For the third consecutive year Mainsail Partners conducted a survey of over 500 entrepreneurs and executives of bootstrapped companies with the goal of understanding their outlook on the U.S. economy and their own businesses headed into 2014.

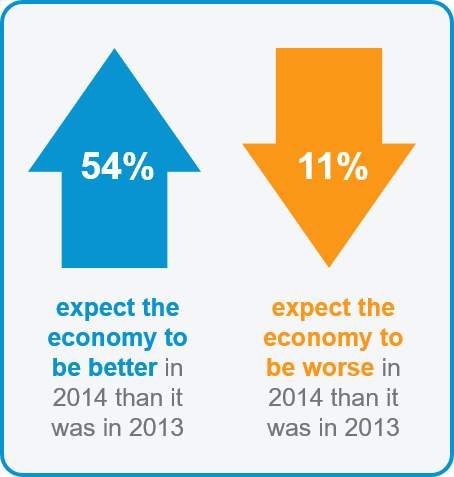

HOW DOES THE SENTIMENT IN 2013 COMPARE TO A YEAR AGO?

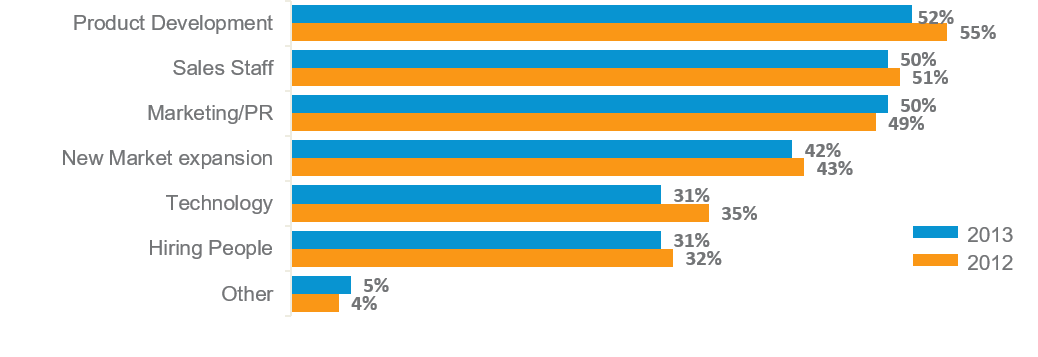

AREAS FOR INVESTMENT IN 2014

For the second year in a row “Product Development” was cited as the most important area of investment with 52% of respondents highlighting this as an area to invest in 2014. “Sales Staff” and “Marketing/PR” were a close second and third. This is consistent with Mainsail’s experience working with bootstrapped companies focused on product improvements and increasing market share

WHAT ARE YOUR MOST IMPORTANT AREAS OF INVESTMENT IN 2014?

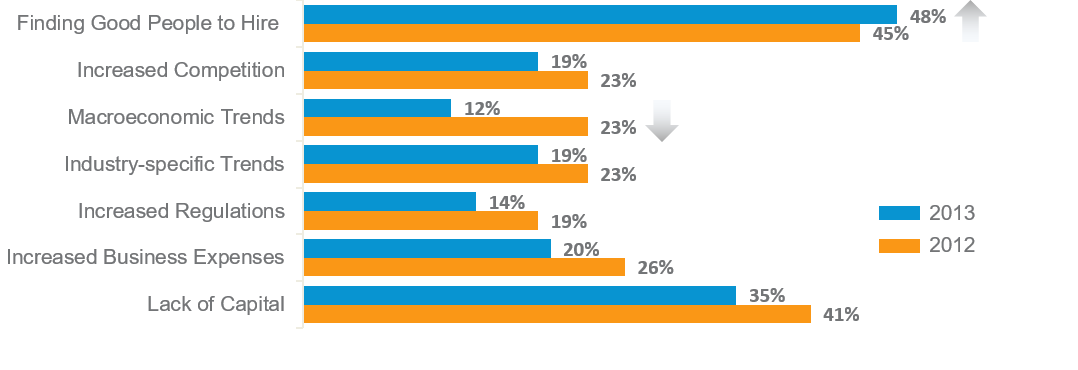

CHALLENGES IN 2014

The survey asked entrepreneurs and management teams what their biggest challenges to growth would be in 2014. Interestingly, entrepreneurs cited fewer challenges (compared to the previous year) in every category except one – “Finding Good People to Hire”.

Finding good people remains biggest challenge. As the job market continues to strengthen, it is not surprising that hiring top talent is only getting more difficult for companies funding their own growth. “Lack of Capital” was cited as the second biggest challenge to growth, but along with every other category, the number of responses was down from the previous year’s survey.

Macroeconomic concerns subside. Perhaps the strongest indication of optimism for the general economy was the decline in respondents highlighting “Macroeconomic Trends” as a challenge, which was nearly half of what it was the previous year.

WHAT DO YOU EXPECT TO BE THE BIGGEST CHALLENGE(S) TO GROWING YOUR BUSINESS IN 2014?

TECHNOLOGIES DRIVING GROWTH

This year Mainsail asked entrepreneurs what technologies and strategies they were using to drive growth, with a particular focus on sales and marketing.

