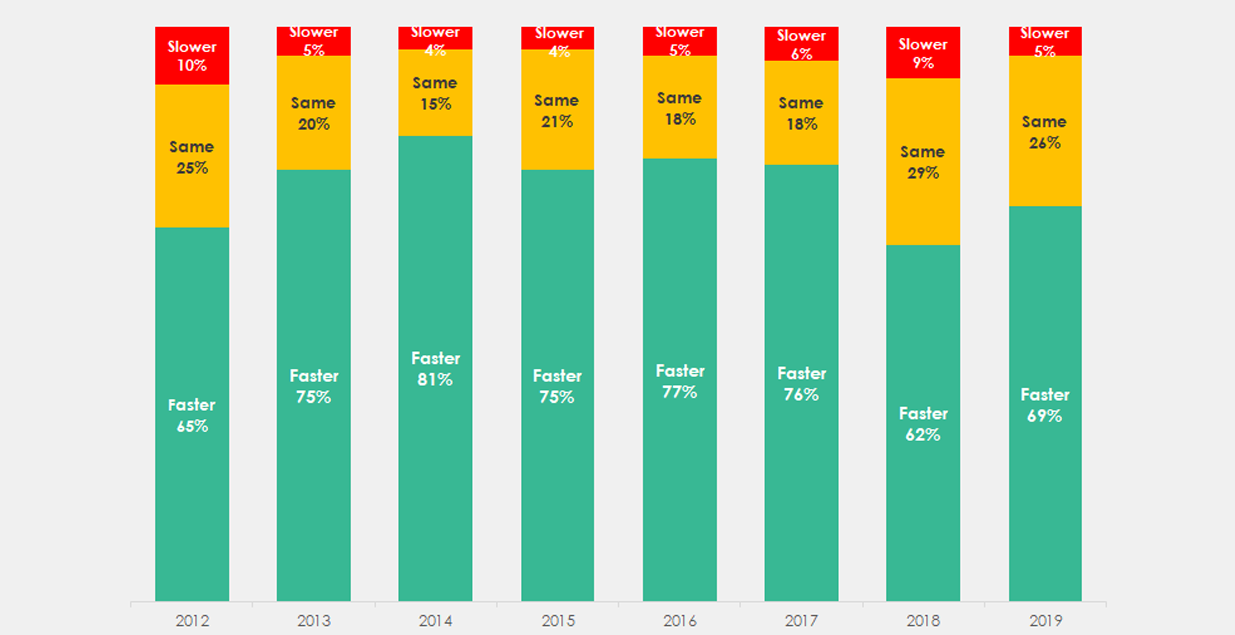

ENTREPRENEURS HAVE STRONG OUTLOOK FOR THEIR BUSINESSES: ~70% of entrepreneurs expect their businesses to grow faster in 2020, up from a record low 62% in 2019.

What best describes your expectations for your business in 2020?

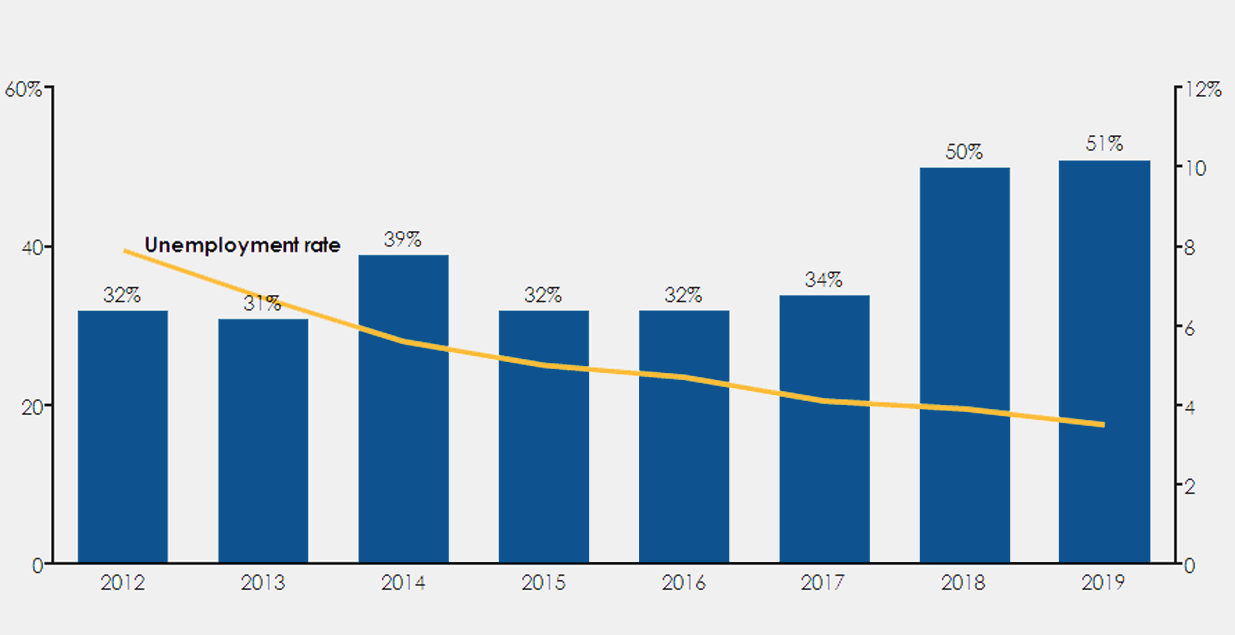

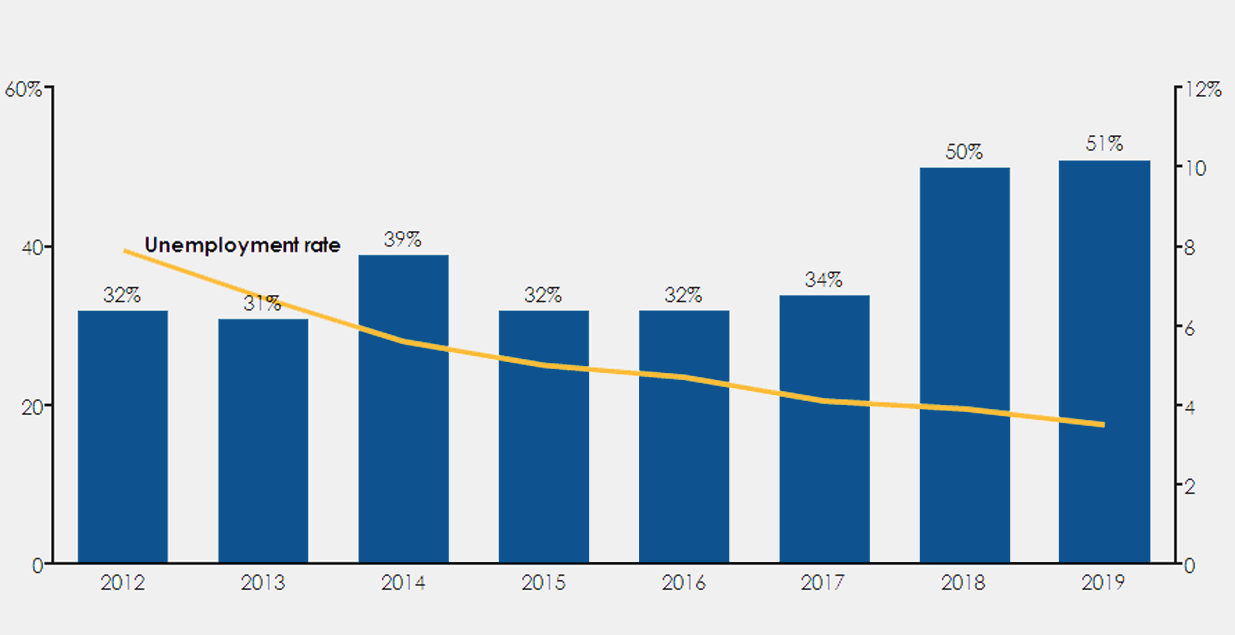

A RECORD NUMBER OF COMPANIES ARE HIRING IN 2020: 51% of respondents list ‘hiring’ as an important area of investment in 2020, a record high, potentially due to record low unemployment rates.

What are your most important areas of investment in 2020? (those who selected “hiring’’)

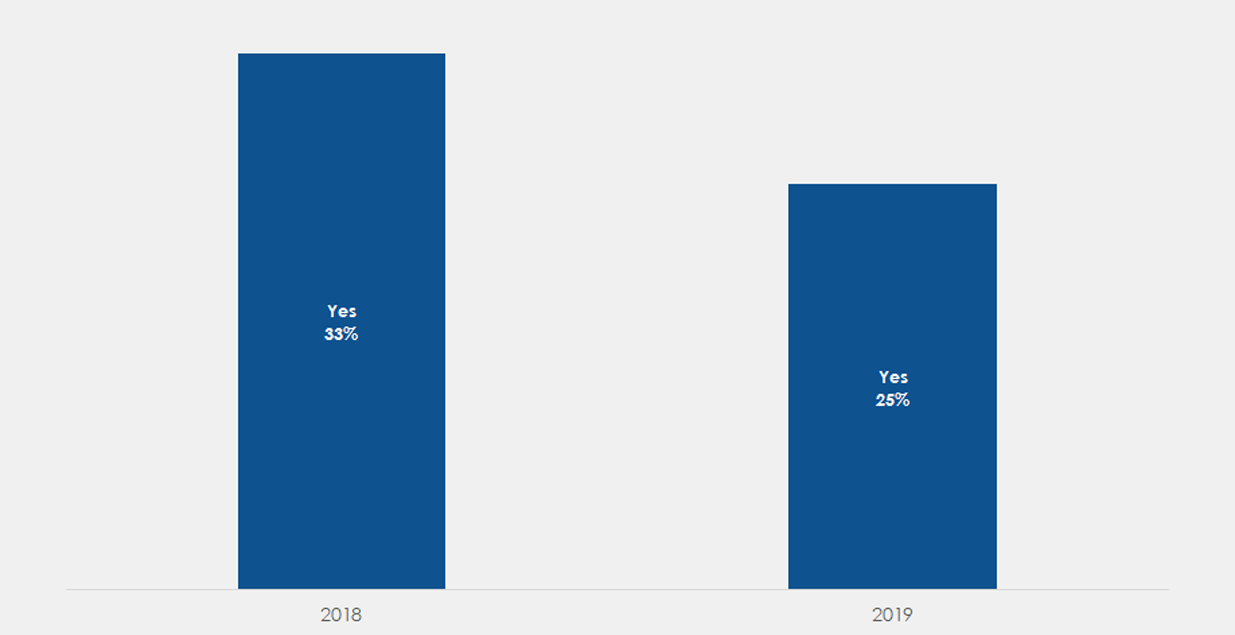

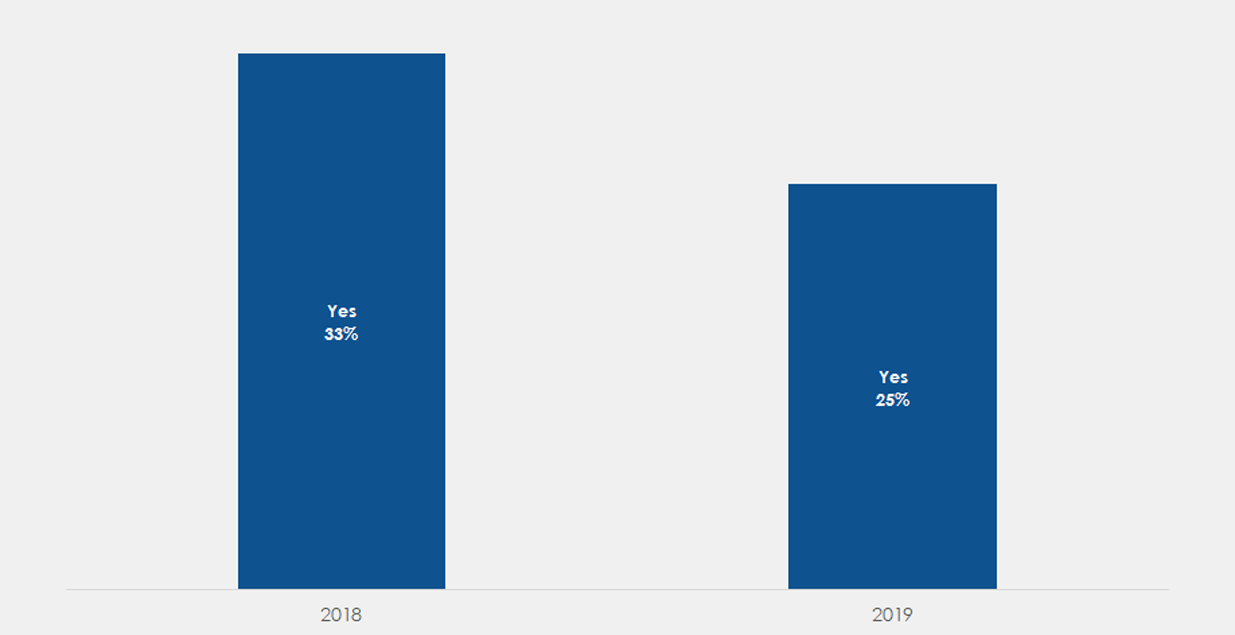

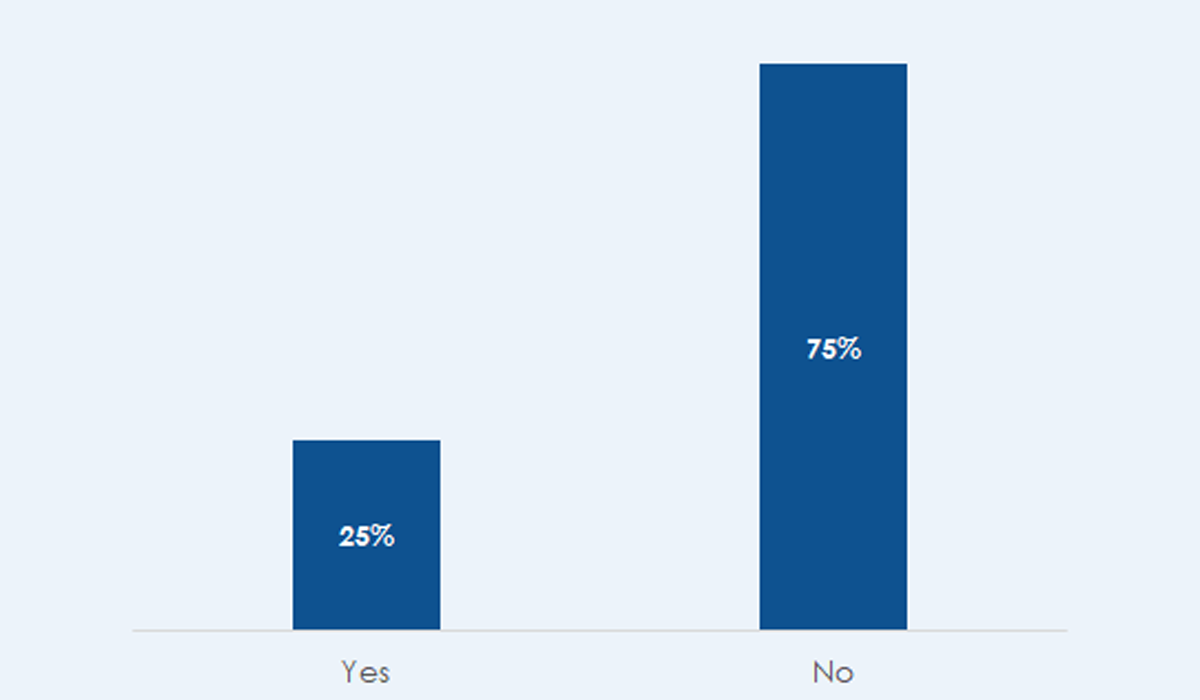

ENTREPRENEURS DO NOT PLAN TO MANAGE THEIR BUSINESSES DIFFERENTLY THIS YEAR: Despite the protracted bull market cycle, only 25% entrepreneurs expect to manage their businesses differently in 2020.

Will you manage your business differently in 2020 due to any of these or other macro-economic concerns?