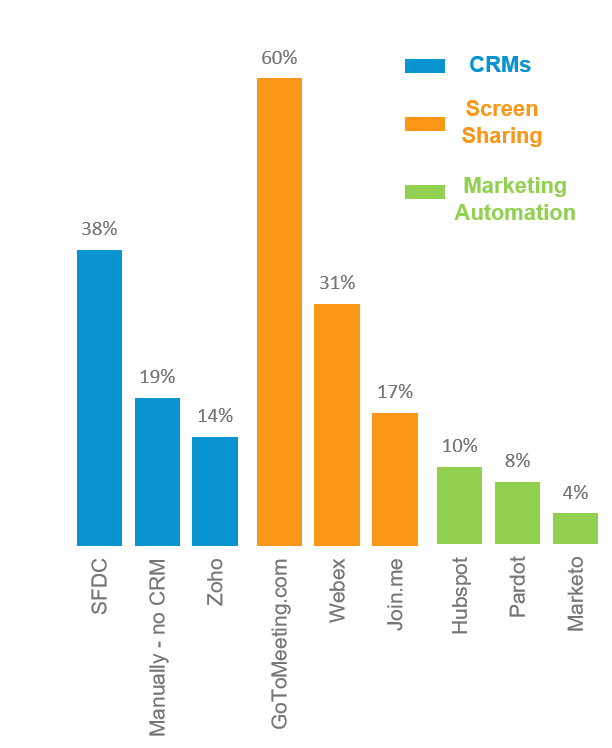

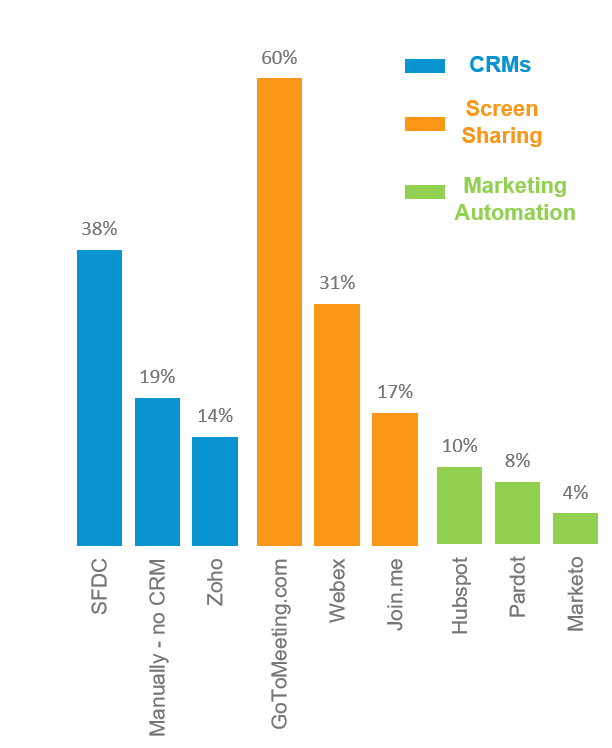

Salesforce.com continues to dominate. Customer relationship management (CRM) systems are at the core of most sales organizations, so we started by asking “What CRM do you use today?”. Not surprisingly, “Salesforce.com” was the leading response with 38%. It was surprising that more than 50 different systems were named, with “Zoho” being the next closest response at 14%. Nearly 20% of all companies are still using spreadsheets or other manual processes to track leads and manage their sales pipeline. This is an indication that many companies are still managing their sales team and pipeline sub-optimally.

Screen sharing software leads “other” technologies. In response to the question “What other (non-CRM) technologies are you using to enable your sales force?”, an overwhelming 60% responded with “GoToMeeting” and almost 100% responded with at least one type of screen sharing software. Electronic document signing software and marketing automation platforms were two other frequently mentioned technologies. Docusign was the clear leader in electronic document signing, while Hubspot led the way for marketing software.

MORE ABOUT MAINSAIL AND OUR SURVEY

Mainsail is a leading growth equity firm focused on investing in growing, bootstrapped businesses. Our firm maintains relationships with thousands of entrepreneurs and executives at these companies. The Mainsail Bootstrapped Sentiment Survey was conducted via an online survey sent to more than 10,000 entrepreneurs and senior executives at U.S. based companies.

The survey was conducted between November 22, 2013 and December 22, 2013 and resulted in 512 completed and qualified responses. This is the third annual Mainsail survey and is intended to help us continue to understand the needs and perspectives of companies that Mainsail invests in and helps to grow.

For the purposes of this survey, bootstrapped companies are defined as businesses which have taken no previous capital from venture capital firms, private equity firms, or other institutional investors. Qualification as a bootstrapped company was verified through prior conversations or in some cases via a qualifying question.

Mainsail believes this subset of small to medium sized businesses is unique in terms of the approach these entrepreneurs and management teams take to growing their business with a focus on profitability. This focus tends to make these businesses more sensitive to economic headwinds and changes in the business environment, and therefore potentially an early indicator of the sentiment of the broader market.