SURVEY SEGMENTS

ADDITIONAL INSIGHTS

BUSINESS EXPECTATIONS

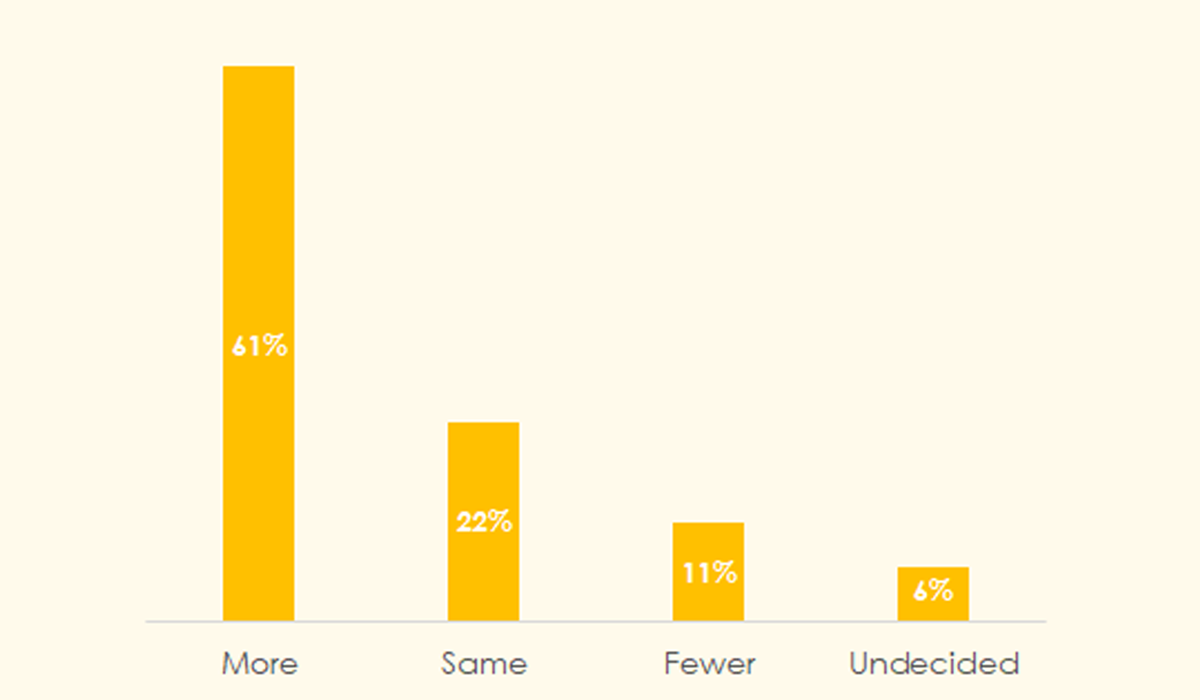

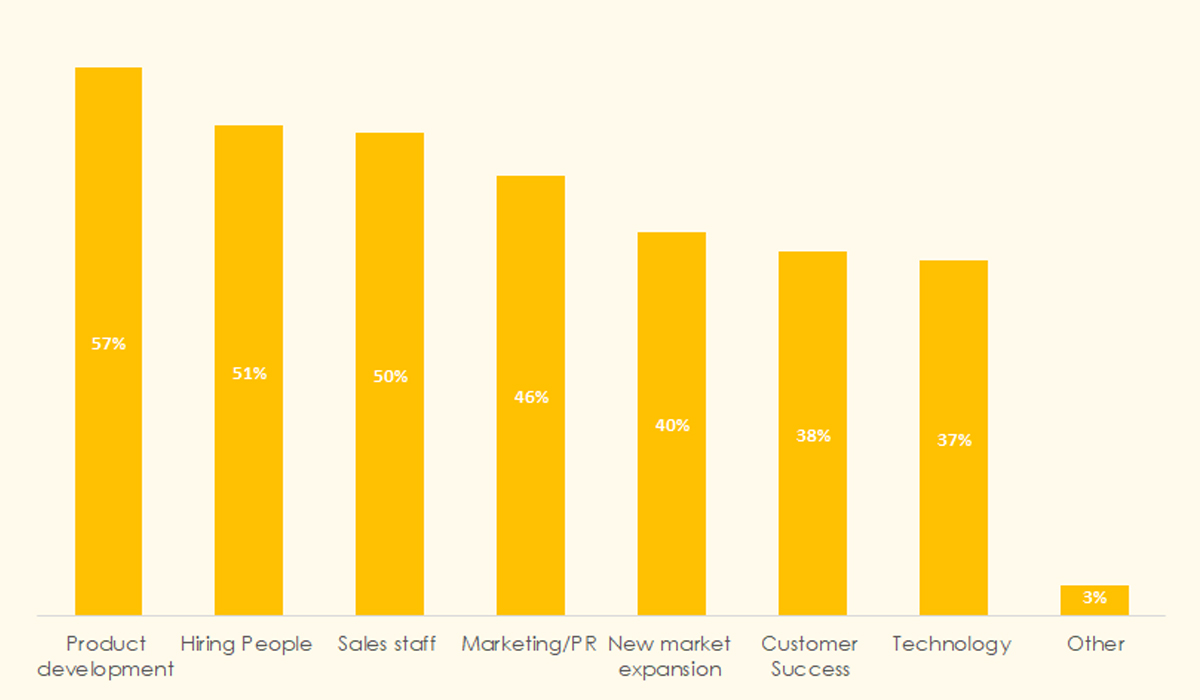

Hiring is a top priority for entrepreneurs in 2020, 60% of businesses are expecting to hire more people in 2020 than they did in 2019. Investing in hiring more people and building out a sales staff are also the #2 and #3 ranked investment areas.

Will you hire more or fewer people in 2020 than you did in 2019?

What are your most important areas of investment in 2020?

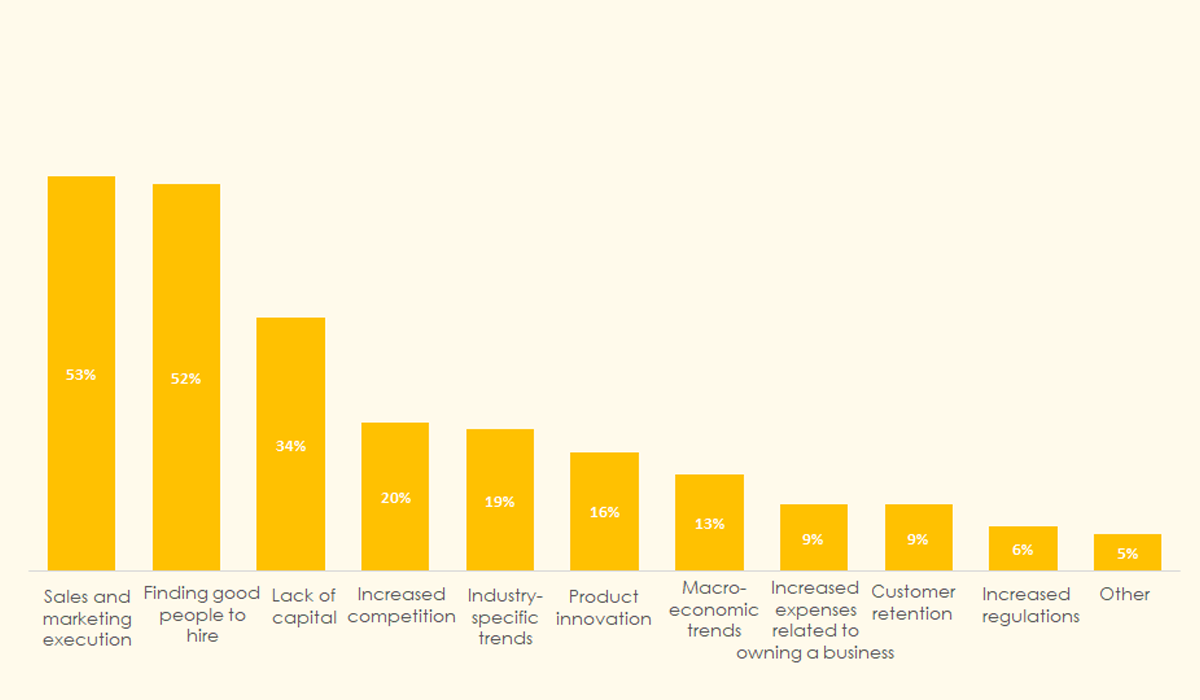

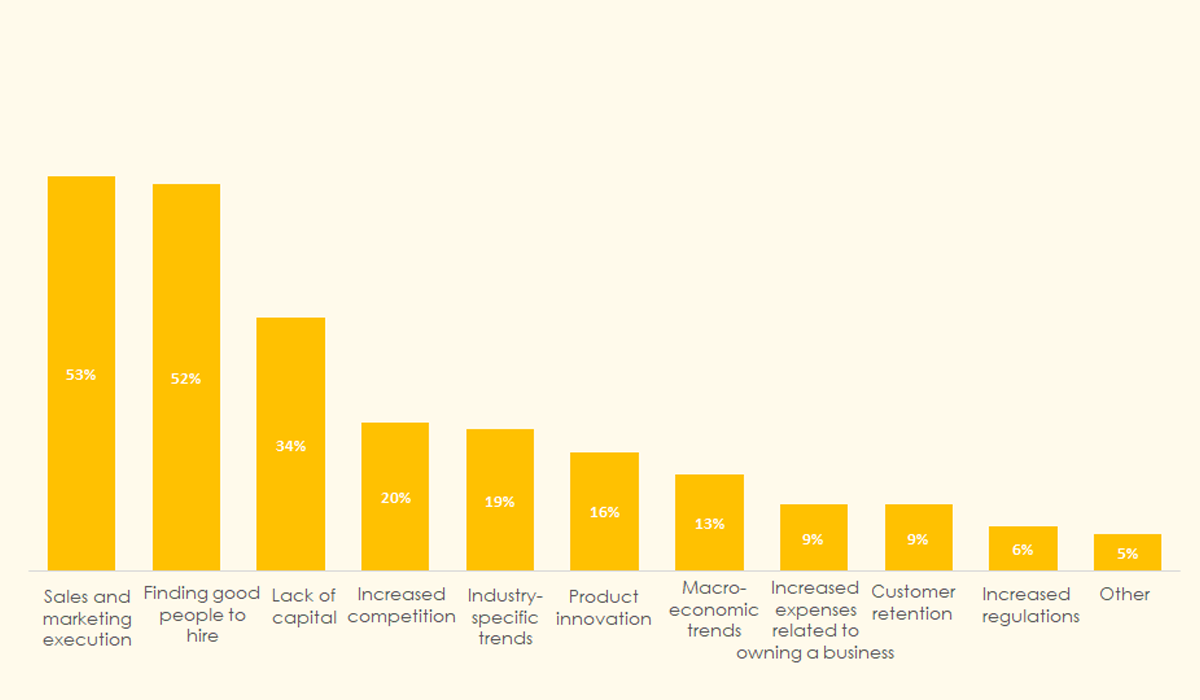

What do you expect to be the biggest challenge(s) for growing your business in 2020?

OFFICE EXPANSION

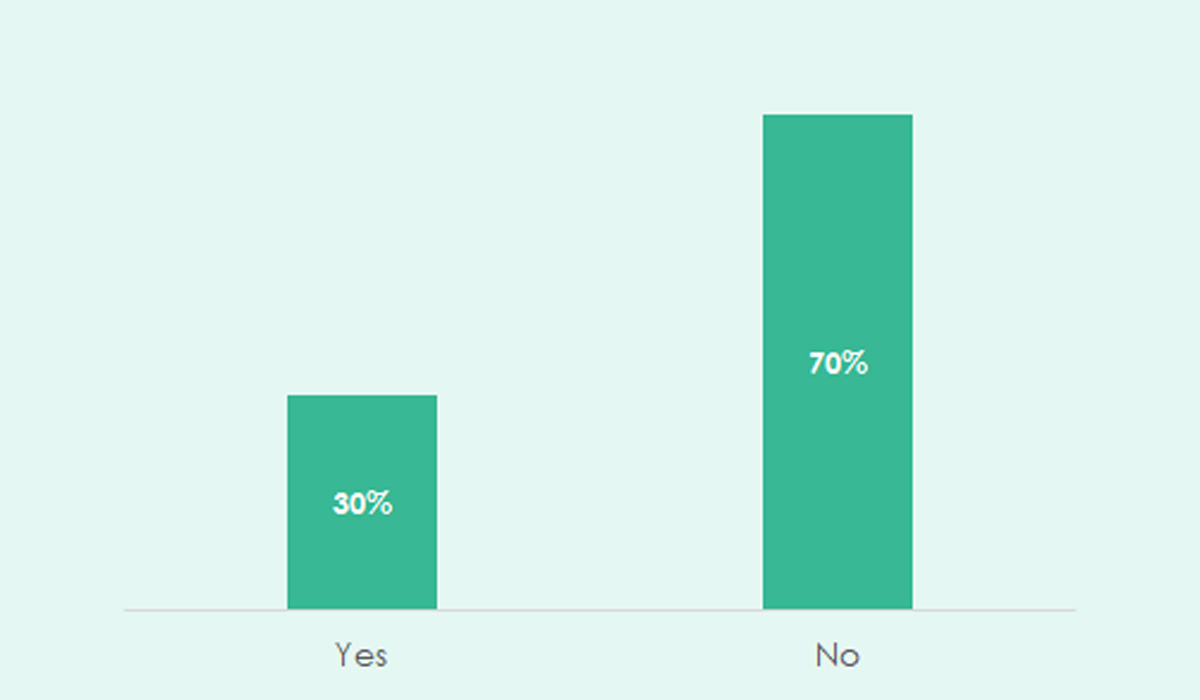

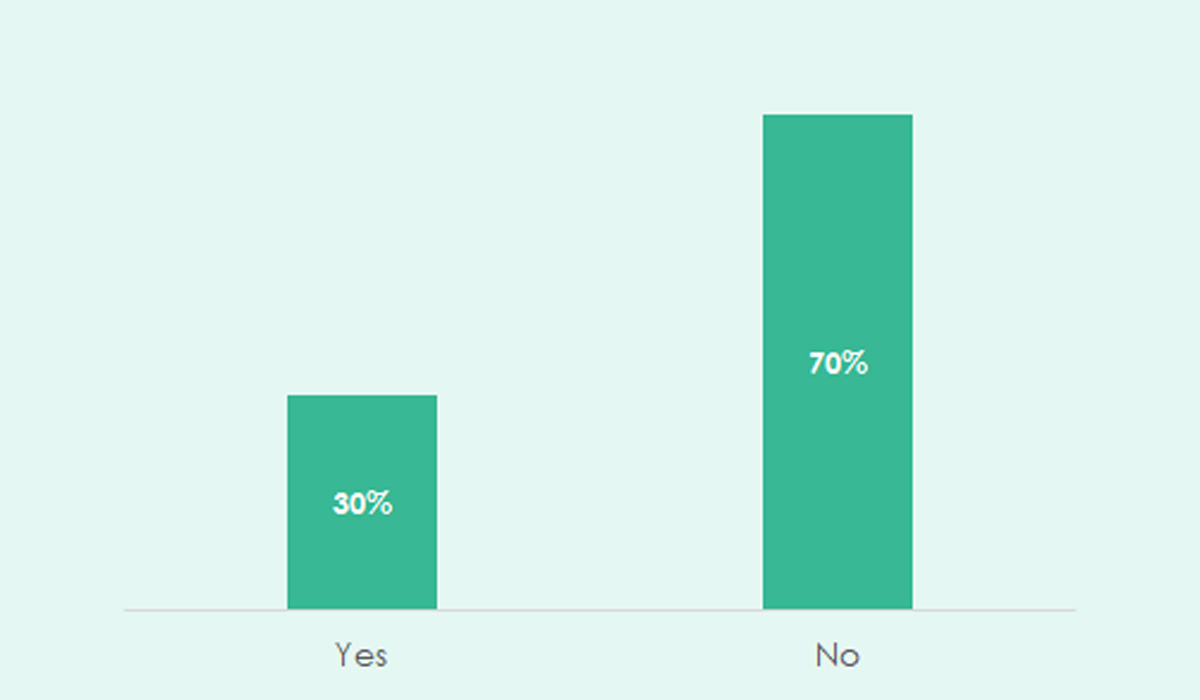

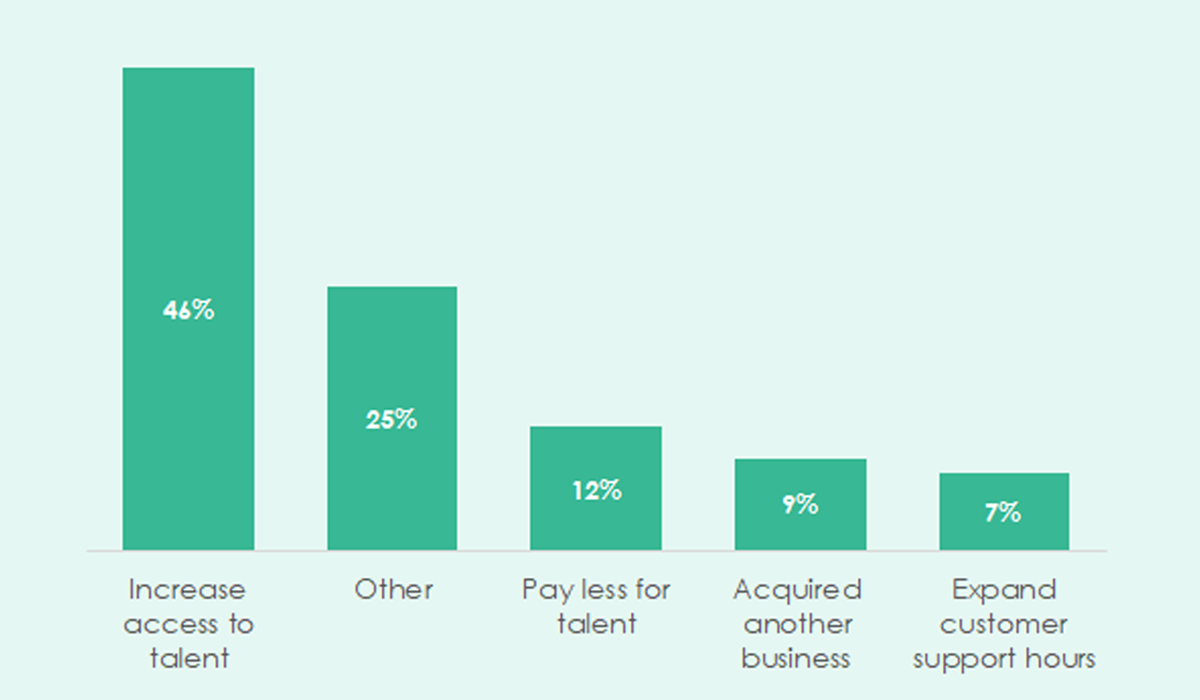

A significant portion of entrepreneurs have opened multiple offices: 30% of entrepreneurs have other offices across the country, mostly due to talent needs.

Do you have other offices across the country?

Why did you open a second location?

OFFICE LOCATION

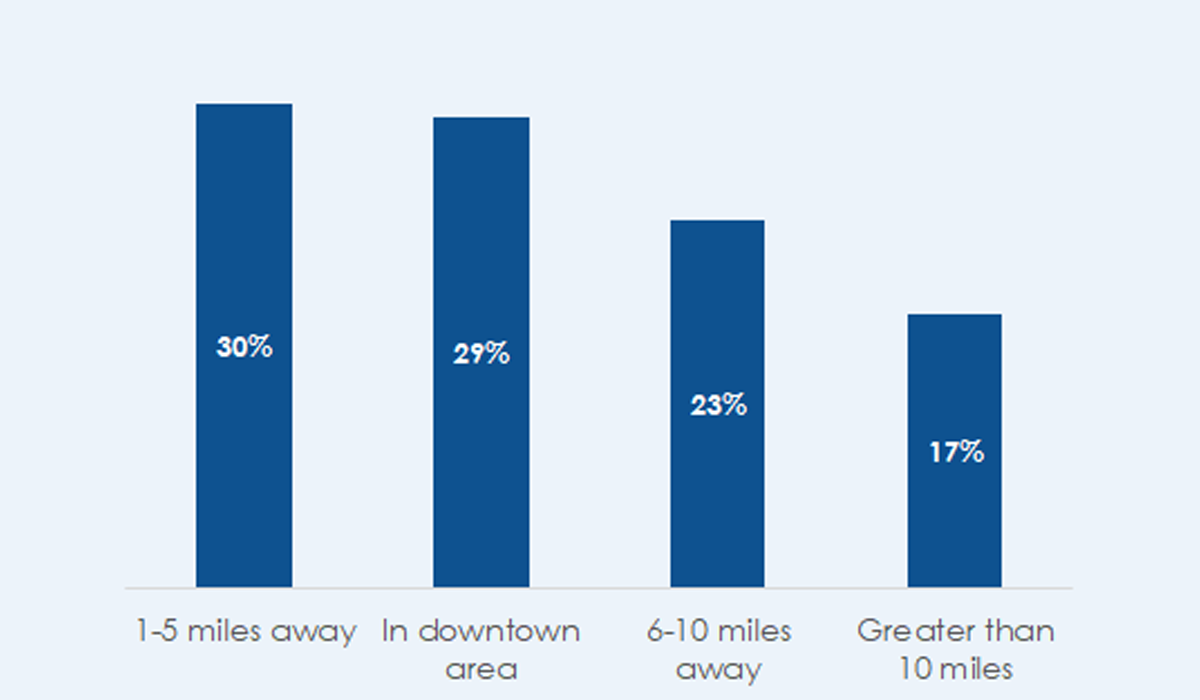

Location matters: ~80% of all companies are located within 10 miles of the central business district.

How far is your office space from the nearest downtown area?

Do you have access to hire top talent locally?

REMOTE WORKERS

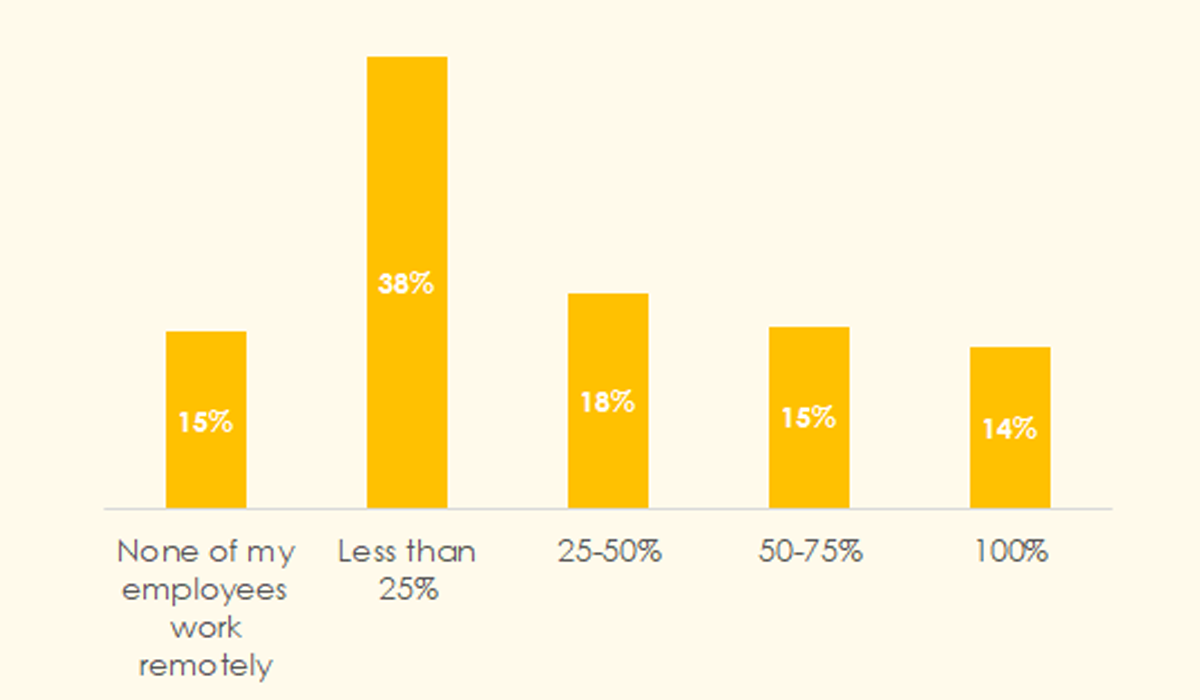

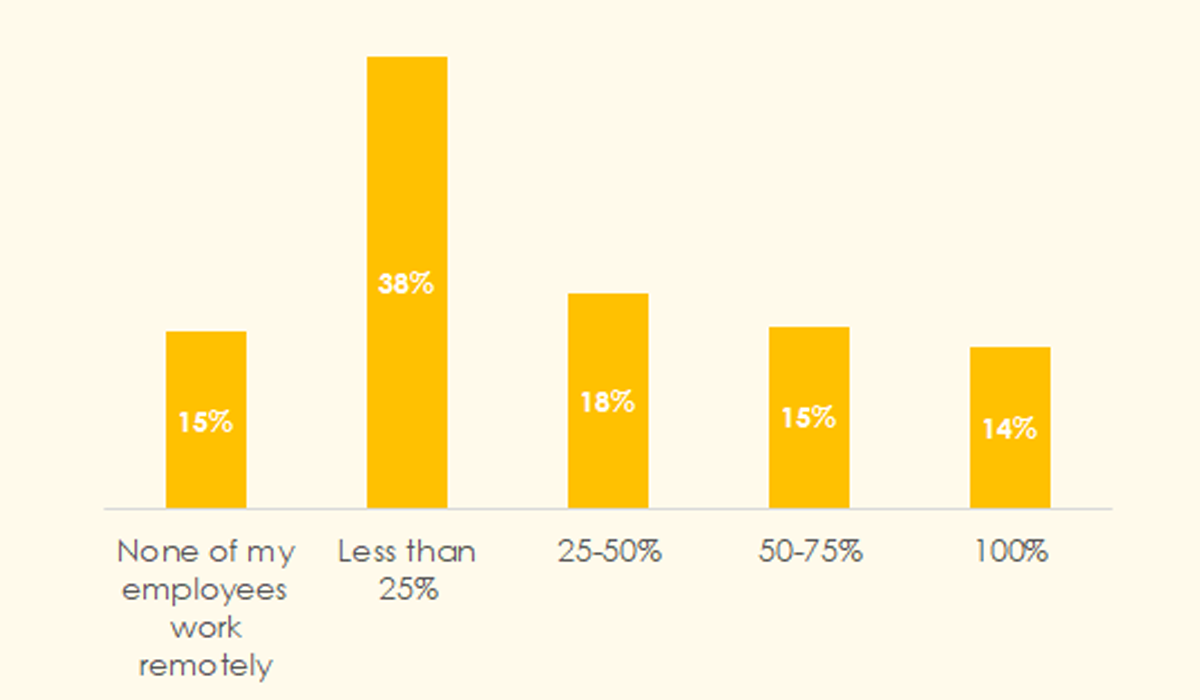

Remote work is increasing: 47% of respondents have at least ¼ of their workforce as remote.

What percent of your workforce is remote?

Why did you choose to build a distributed workforce?

ACQUISITIONS

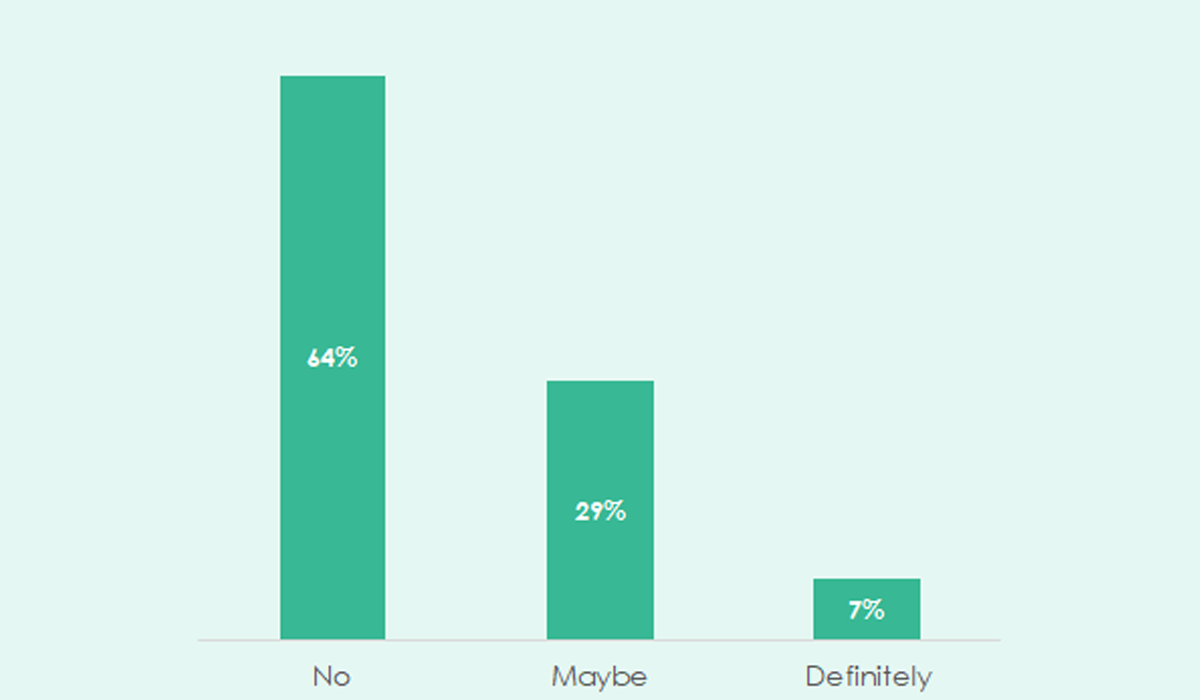

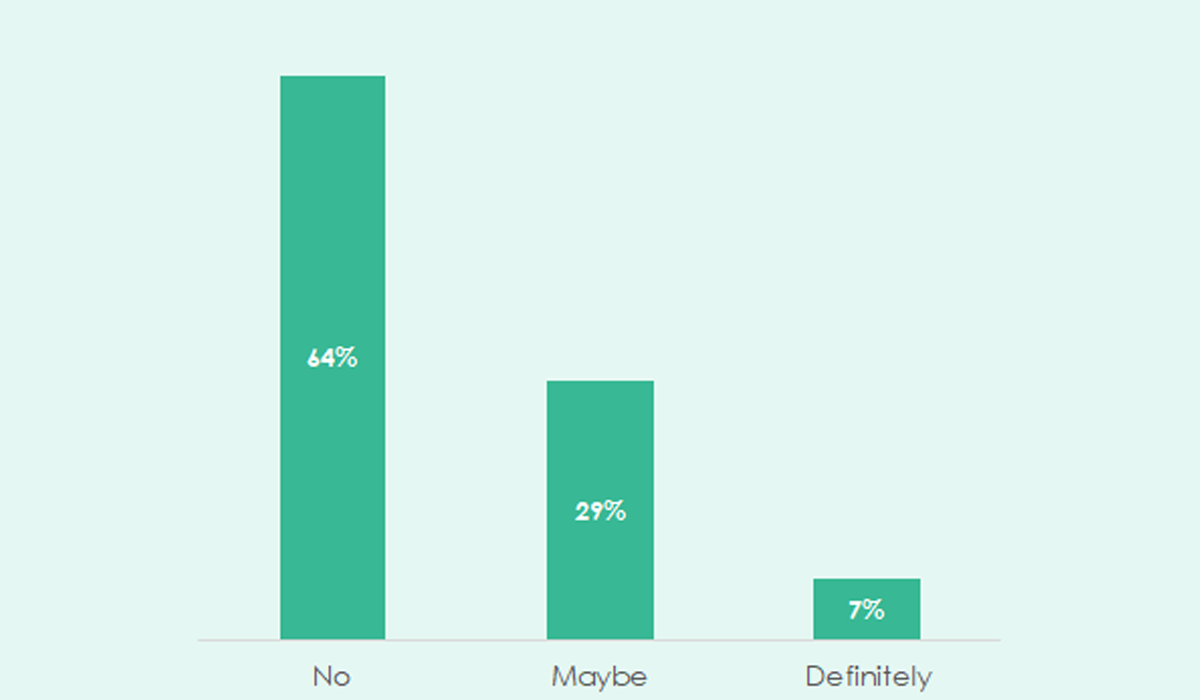

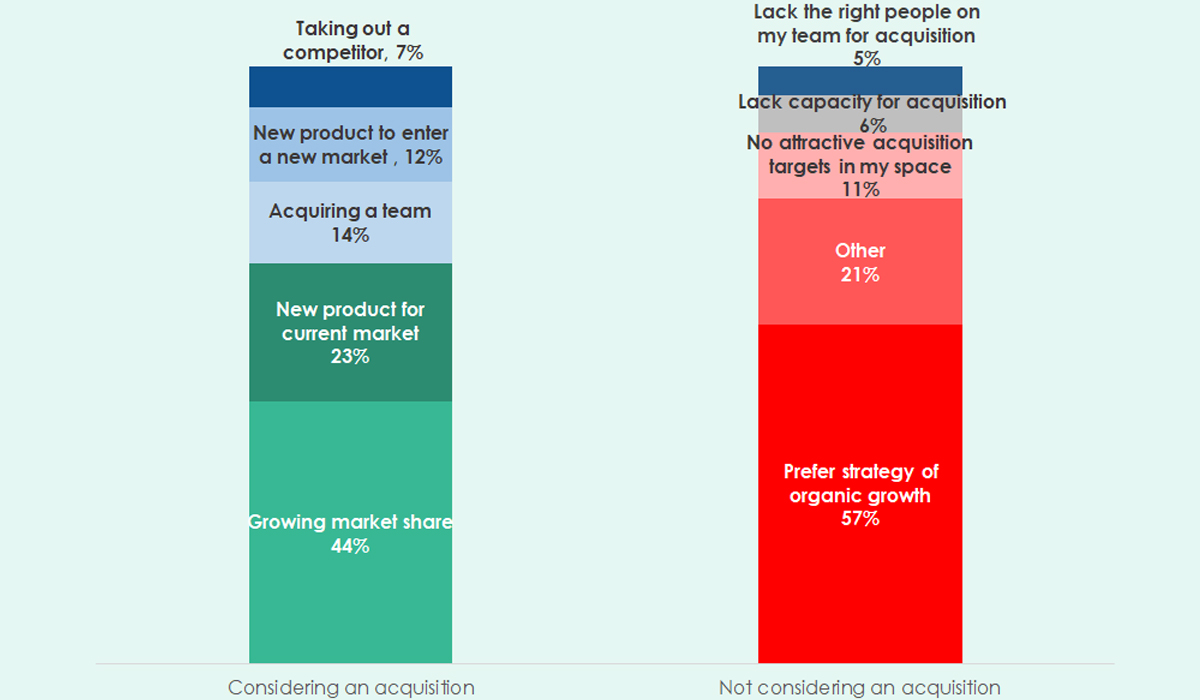

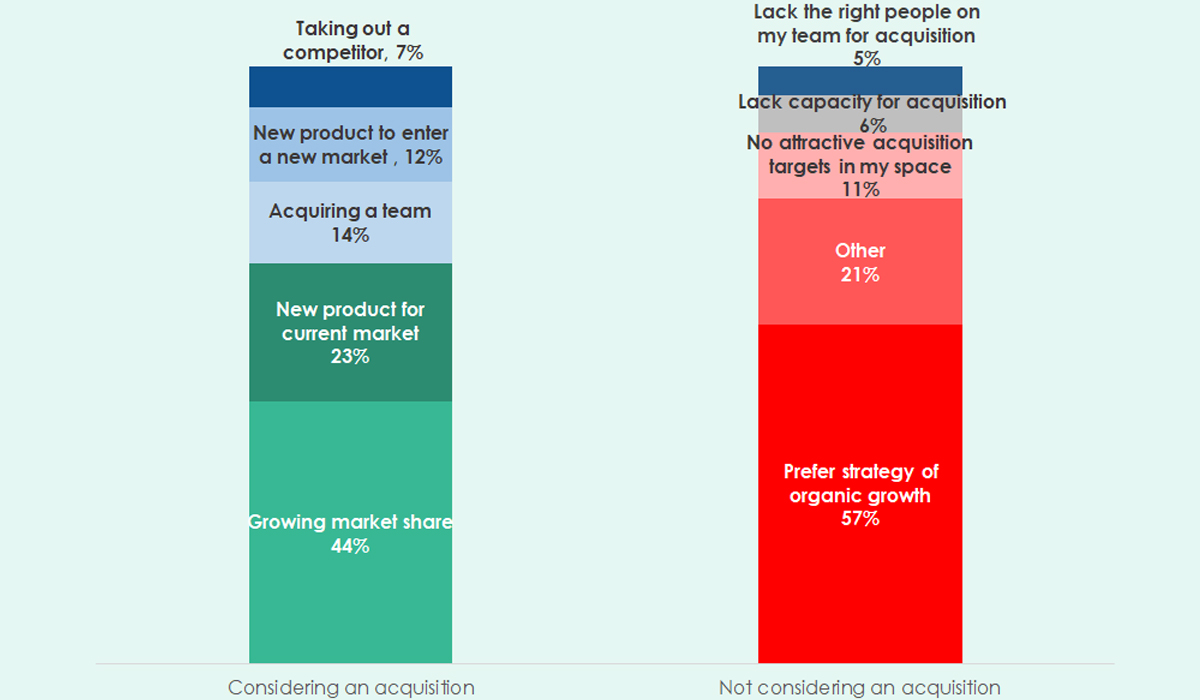

Most entrepreneurs aren’t considering an acquisition, the main obstacle is access to capital: Only 7% of companies are planning for an acquisition in 2020. Of companies who are not planning an acquisition, 58% of respondents list ‘lack of capital’ as a primary reason.

Are you considering acquiring another company as part of your 2020 growth strategy?

What are the reasons you are or are not considering an acquisition?

MACRO ECONOMIC EFFECTS

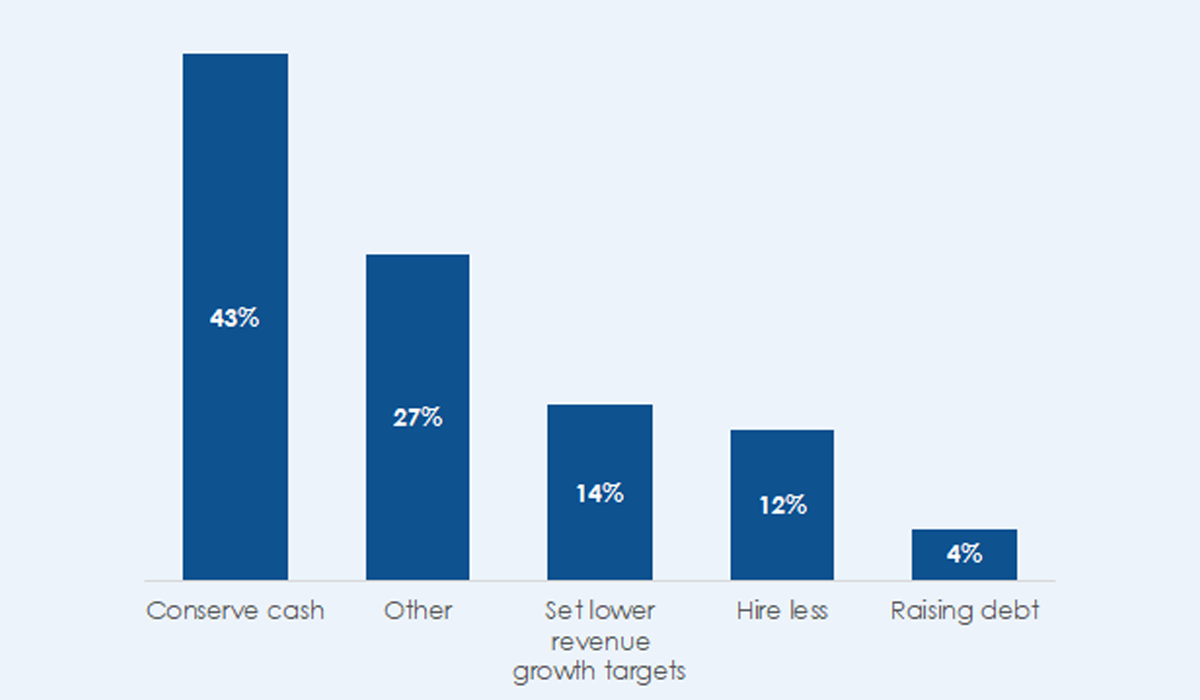

Only ~25% of entrepreneurs will change their operating procedures in 2020 due to macroeconomic concerns. Of businesses who are planning on changing operating procedures, the most popular method is conserving cash.

Will you manage your business differently in 2020 due to any of these or other macro-economic concerns?

What will you do differently?

About the Bootstrapped Sentiment Survey

The survey was conducted between November 20 – December 29, 2019 and resulted in total 313 responses. This is the ninth annual Mainsail survey and is intended to help us continue to understand the needs and perspectives of companies that Mainsail invests in and helps to grow. The survey was conducted via an online survey sent to entrepreneurs and senior executives at U.S.-based companies.

For the purposes of this survey, “bootstrapped companies” are defined as businesses which have taken no previous capital from venture capital firms, or other institutional investors. Qualification as a bootstrapped company was verified through a qualifying question.

Totals may not sum due to rounding. The statements contained herein that are not historical facts are forward-looking statements. The forward-looking statements are based on current expectations, beliefs, assumptions, estimates, and projections about the industry and markets. Forward-looking statements contained herein are not guarantees of future performance and involve certain risks, uncertainties, and or forecasted in such forward-looking statements. Mainsail Partners is under no obligation, and does not intend, to update any forward-looking statements to reflect changes in the underlying assumptions or factors, new information, future events, or other changes. For additional disclosures, please click here.